Gotrade News - Apple is set to release its Q4 earnings report this Thursday (Jan 29) after the closing bell. Investors are waiting to see if the company can justify its premium valuation amidst an increasingly heated AI race.

Market analysis suggests the stock’s next move heavily depends on management’s ability to sell their future strategy, not just iPhones. You need to pay attention to this report as it could set the tone for the entire tech sector.

Key Takeaways:

-

Revenue is projected to grow 11% to $138 billion, but AI monetization remains a major question mark.

-

Services growth has slowed to the 7% level, sparking analyst concerns over high-margin sustainability.

-

Reliance on third-party AI tech like Google is seen as a cost burden without significant direct revenue.

Revenue Projections & The AI Elephant in the Room

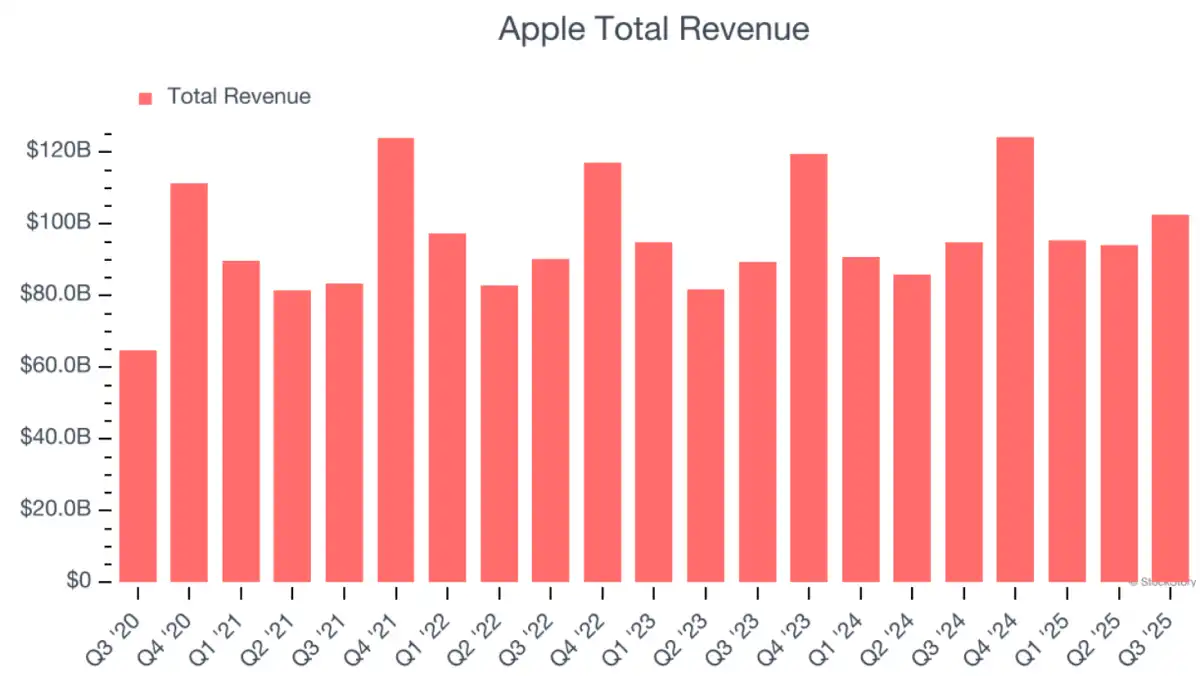

Consensus analysts project Apple’s revenue to grow approximately 11% year-over-year to $138.1 billion. This figure signals a significant recovery compared to the modest 4% growth recorded during the same period last year.

Apple has a solid track record of beating Wall Street’s revenue expectations over the last two years. This trend offers some optimism that the business can stay the course despite global economic fluctuations.

However, the main focus for investors isn't just iPhone sales or seasonal hardware spikes. The biggest challenge right now is the lack of a clear, independent monetization strategy for their artificial intelligence technology.

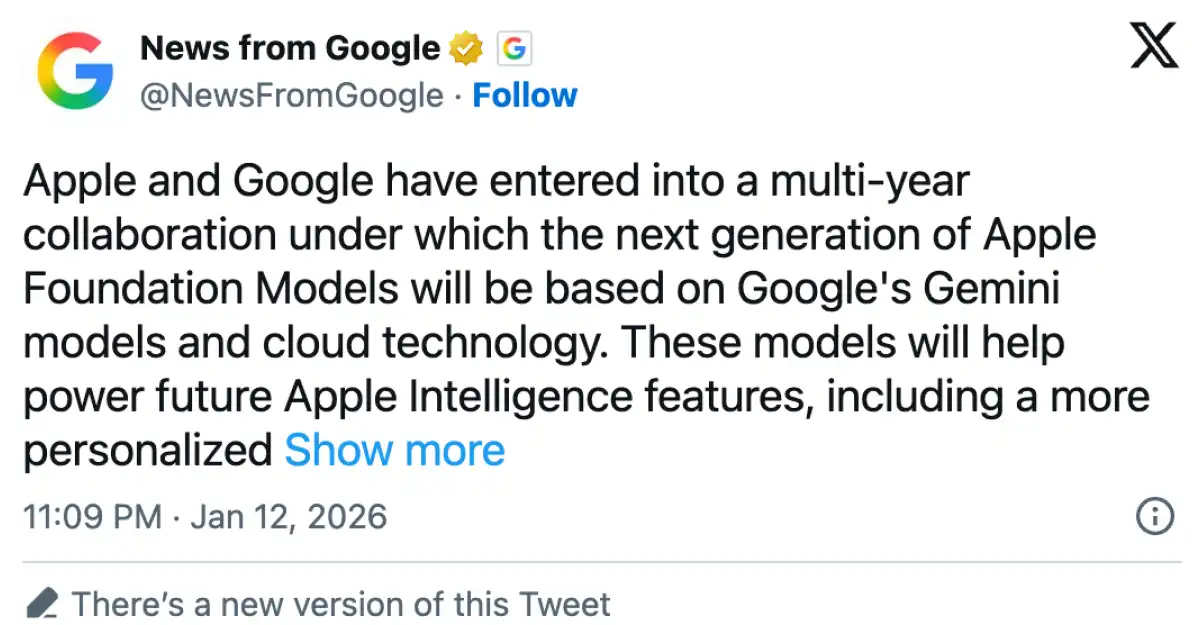

Reports from Seeking Alpha highlight that Apple still leans heavily on Google's Gemini infrastructure. This dependency creates additional operational costs without generating an equivalent stream of new revenue from AI products.

This situation contrasts sharply with other tech rivals who are already monetizing AI features directly to users. Investors are starting to ask if the stock’s pricey valuation is still justified if internal AI innovation remains slow.

Market Sentiment & Valuation Reality Check

Beyond tech issues, a slowdown in the services sector is drawing sharp scrutiny from institutional analysts. Sensor Tower data indicates that App Store revenue growth decelerated to around 7% in the December quarter.

Analysts at Jefferies have even cut their price target for Apple, citing fears over this deceleration in high-margin services. The current valuation is seen as vulnerable to correction if earnings growth doesn't match the market's optimistic expectations.

On the flip side, JPMorgan maintains a positive rating with a price target hitting $315 per share. They believe strong supplier contracts will keep profit margins stable even as component costs rise.

Hardware competition is also heating up with the arrival of smart glasses from Meta Platforms. This innovative product could potentially disrupt iPhone market dominance in the long run if Apple doesn't counter with its own breakthrough.

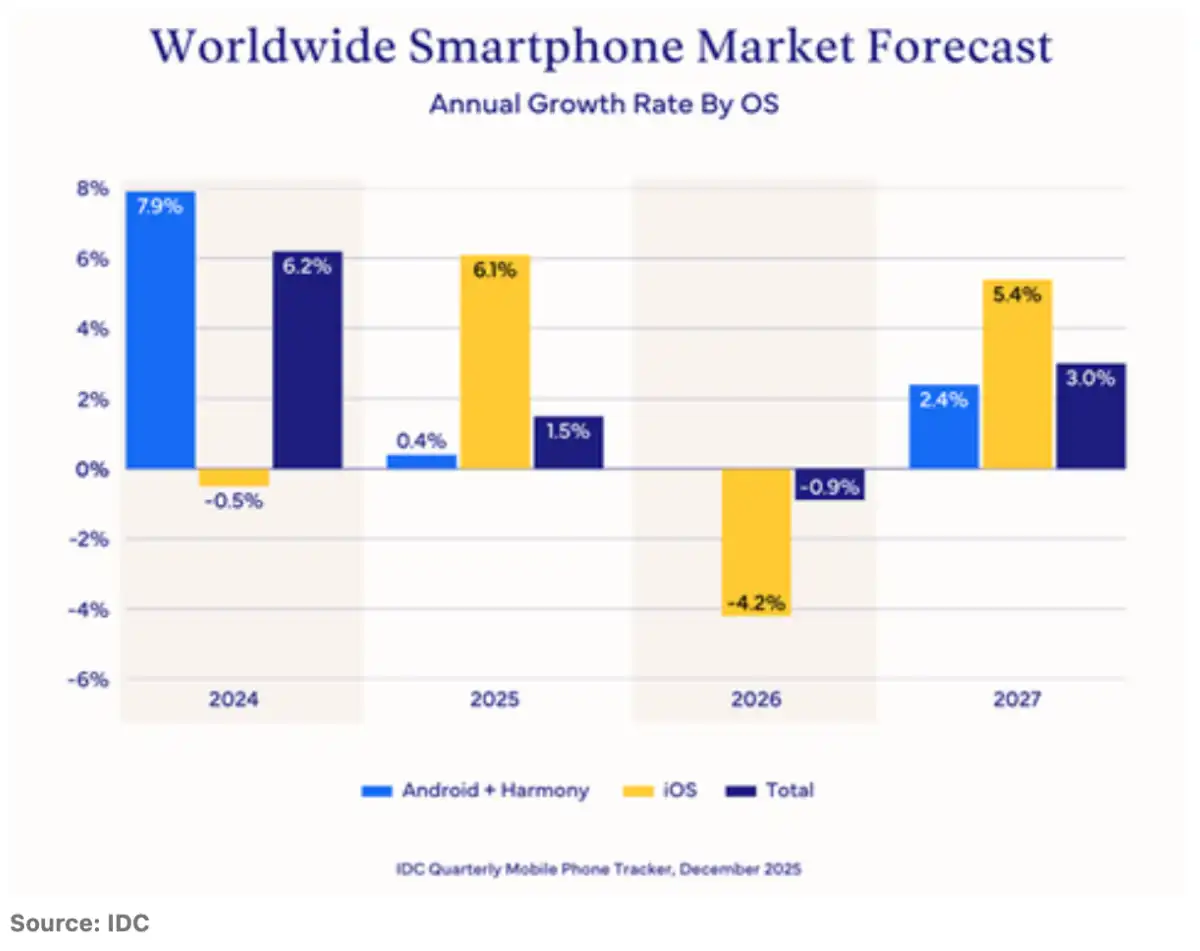

IDC projections suggest iOS smartphone unit sales might dip or stagnate next year. Delays in new iPhone models and memory supply constraints are the fundamental factors weighing on these volume predictions.

Ready to Make Your Move on Apple?

Apple Earnings reports often trigger significant price action, creating openings for investors who can spot the momentum. Do you see a potential dip as a discount opportunity, or a signal to wait for trend confirmation?

On Gotrade, you can own Apple (AAPL) stock starting from just $1 without needing massive capital. Use this earnings release to fine-tune your investment strategy today.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

Stock Story, Apple (AAPL) Q4 Earnings Report Preview: What To Look For. Accessed on January 28, 2026

Seeking Alpha, Apple: Rolling Over Into Key Earnings. Accessed on January 28, 2026

ts2, Apple stock climbs as Wall Street targets shift ahead of Jan. 29 earnings. Accessed on January 28, 2026

Featured Image: Shutterstock