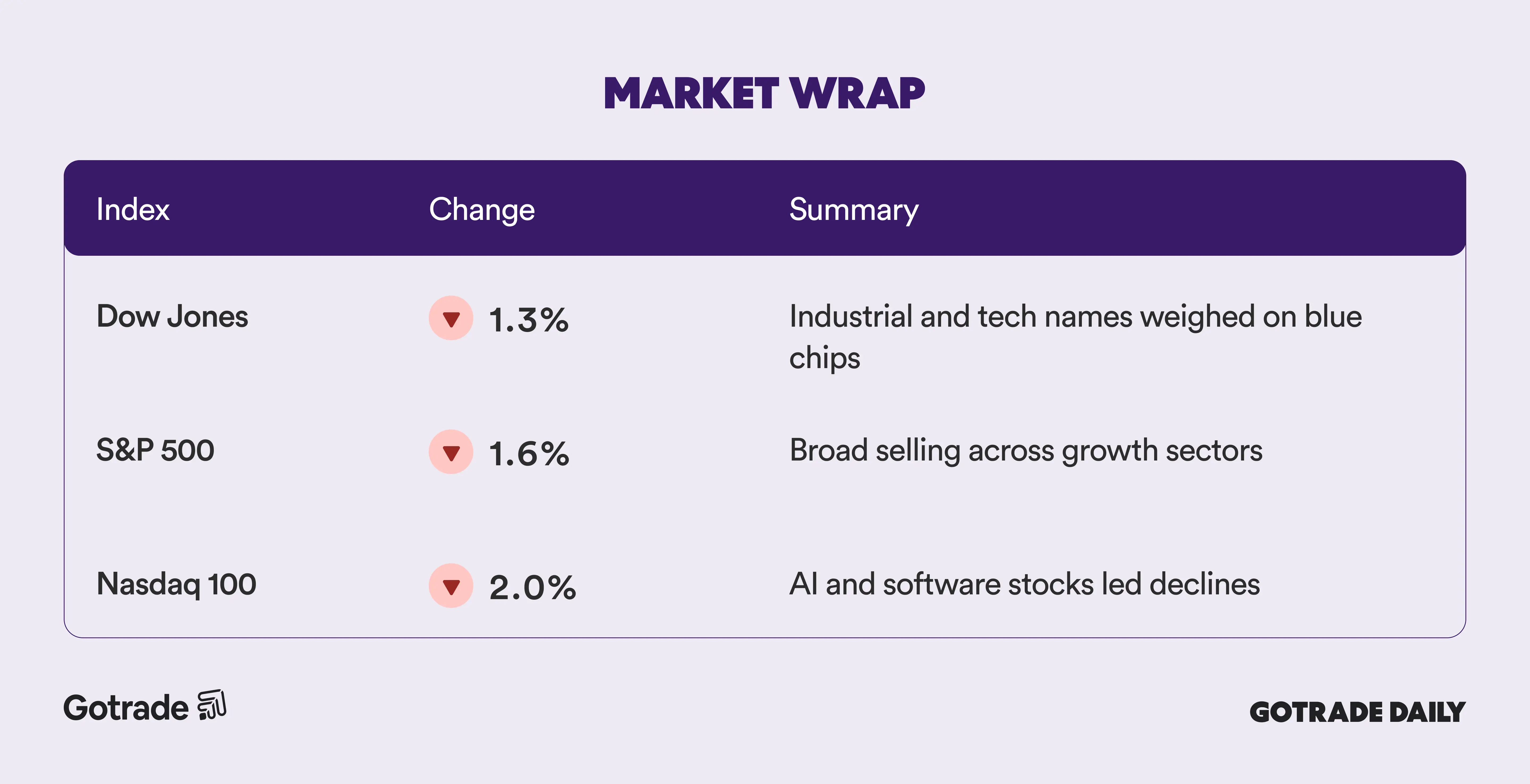

U.S. equities declined Thursday as investors reassessed the real-world impact of artificial intelligence across industries, shifting from enthusiasm about AI growth toward evaluating which business models may be vulnerable. The Dow Jones Industrial Average fell 669.42 points to 49,451.98, while the S&P 500 dropped 1.57% and the Nasdaq Composite slid 2.03%. Weak guidance from Cisco (CSCO), which fell 12%, intensified concerns about spending cycles tied to enterprise technology infrastructure.

Selling pressure spread beyond technology. Financial firms such as Morgan Stanley (MS) weakened as markets debated how AI tools could reshape advisory and wealth platforms, while logistics provider C.H. Robinson (CHRW) plunged 14% on fears automation could compress margins. Software names also stayed under pressure, with Palantir (PLTR) down nearly 5% and Autodesk (ADSK) off about 4% as investors reconsidered long-term growth assumptions.

Despite broad declines, capital rotated selectively rather than exiting risk assets entirely. Defensive stocks gained ground, with Walmart (WMT) rising 3.8% and Coca-Cola (KO) adding 0.5%, lifting consumer staples and utilities to the top of sector performance. The move suggests investors are repositioning portfolios rather than abandoning equities outright.

Commodities reinforced the cautious tone. Silver futures dropped roughly 10%, reversing a popular retail trade that had surged earlier this year. The move highlighted how crowded positioning can unwind quickly when sentiment shifts.

Attention now turns to Friday’s CPI release. Economists expect a 0.3% monthly increase for both headline and core inflation. With labor data still resilient, inflation readings may determine whether markets stabilize or continue repricing growth and rate expectations.

📊 Market Wrap Feb 13th 2026

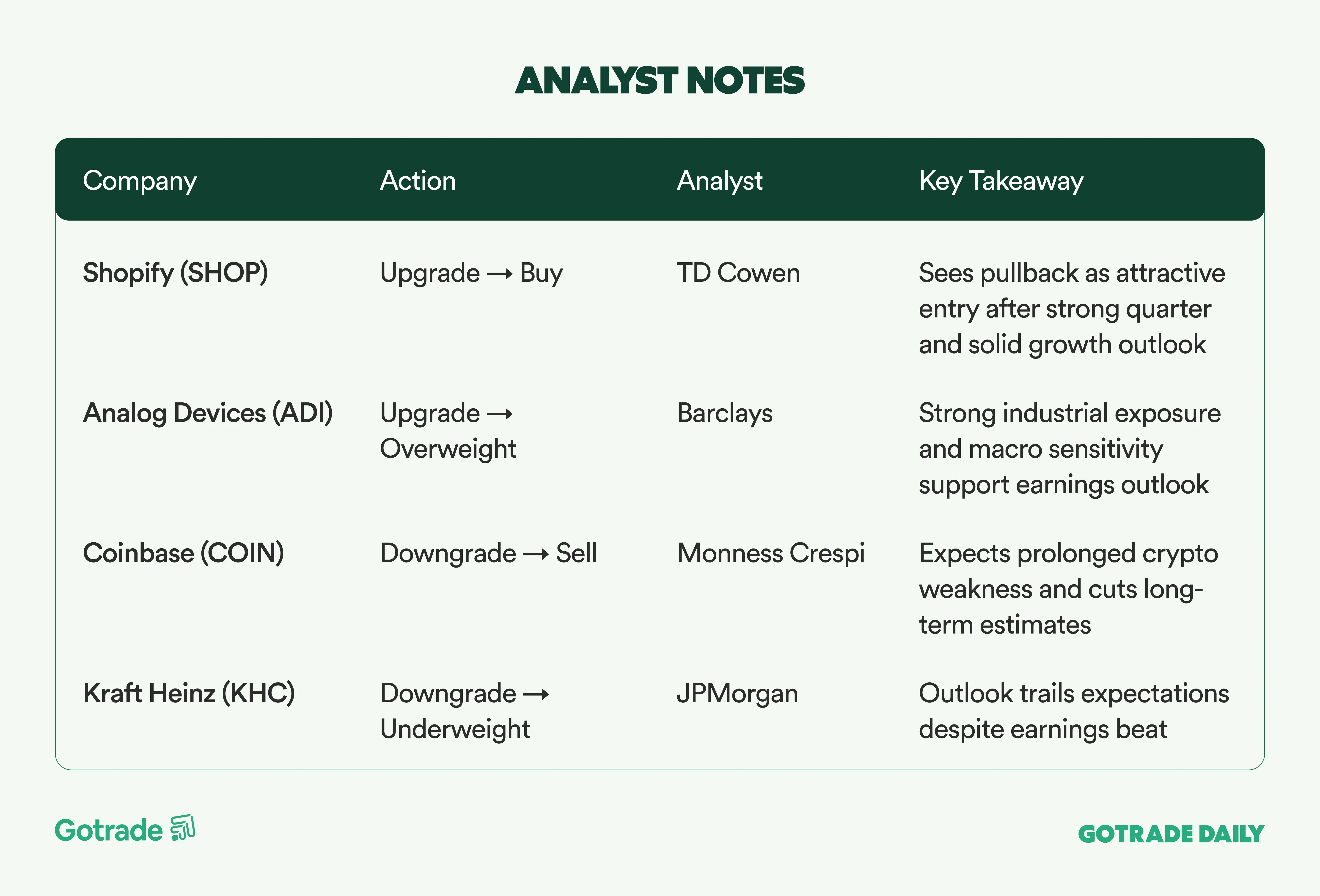

🧠 Analyst Notes

💬 Market Highlights

Tripadvisor Plunges to Record Low After Q4 Miss, Explores Sale of TheFork

Tripadvisor (TRIP) fell more than 19% to a record low after reporting fourth-quarter results that missed expectations. Revenue came in at $411 million, essentially flat year over year and slightly below consensus, while adjusted EPS of $0.04 missed the $0.13 estimate. The company swung to a net loss of $38 million compared to a marginal profit a year ago.

The Experiences segment remained the key growth driver, rising 10% year over year and now accounting for nearly half of group revenue. However, hotel revenue declined 15%, weighing on margins. Management said it is exploring strategic alternatives for TheFork to sharpen focus on Experiences and unlock shareholder value. Tripadvisor also launched cost-saving initiatives targeting at least $85 million in annualized savings starting in 2026.

Crocs Surges to Highest Level Since August on Strong Holiday Demand

Crocs (CROX) jumped nearly 20% after delivering a fourth-quarter earnings beat and issuing 2026 guidance above expectations. While consolidated revenue declined 2.3% year over year to $958 million, direct-to-consumer sales rose 4.7% and international revenue climbed 14.1%, offsetting North American weakness.

Management identified $100 million in cost savings for 2026 to enhance efficiency while continuing brand investments. For the full year, Crocs expects revenue to be roughly flat to slightly up and EPS between $12.88 and $13.35, above consensus. The strong market reaction reflects confidence in brand resilience and diversified growth drivers.

Baxter Slides After Q4 Earnings Miss and Weak 2026 Outlook

Baxter (BAX) dropped about 13% after reporting fourth-quarter non-GAAP EPS of $0.44, down from $0.58 a year earlier and below expectations. The decline was driven by unfavorable product mix, inventory adjustments, and a higher effective tax rate.

Although quarterly revenue increased 8% year over year, gross margin declined sharply, pressuring overall profitability. For 2026, the company guided non-GAAP EPS of $1.85 to $2.05, well below the $2.25 consensus estimate, raising concerns about margin pressure and near-term growth visibility in the medtech sector.

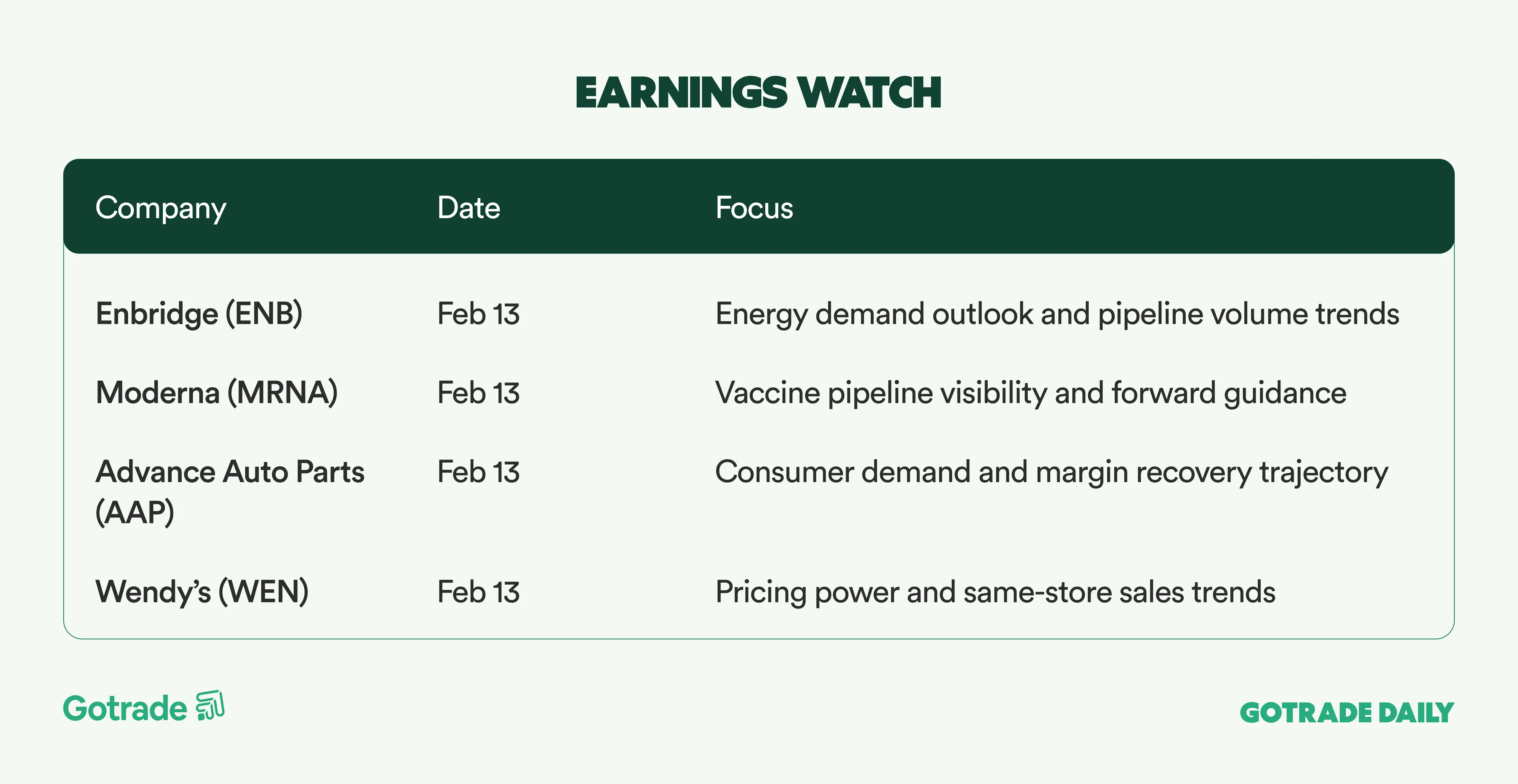

📅 Earnings Watch

What stocks are you watching today?