Markets steady as investors weigh inflation, GDP, and earnings signals

U.S. equities edged higher in a volatile session Tuesday as investors positioned ahead of a dense macro calendar later this week. The Nasdaq Composite rose 0.1%, recovering from an early drop of more than 1%, while the S&P 500 and Dow Jones Industrial Average also gained about 0.1%.

Markets entered the week following their worst performance of 2026, when renewed concerns about AI-driven disruption weighed on software and IT services stocks. Those fears resurfaced even after softer inflation data and a stronger-than-expected January jobs report last week, suggesting sentiment remains fragile despite supportive macro signals.

Large-cap tech performance was mixed. Apple (AAPL) climbed 3.2% on reports it is accelerating work on AI-powered wearables, leading the Magnificent Seven. Nvidia (NVDA) and Amazon (AMZN) rebounded about 1%, while Tesla (TSLA), Alphabet (GOOG), and Microsoft (MSFT) fell more than 1%. Meta (META) edged slightly lower, reinforcing the pattern of selective positioning within mega-cap tech rather than broad risk-off rotation.

Outside tech, Paramount Skydance jumped 5% after Warner Bros. Discovery resumed acquisition talks, while WBD rose nearly 3%. Netflix (NFLX) added modestly, reflecting continued consolidation themes in streaming and media.

The 10-year Treasury yield rose to 4.07%, signaling slightly firmer rate expectations ahead of key economic data. Commodities weakened, with gold down 3% and silver sliding nearly 6%, while bitcoin drifted toward $67,700.

Attention now turns to Friday’s PCE inflation report and Q4 GDP release, both of which could reshape expectations for Federal Reserve policy and market direction into March.

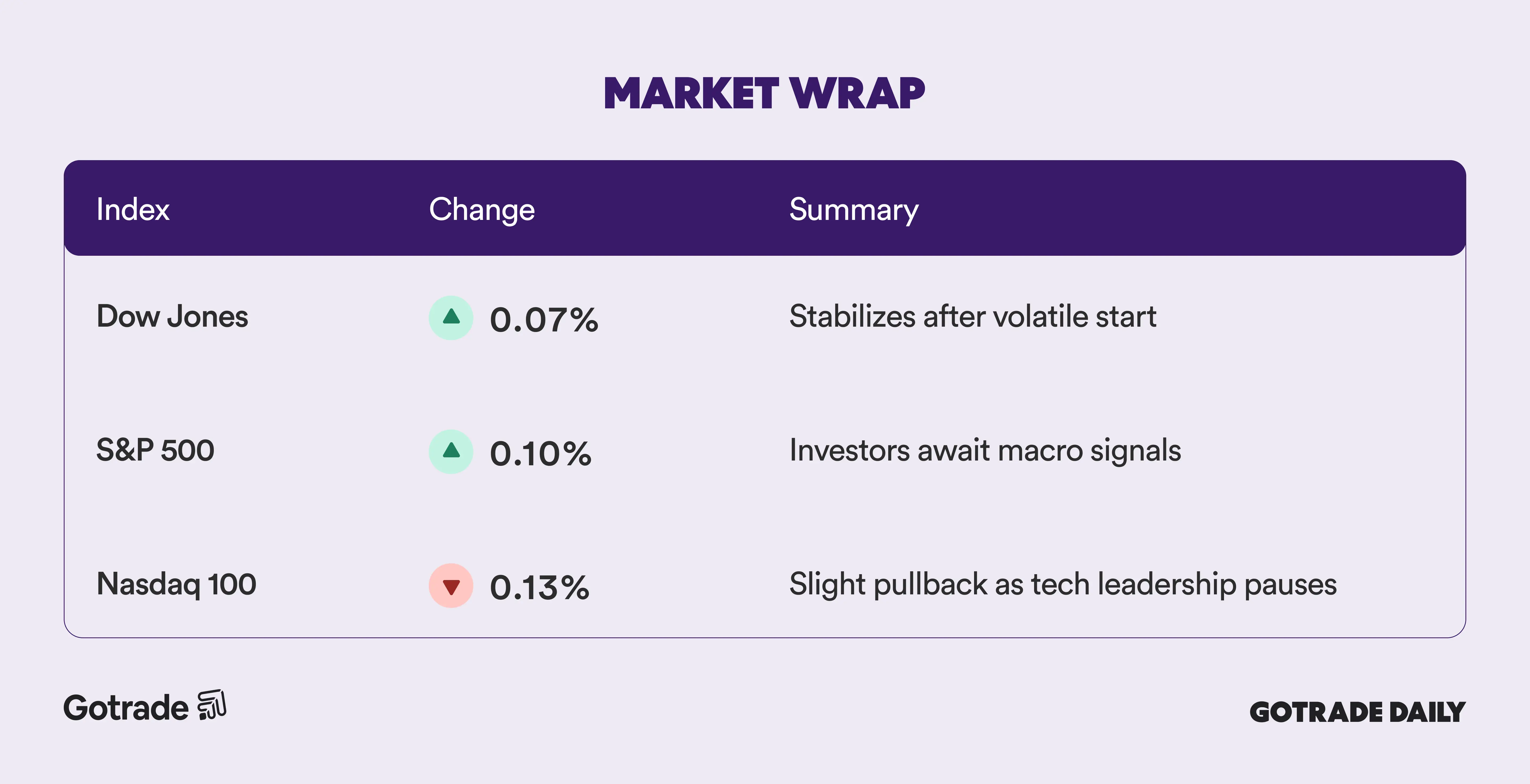

Market Wrap

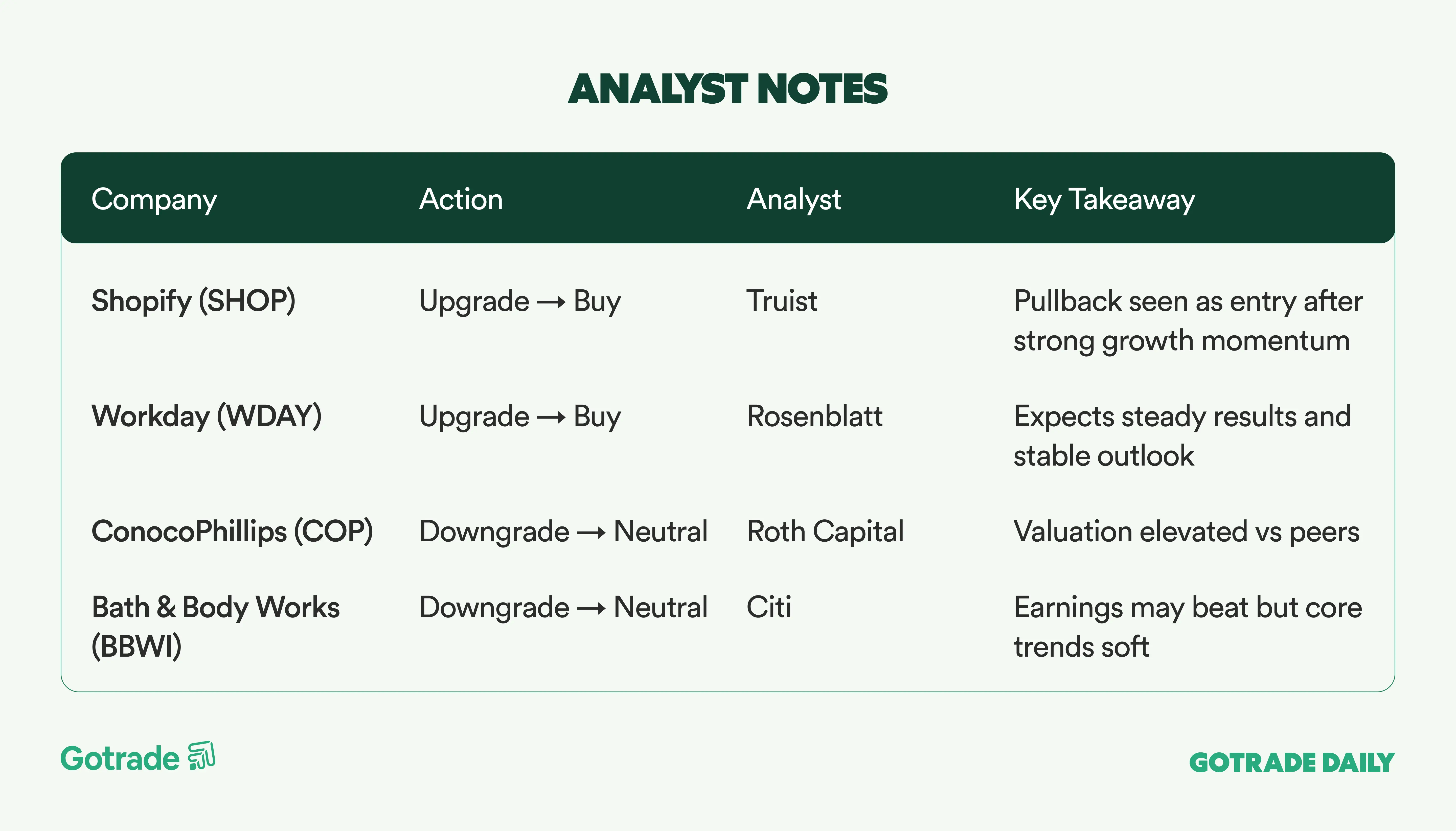

Analyst Notes

Market Highlights

Palo Alto Networks Builds Visibility on Enterprise AI Security Demand

Palo Alto Networks (PANW) projected fiscal 2026 revenue of $11.28B–$11.31B and next-generation security ARR up to $8.62B, reinforcing confidence that enterprise demand for cybersecurity platforms remains strong as AI adoption accelerates. Management pointed to multiple large contracts exceeding $40M–$50M, particularly from global enterprises transitioning from pilot AI programs to full-scale deployment.

The company emphasized a structural shift in corporate priorities, from experimenting with AI tools to implementing governance and control frameworks. That transition is driving demand for integrated platforms that secure networks, endpoints, cloud systems, browsers, and AI agents simultaneously. Strong growth in SASE ARR and software firewall subscriptions suggests recurring revenue visibility is improving alongside enterprise adoption cycles.

Cadence Signals Structural Growth from AI Chip Design Cycle

Cadence (CDNS) reported a record backlog of $7.8B and guided 2026 revenue to $5.9B–$6B, supported by rising adoption of AI-driven semiconductor design tools. Management highlighted productivity gains of up to 7–10× for customers using AI-enabled design workflows, accelerating product development timelines and deepening customer reliance on its software ecosystem.

Strategic partnerships with major semiconductor players including Qualcomm, Samsung Foundry, Intel Foundry, and hyperscaler customers reinforce Cadence’s positioning as a core infrastructure provider in the AI hardware stack. Recurring software revenue returning to double-digit growth further strengthens earnings visibility, while expanding hardware demand indicates broader capital spending momentum across chip design and manufacturing.

Eli Lilly Expands Pipeline Optionality Through Targeted Licensing Deal

Eli Lilly (LLY) agreed to pay $100M upfront to license additional indications for CSL’s antibody drug clazakizumab, which targets inflammatory pathways linked to multiple chronic conditions. The therapy is already in late-stage development for cardiovascular risk reduction in kidney disease patients, while CSL retains rights for that original indication.

The structure of the deal allows Lilly to broaden its immunology portfolio without assuming full development risk, as milestone payments and royalties are tied to successful approvals. For investors, the move signals continued strategic emphasis on targeted pipeline expansion rather than large-scale acquisitions, a strategy that can preserve capital flexibility while still supporting long-term growth visibility.

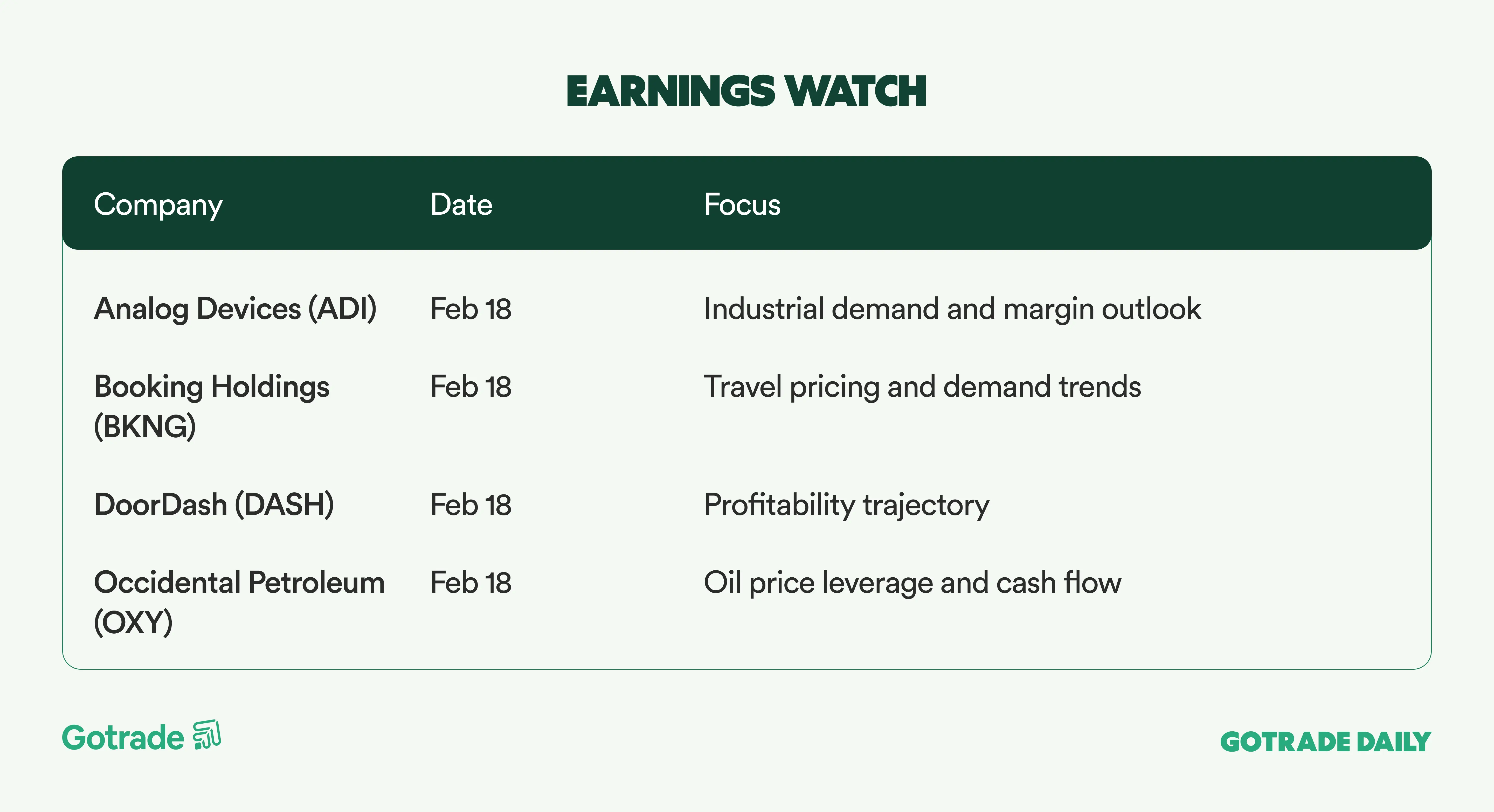

Earnings Watch

Markets are stabilizing but remain tactical as investors balance AI-driven sector rotation, earnings signals, and incoming macro data. With inflation and GDP reports approaching, positioning suggests traders are preparing for volatility rather than committing to a single directional view.

What stocks are you watching today?