Jobs report in focus as markets rotate and volatility picks up.

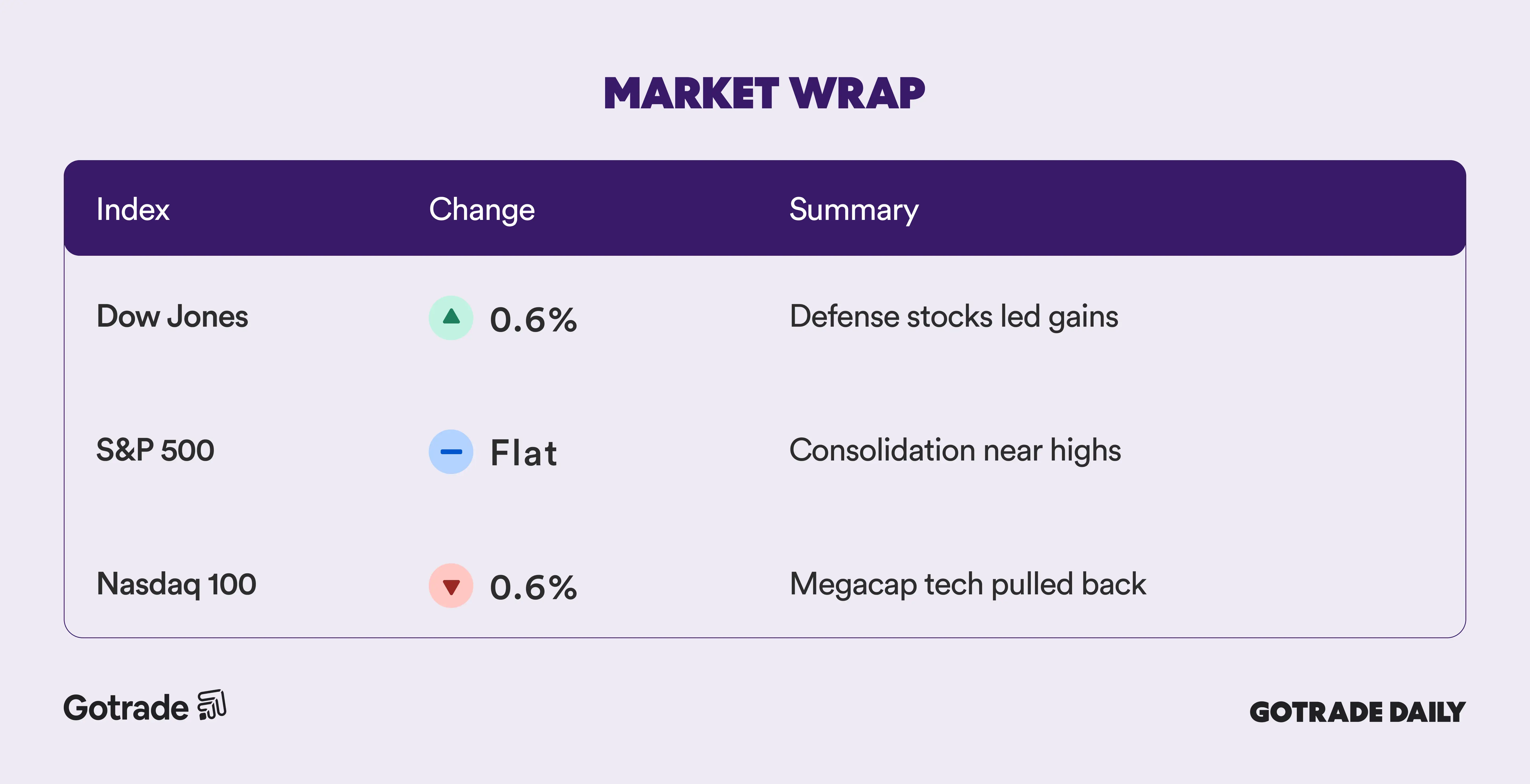

US stocks closed mixed on Thursday as investors rotated away from large-cap technology while selectively adding exposure to defense and industrial names. The Dow Jones Industrial Average (DJI) rose 0.6%, supported by gains in defense stocks, while the S&P 500 (SP500) finished little changed after pulling back from recent record territory. The Nasdaq 100 (NDX) slipped 0.6% as megacap technology shares lagged.

Technology stocks weighed on broader market momentum, led by declines in Nvidia (NVDA), Apple (AAPL), and Meta (META), as traders locked in profits following a strong start to 2026. In contrast, defense stocks rebounded sharply, with Lockheed Martin (LMT) and Northrop Grumman (NOC) posting strong gains after President Trump reiterated plans to significantly boost US military spending. The move helped reverse losses from the prior session, when the sector faced heightened policy-related pressure.

Investor attention remained fixed on the labor market as a series of mixed employment signals set the stage for Friday’s December nonfarm payrolls report. Challenger, Gray & Christmas reported that planned layoffs fell to their lowest level of 2025 in December, suggesting some stabilization. However, recent private payrolls data and government hiring reports have pointed to softer momentum, keeping expectations finely balanced ahead of the official jobs release.

Geopolitical considerations also stayed in focus, including US policy discussions around Venezuela’s oil sector and potential legal scrutiny of existing tariffs. With equity indexes near record levels, markets appeared inclined to consolidate while awaiting clearer direction from macro data.

📊 Market Wrap Jan 9th 2026

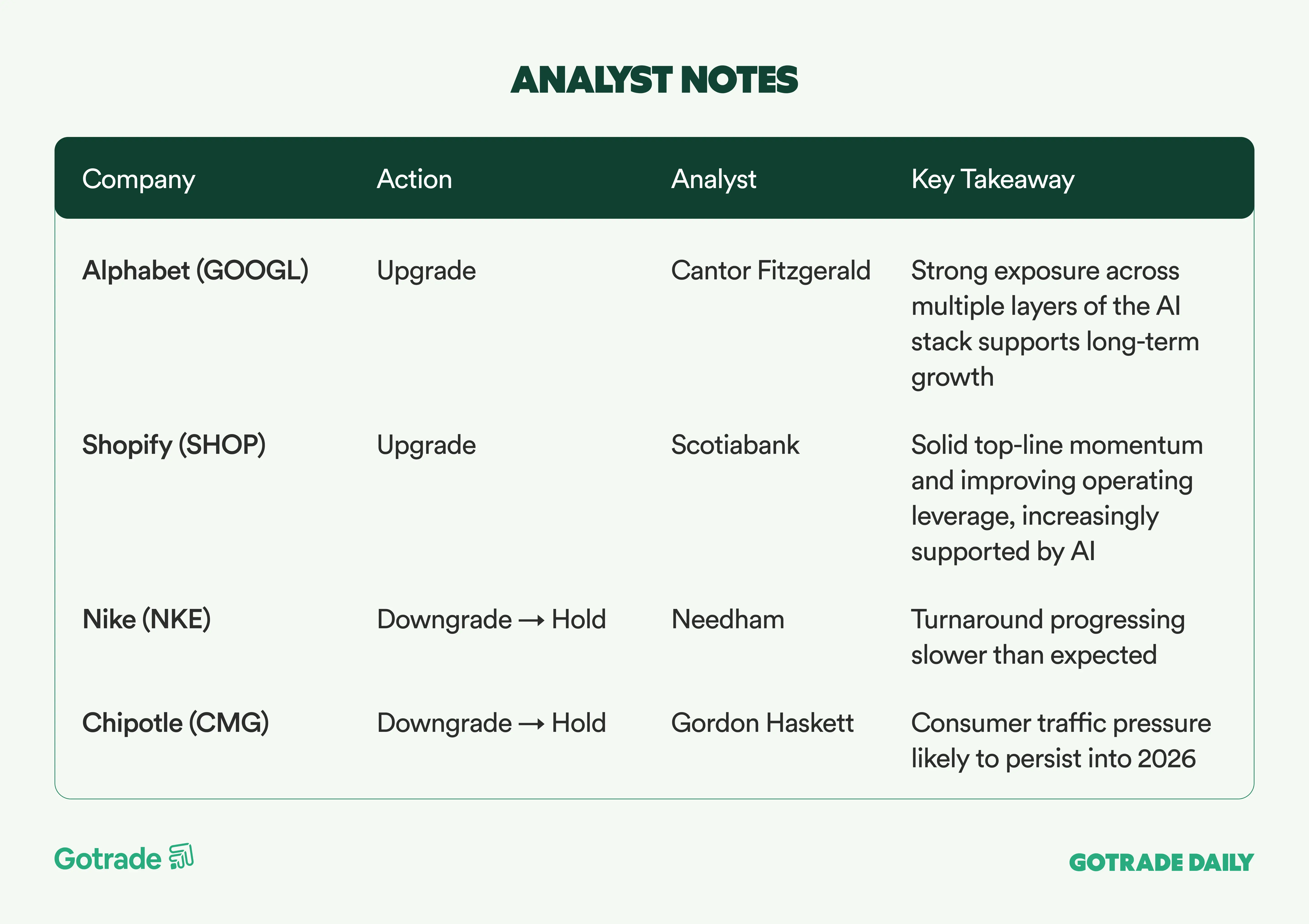

🧠 Analyst Notes

💬 Market Highlights

Qualcomm Strengthens Automotive Business Through Volkswagen and Hyundai Partnerships

Qualcomm (QCOM) announced two strategic automotive partnerships with Volkswagen and Hyundai Mobis to accelerate growth in its auto semiconductor unit. Under the Volkswagen agreement, Qualcomm will supply high-performance system-on-chips for next-generation infotainment platforms being developed alongside Rivian.

Separately, Qualcomm signed an MoU with Hyundai Mobis to co-develop integrated, software-defined vehicle solutions for emerging markets using Snapdragon Ride Flex. The deals reinforce Qualcomm’s positioning in intelligent, software-driven mobility.

Canopy Growth Rallies After Balance Sheet Recapitalization Moves

Canopy Growth (CGC) shares moved higher after the company unveiled multiple initiatives aimed at strengthening its balance sheet. The cannabis producer secured a new long-term loan maturing in 2031, generating approximately US$150 million in net proceeds, while also restructuring outstanding convertible debentures. The transactions are expected to lift Canopy’s cash position to nearly C$425 million, improving liquidity and financial flexibility.

Coinbase Upgraded to Buy at BofA on “Everything Exchange” Strategy

BofA Securities upgraded Coinbase (COIN) to Buy with a US$340 price target, citing accelerating product expansion and a broader addressable market. Recent launches into stock and ETF trading, as well as prediction markets, support Coinbase’s ambition to become an “everything exchange.” BofA also highlighted a favorable regulatory and political backdrop for crypto under the current U.S. administration as a key tailwind heading into 2026.

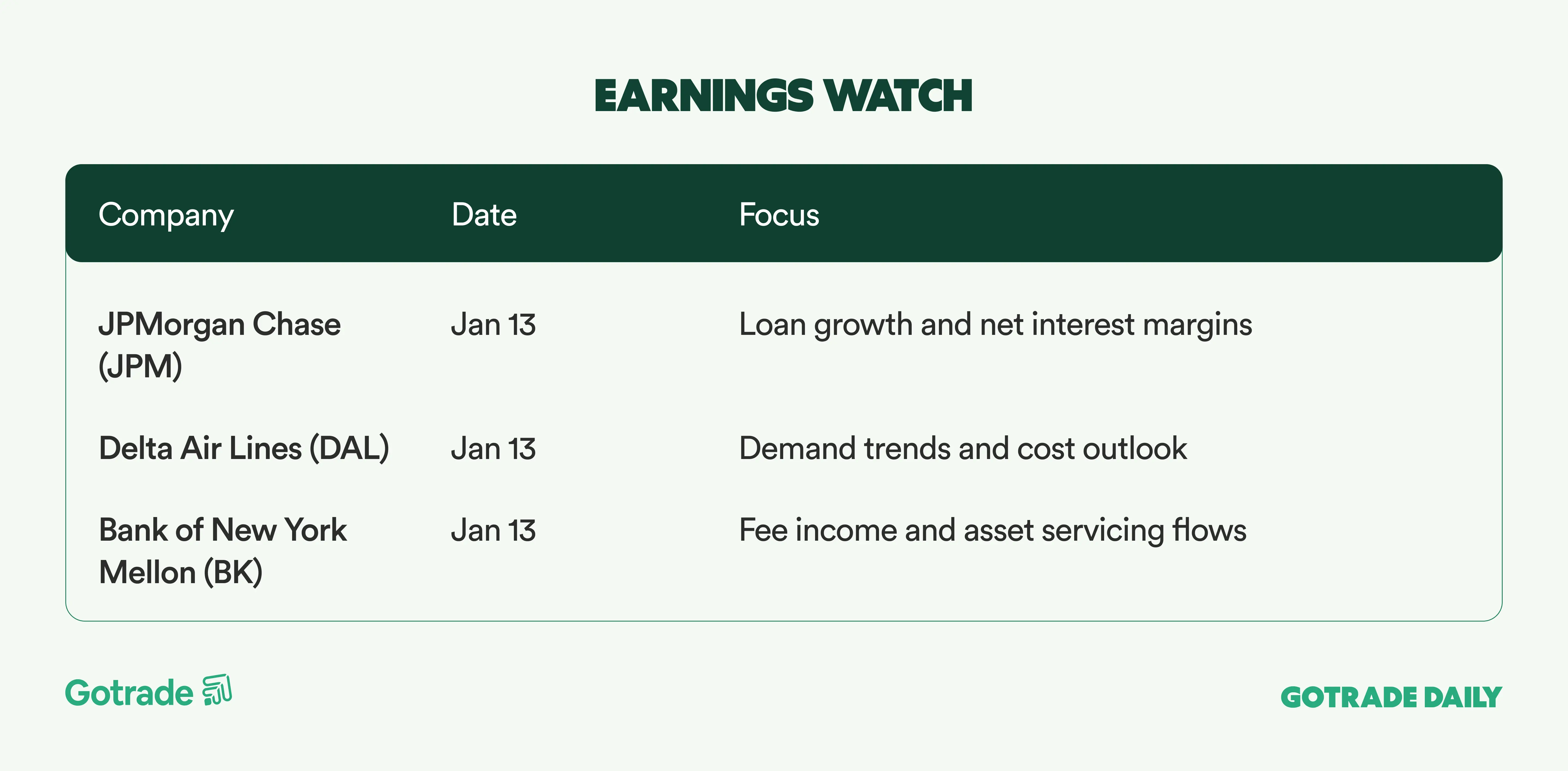

📅 Earnings Watch

Markets head into Friday with positioning increasingly shaped by expectations around the labor market and interest rate policy. With risk assets near highs, the December jobs report is likely to play a key role in setting near-term direction.

What stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.