Volatility widens as earnings shape positioning.

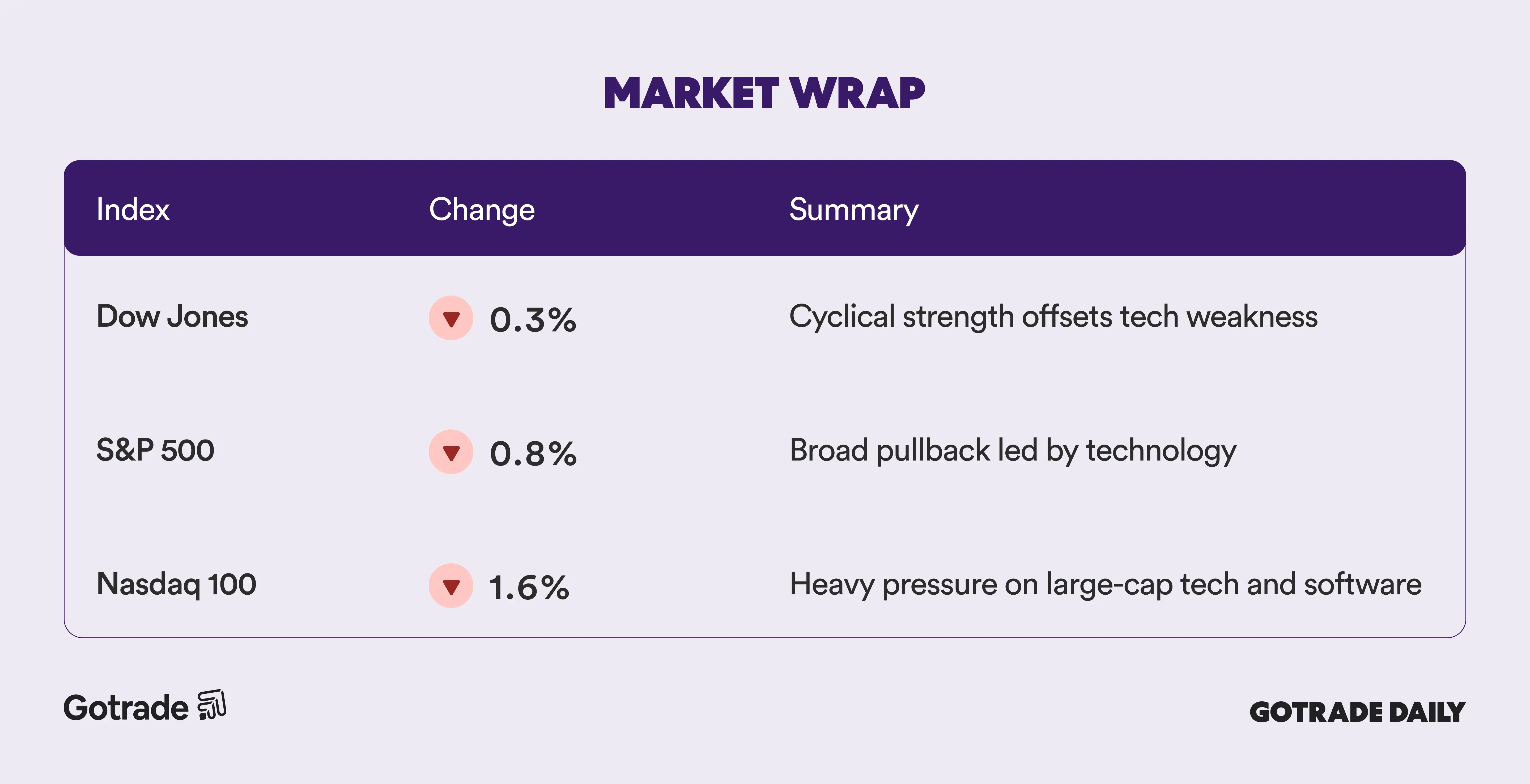

U.S. equities pulled back as investors rotated out of technology stocks, pressuring major indexes despite selective strength elsewhere. The S&P 500 fell 0.84%, while the Nasdaq Composite dropped 1.43%, led by declines in large-cap tech names including Microsoft (MSFT), Meta Platforms (META), Nvidia (NVDA), and Apple (AAPL). The Dow Jones Industrial Average slipped 0.34%, though it briefly touched a fresh intraday record earlier in the session.

Pressure was most visible in software and AI-linked stocks. ServiceNow (NOW) and Salesforce (CRM) both fell close to 7%, extending their 2026 underperformance as investors reassessed valuation, capex intensity, and long-term durability across enterprise software. Market participants described the move as a familiar unwind of prior momentum leaders during periods of rotation.

Cross-asset volatility remained part of the backdrop. After last week’s sharp drawdowns, gold and silver rebounded meaningfully, helping to stabilize sentiment. The recovery was visible in U.S.-listed proxies, with iShares Silver Trust (SLV) rising 4.3% to $75.56 by early afternoon after fluctuating between $75.20 and $80.70. Gold-linked ETFs such as VanEck Gold Miners ETF (GDX) also moved higher as investors reassessed positioning following the drawdown.

Risk appetite also cooled in digital assets. Bitcoin fell to its lowest level since November 2024, extending losses after dropping below the $80,000 level over the weekend. The pullback across crypto, alongside last week’s metals volatility, reinforced a more cautious tone across speculative assets.

Taken together, the rebound in metals alongside equity rotation points to a market reassessing risk across asset classes, where exposure is increasingly framed around specific events and scenarios rather than broad directional moves, often alongside tools such as options to manage uncertainty.

Not all stocks moved in tandem. Palantir Technologies (PLTR) jumped nearly 7% after delivering strong quarterly results and upbeat guidance, highlighting how earnings clarity continues to drive sharp stock-level dispersion even as the broader technology complex weakens.

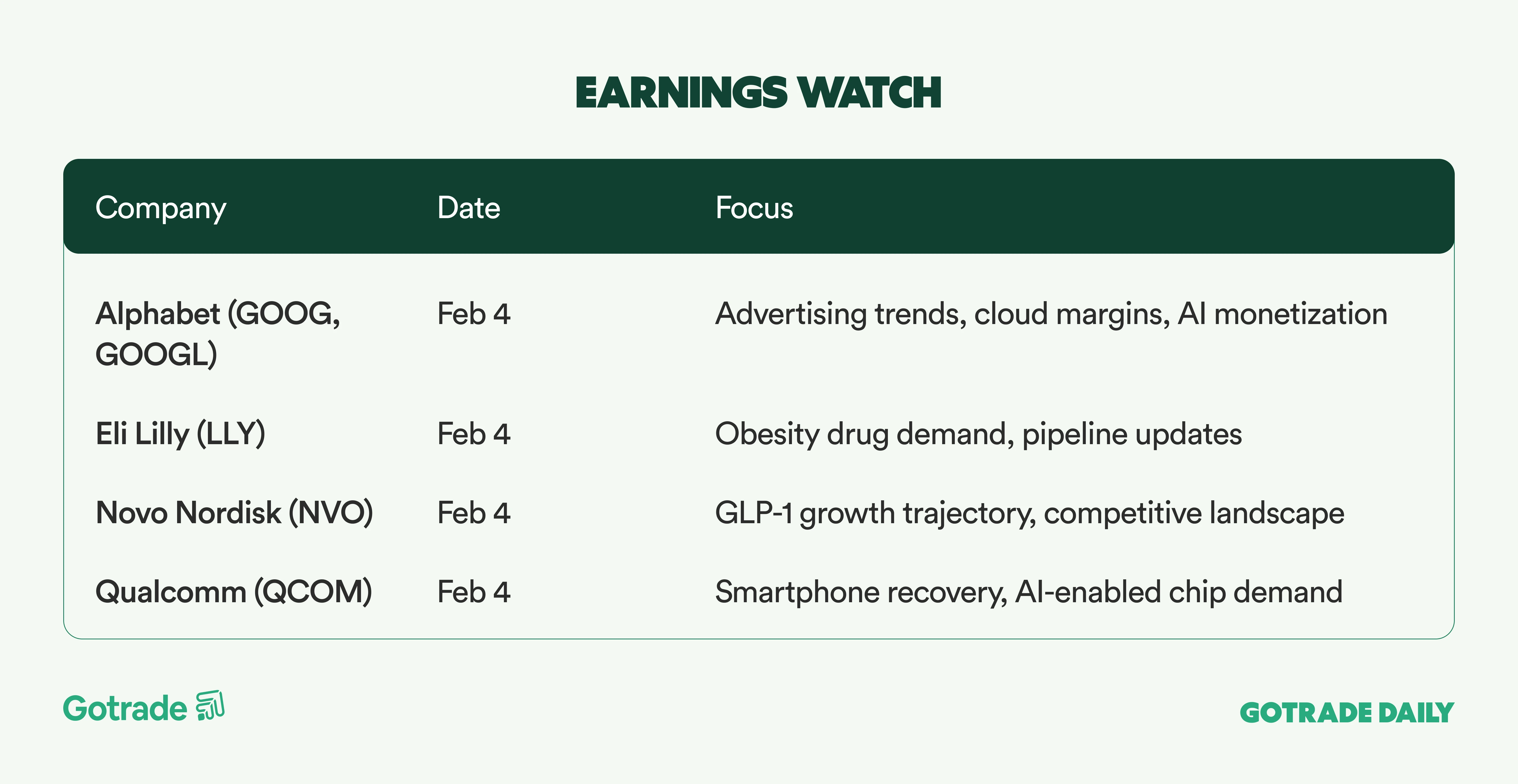

With more than 100 S&P 500 companies reporting earnings this week, investor focus is shifting from broad momentum trades toward fundamentals, guidance quality, and balance-sheet strength, particularly for megacap names such as Alphabet (GOOG, GOOGL) and Amazon (AMZN) reporting later this week.

📊 Market Wrap Feb 4th 2026

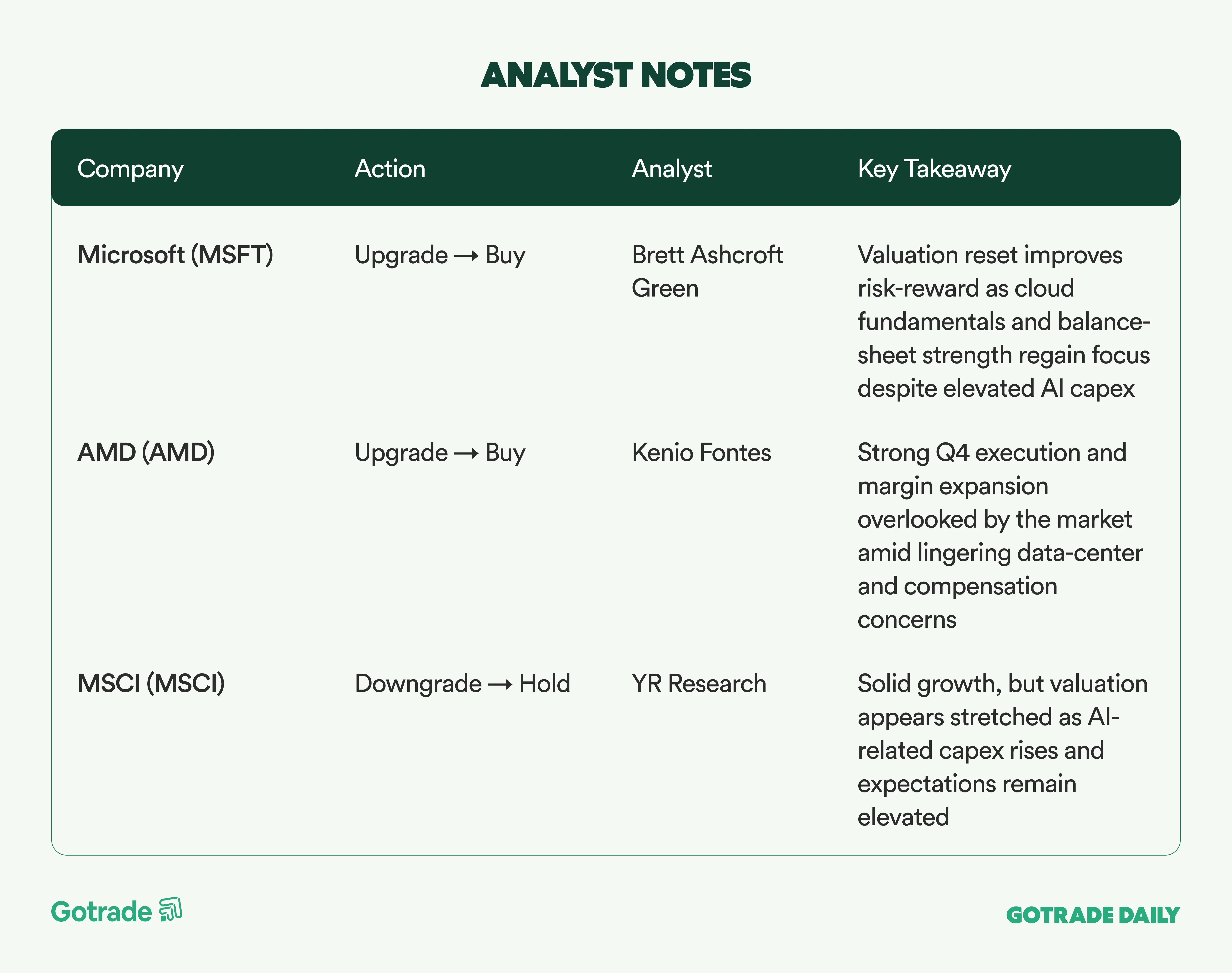

🧠 Analyst Notes

💬 Market Highlights

AMD Accelerates Its Shift Into a Full-Scale AI Infrastructure Powerhouse

Advanced Micro Devices (AMD) outlined an aggressive multi-year growth trajectory, targeting more than 60% annual Data Center revenue growth and scaling its AI business to tens of billions of dollars by 2027, driven by the upcoming launches of the MI400 GPU and the Helios platform.

Management highlighted expanding adoption of Instinct accelerators, now used in production by eight of the world’s ten largest AI companies, alongside continued EPYC CPU share gains and ramping rack-scale AI deployments. With operating expenses expected to grow more slowly than revenue, AMD is positioning itself as a structurally credible alternative in the AI infrastructure stack, even as risks remain around China exposure and memory cost inflation.

Novo Nordisk Enters a Structural Pressure Phase as Patent Cliffs Approach

Novo Nordisk (NVO) delivered solid operational growth in 2025, led by continued expansion in obesity care, but guided to a meaningful earnings contraction in 2026 as pricing pressure and semaglutide patent expirations begin to bite. While obesity revenue grew strongly and early uptake of oral Wegovy shows encouraging signals, operating profit and forward sales guidance fell short of market expectations. Agreements tied to U.S. pricing policy and intensifying GLP-1 competition underscore a transition from hypergrowth to normalization, prompting a broader repricing across obesity-focused pharmaceutical names.

DaVita Reasserts Defensive Earnings Strength Despite Berkshire Share Sale

DaVita (DVA) shares surged after the company posted a decisive fourth-quarter earnings beat and issued upside 2026 EPS guidance, reinforcing the durability of its reimbursement-driven dialysis model.

Revenue growth was supported by higher reimbursement rates, favorable patient mix, and strong operating leverage, outweighing negative sentiment from Berkshire Hathaway’s partial stake reduction. With high cash flow visibility and structurally resilient demand, DaVita is once again being framed by investors as a defensive compounder with improving earnings momentum.

📅 Earnings Watch

As leadership narrows and volatility spans equities, metals, and digital assets, market moves are increasingly shaped by earnings visibility and event risk rather than broad sentiment. The sessions ahead are likely to further test which sectors can sustain momentum as investors recalibrate exposure.

What stocks are you watching today?