AI reassessment and rate cuts support broader participation.

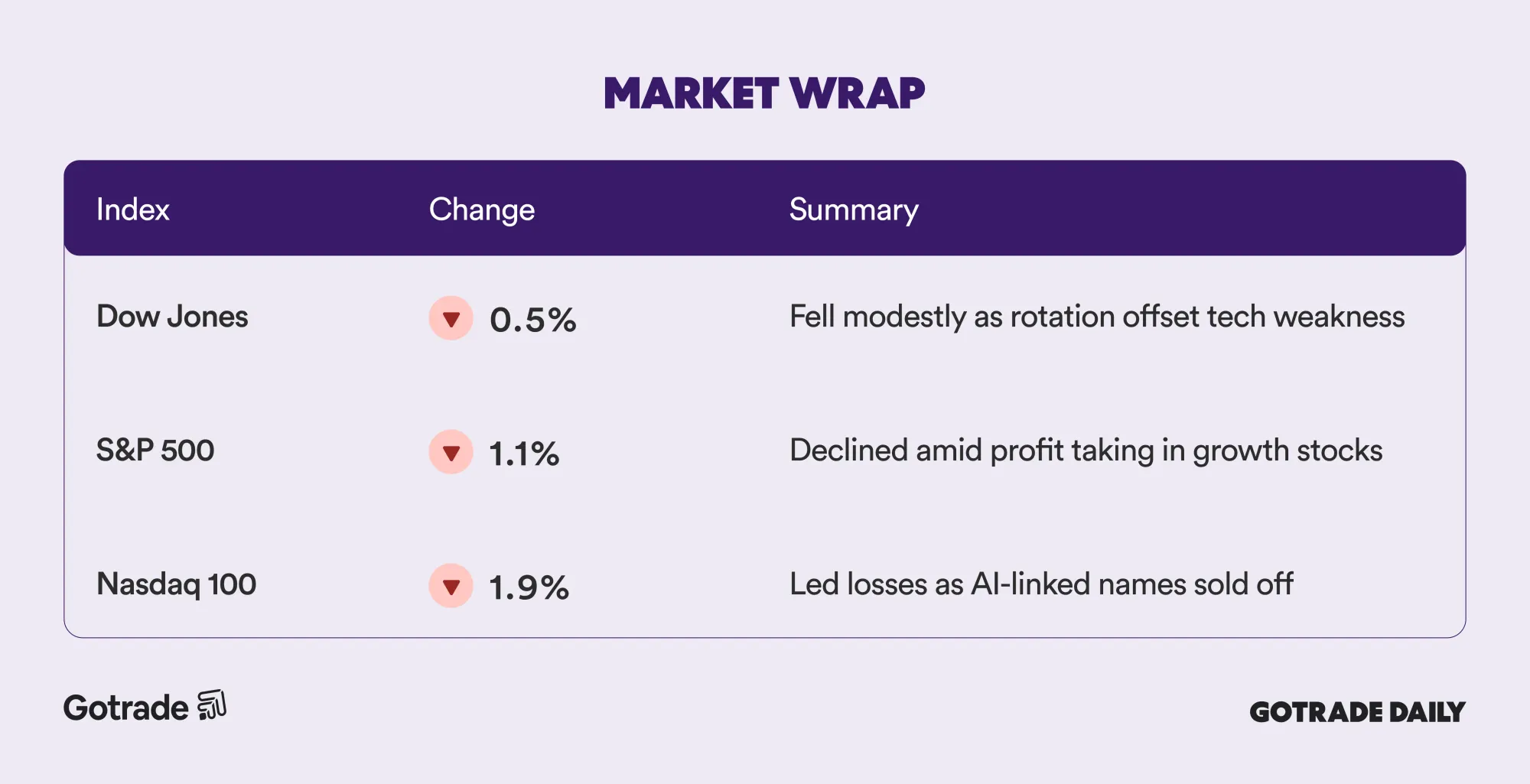

US stocks fell on Friday, extending a pullback that reflected growing investor caution around large technology names tied to artificial intelligence. Losses were led by the Nasdaq, while broader benchmarks showed more moderate declines as capital continued rotating into other areas of the market.

The shift comes as investors reassess valuation, margin sustainability, and capital intensity within the AI trade. Recent sharp declines in stocks such as Oracle (ORCL) and Broadcom (AVGO) reignited concerns around AI spending discipline, while stronger corporate results from non tech sectors supported sentiment elsewhere.

For traders, the key takeaway this week is not the index-level weakness but the change in leadership. With the Federal Reserve having delivered another rate cut and signaling a more accommodative stance, conditions are forming for cyclical, financial, healthcare, and smaller-cap stocks to play a larger role into year end and early next year.

📊 Market Wrap Dec 15th 2025

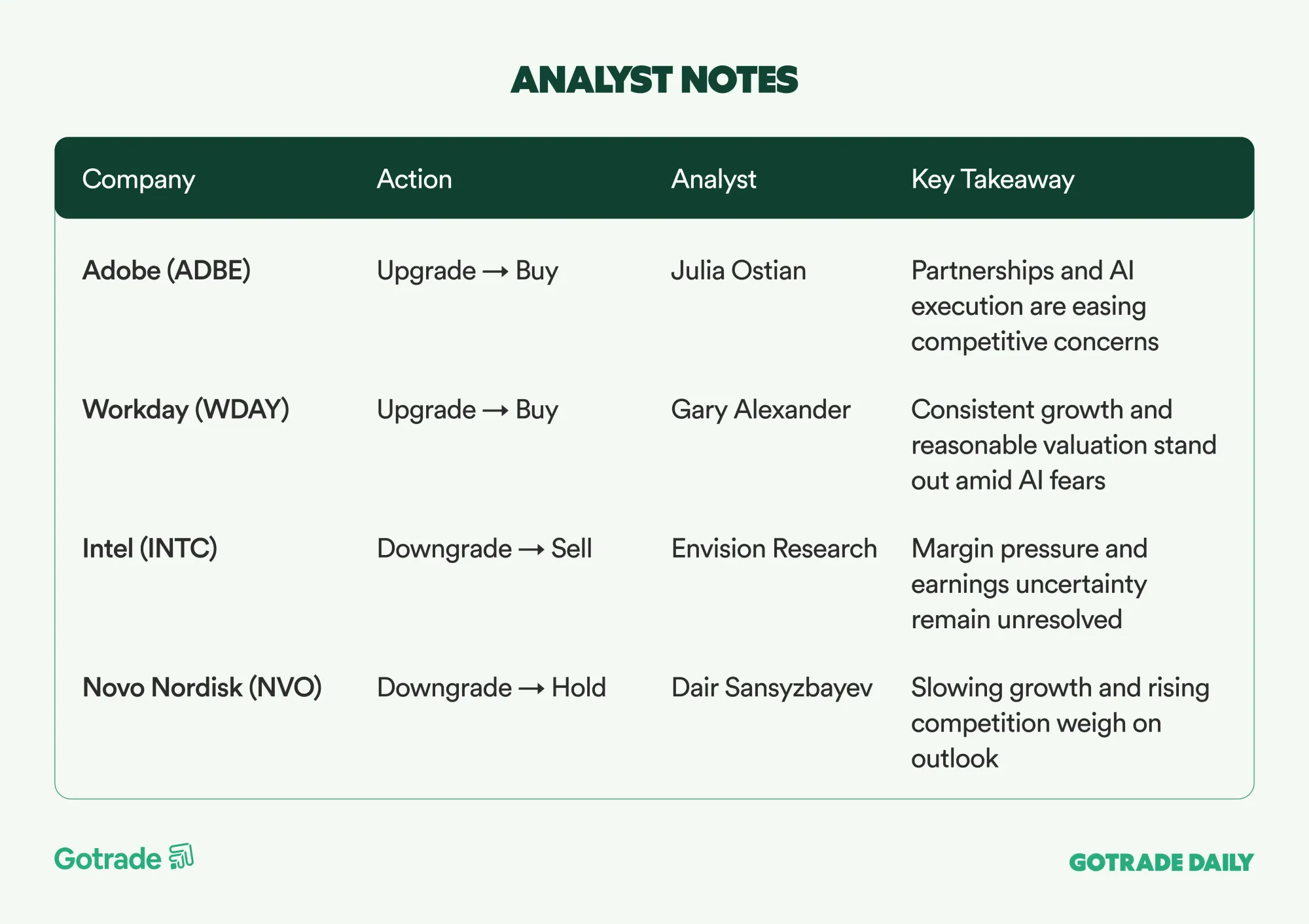

🧠 Analyst Notes

💬 Market Highlights

Healthcare Sector Shows Relative Strength

Healthcare stocks helped cushion broader market weakness, with the Health Care Select Sector SPDR Fund (XLV) rising about 1.4% over the past week. Gains were led by managed care names such as Molina and Elevance, while parts of medical devices and biotech lagged. Key headlines included CVS Health (CVS) raising its 2025 guidance but issuing a softer-than-expected 2026 revenue outlook, Eli Lilly (LLY) reporting positive late-stage trial results for its weight-loss drug retatrutide, and Novartis (NVS) announcing an AI-driven drug discovery partnership valued at up to $1.7 billion.

Alphabet May Book New Accounting Gains from SpaceX Valuation

Alphabet (GOOG, GOOGL) could record additional unrealized gains after a recent SpaceX tender offer implied a valuation of around $800 billion. Historically, increases in SpaceX’s valuation have flowed through Alphabet’s financials as unrealized gains on non-marketable equity securities, occasionally boosting reported earnings despite no cash impact.

Oracle Draws Bullish Views Despite Sharp Weekly Decline

Oracle (ORCL) fell roughly 13% over the past week following a fiscal second-quarter revenue miss, marking its steepest weekly drop in more than seven years. Even so, several analysts view the sell-off as a reset in valuation and narrative rather than a deterioration in fundamentals, citing Oracle’s positioning at the intersection of cloud and AI, along with strong demand visibility supported by contracts and backlog.

📅 Earnings Watch

Markets remain in a rotation phase, with investors selectively reallocating away from crowded growth trades toward sectors tied more closely to the broader economy. As the year draws to a close, positioning and risk management continue to take priority amid shifting leadership.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.