U.S. equities extended their sell-off as investors moved decisively into a risk-off stance, unwinding crowded positions in technology and AI-linked stocks. The Dow Jones Industrial Average fell nearly 600 points to close at 48,908.72, while the S&P 500 dropped 1.23% to 6,798.40, slipping into negative territory for 2026. The Nasdaq Composite led losses, down 1.59% to 22,540.59, as pressure intensified across software, semiconductors, and other high-growth names.

Alphabet (GOOGL) was the latest Magnificent Seven company to report earnings, delivering solid results but unsettling markets with its outlook for sharply higher AI spending. Management guided 2026 capital expenditures of up to US$185 billion, reigniting debate over return visibility and capital discipline, as Alphabet shares fell 0.5%. The divergence within AI remained clear, with Broadcom (AVGO) gaining on the spending signal while Qualcomm (QCOM) slid more than 8% after issuing a weaker-than-expected forecast tied to global memory constraints.

Selling pressure deepened across software and AI beneficiaries. Advanced Micro Devices (AMD) stayed under heavy pressure, while stocks such as Microsoft (MSFT), Oracle (ORCL), Salesforce (CRM), and Palantir Technologies (PLTR) remained weak as investors reassessed how durable enterprise software demand may be in an AI-driven landscape. The rotation reflected a market no longer treating AI as a single trade, but instead separating infrastructure winners from models seen as more exposed to disruption.

As volatility picked up, options activity increasingly reflected a focus on protection rather than outright positioning. Demand for downside hedges linked to the Invesco QQQ Trust climbed to its highest level since 2020, while implied volatility across tech and software ETFs moved higher. The shift suggests investors are choosing to manage risk through defined scenarios, using options to navigate sharper swings as uncertainty builds around earnings visibility, capex intensity, and labor market signals.

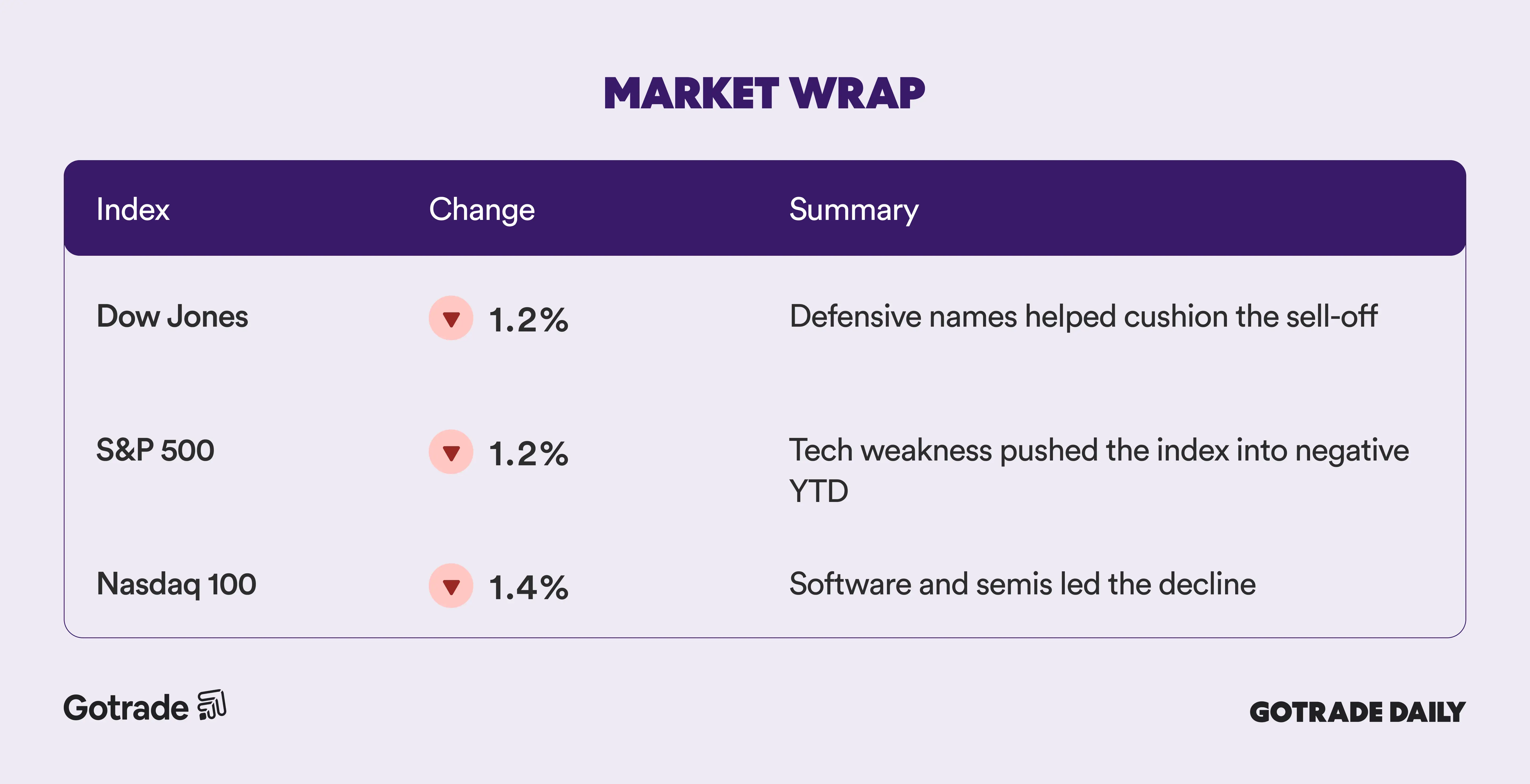

📊 Market Wrap Feb 6th 2026

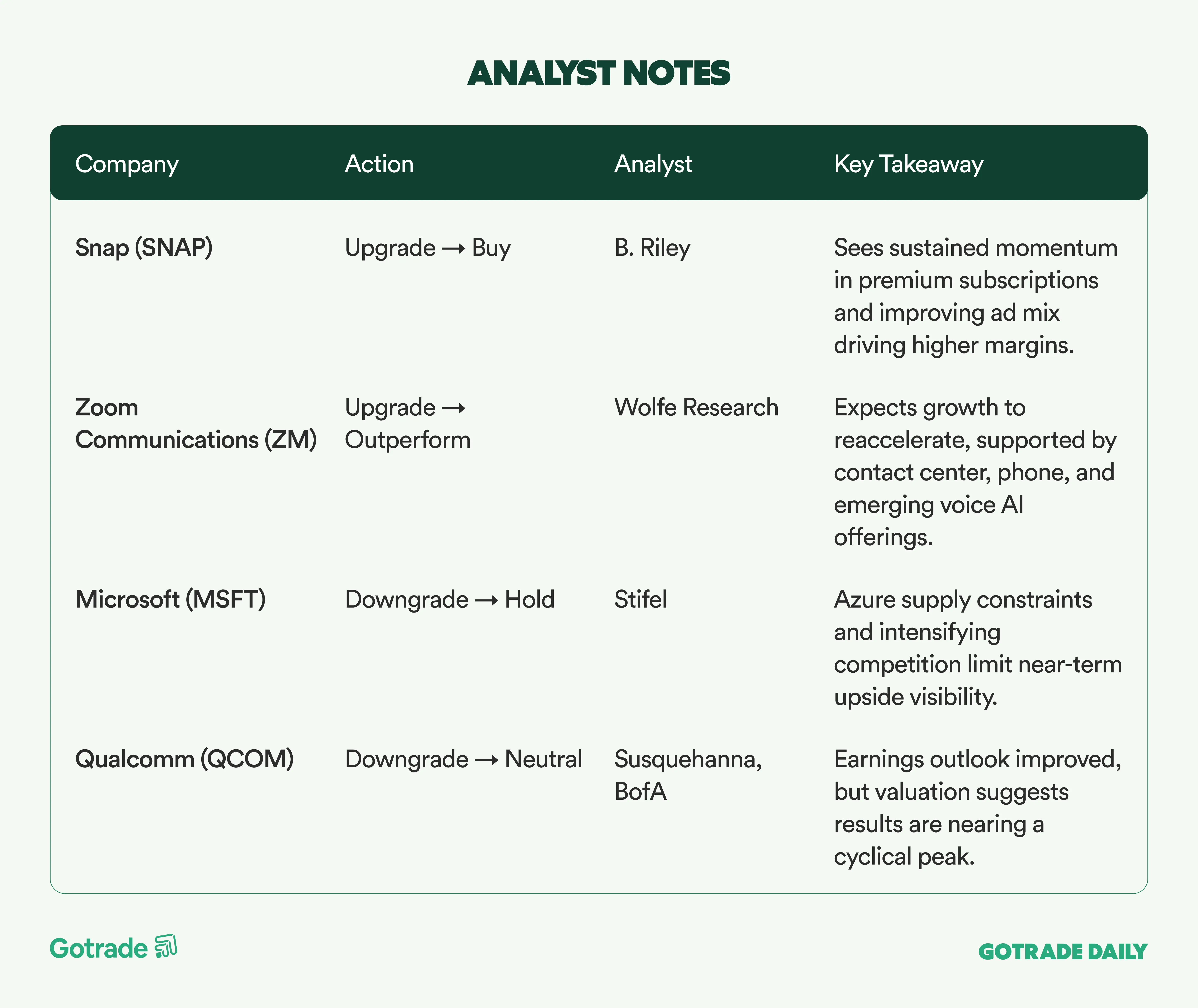

🧠 Analyst Notes

💬 Market Highlights

Strategy Posts Massive Q4 Loss as Bitcoin Drops

Strategy (MSTR) reported a steep Q4 2025 loss as Bitcoin (BTC-USD) weakness drove a large fair-value accounting hit that overwhelmed modest software revenue growth. GAAP EPS came in at -$42.93 versus the -$20.99 analyst consensus, while revenue rose to $123.0 million, above the $118.5 million consensus.

The key driver was a net unrealized loss on digital assets that surged to $17.5 billion, as Bitcoin fell 26% during Q4. As of Feb. 1, 2026, MSTR held 713,502 BTC at a total cost of $54.3 billion (about $76,052 per coin). With BTC trading below $65K around the time of the report, investors will look for clearer capital allocation and funding posture commentary, particularly after management highlighted raising $25.3 billion of capital in 2025 to advance its Bitcoin treasury strategy.

Amazon Targets $200B Capex, Framing AWS as an AI Capacity Monetization Engine

Amazon (AMZN) sharpened its AI-led investment message, guiding to roughly $200 billion in capital expenditures, predominantly for AWS, as demand for core and AI workloads continues to scale. Q4 2025 revenue was $213.4 billion with operating income of $25 billion, and AWS growth accelerated to 24% year over year, reaching a $142 billion annualized run rate.

Management also pointed to its in-house chips business (Graviton and Trainium) surpassing a $10 billion annual revenue run rate with triple-digit growth. The core framing is rapid capacity installation paired with rapid monetization, supported by AWS backlog of $244 billion (+40% year over year). The market’s key debate is whether this elevated capex cycle can sustain durable growth while maintaining clear return on invested capital guardrails.

Roblox Guides 22%-26% 2026 Bookings Growth, Scaling AI and the 18+ Opportunity

Roblox (RBLX) guided to 22%-26% bookings growth in 2026 while continuing to invest in AI, safety, and expansion of its 18+ user base. Q4 2025 results were strong, with revenue of $1.4 billion (+43% year over year) and bookings of $2.2 billion (+63% year over year).

Management emphasized accelerating adoption among users aged 18+, growing over 50% and monetizing 40% higher than younger cohorts, and highlighted a strategic push into higher-monetizing genres such as shooters and RPGs. AI is positioned as a core platform layer across discovery, personalization, safety, translation, and creator tooling, alongside broader age-estimation rollout reaching about 45% of global DAU by Jan. 31, 2026.

Importantly, management said 2026 guidance does not assume a new mega-viral hit, framing next year as a scalability and consistency story rather than a one-off content spike.

📅 Earnings Watch

As markets move deeper into a repricing phase, leadership is increasingly shaped by capital discipline, balance sheet strength, and clarity on returns. With volatility elevated across equities, commodities, and derivatives, the coming data and earnings will determine whether recent moves mark stabilization or further differentiation.

What stocks are you watching today?