Equities advance while investors weigh moves in metals, crypto, and earnings.

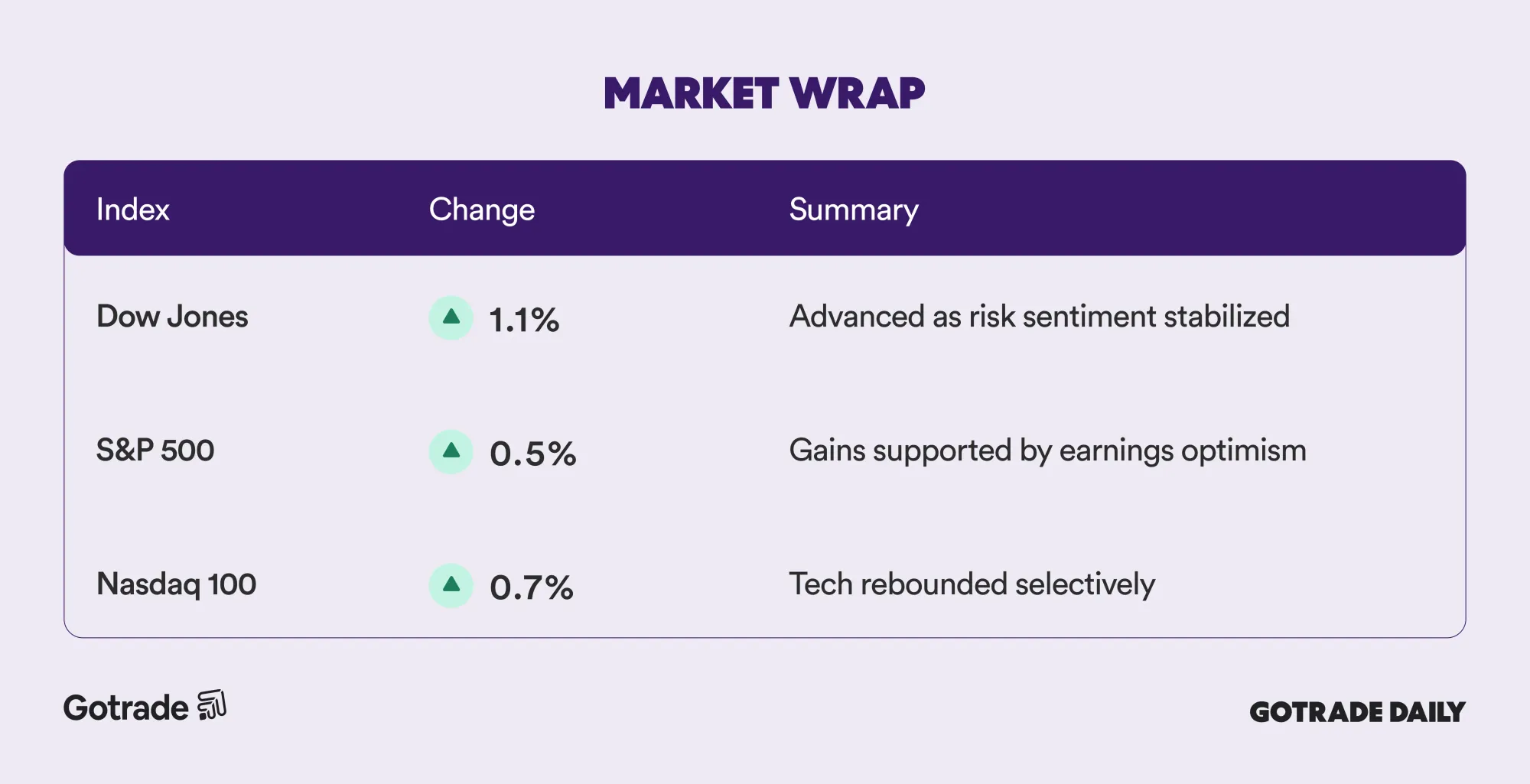

U.S. equities opened the new month on a stronger note, with investors largely looking through last week’s sharp selloff in precious metals and crypto. The Dow Jones Industrial Average surged more than 500 points, while the S&P 500 and Nasdaq Composite also finished higher, pointing to a reset in sentiment after a volatile end to January.

Cross-asset moves were still front and center. Bitcoin briefly dropped below $80,000 for the first time since April, extending the risk-off tone that followed Friday’s heavy declines in gold and silver. As bitcoin and metals came off their lows during Monday’s session, equity selling pressure eased and stocks stabilized.

Investors also tracked the AI trade closely. Nvidia (NVDA) slipped after reports suggested its proposed $100 billion investment in OpenAI has stalled, reinforcing debate around the pace of AI spending and the market’s sensitivity to capex headlines.

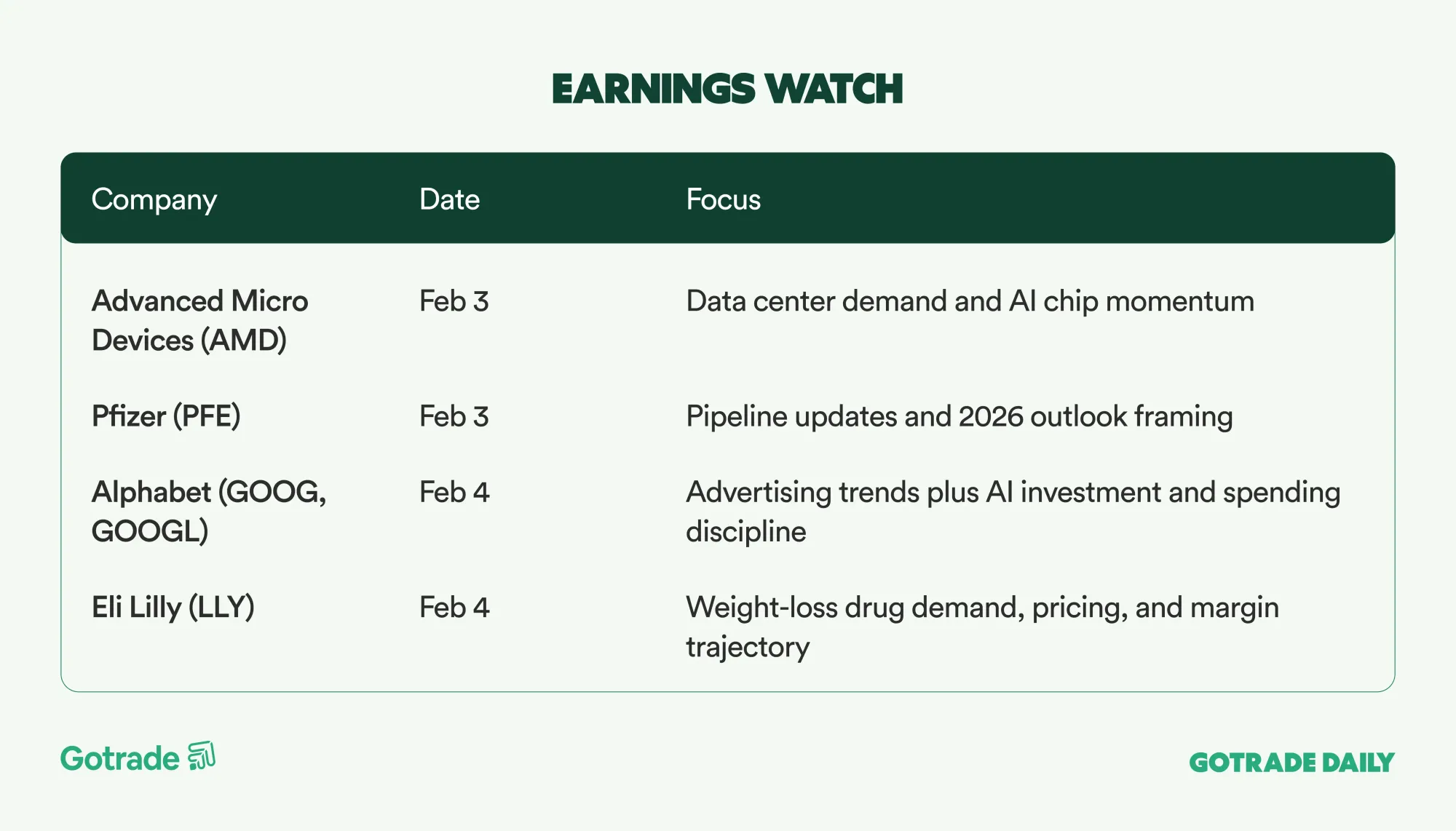

With more than 100 S&P 500 companies scheduled to report this week, earnings remain a key support. Even with strong headline beat rates so far, recent post-earnings moves in large-cap tech have kept positioning selective, with markets reacting more to guidance and spending signals than to top-line strength alone.

📊 Market Wrap Feb 3rd 2026

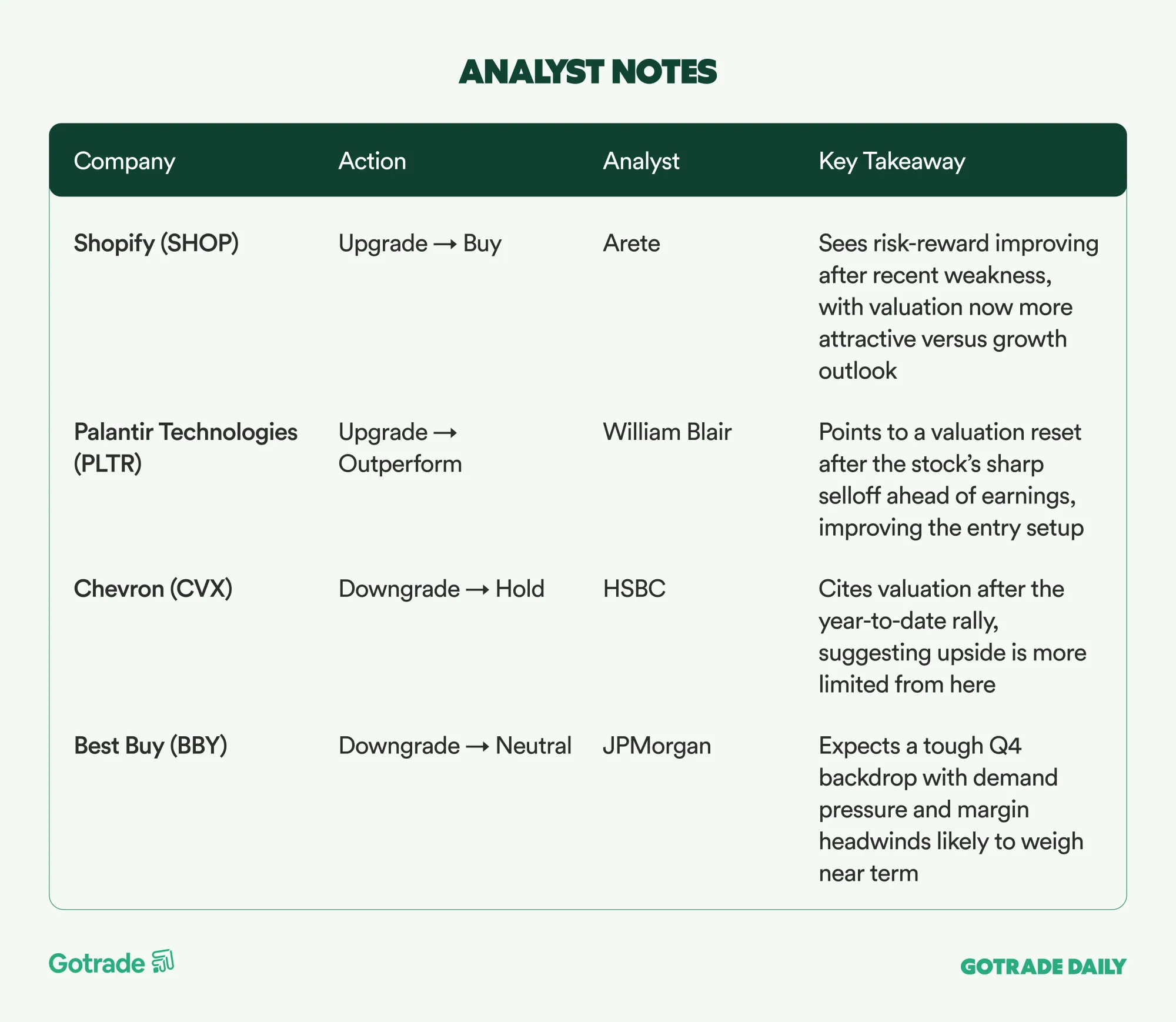

🧠 Analyst Notes

💬 Market Highlights

Robinhood Expands UK Footprint with ISA Launch Targeting Young Investors

Robinhood (HOOD) launched a stocks and shares ISA in the UK, offering zero platform fees, commission-free trading, low FX costs, and a 2% cash incentive ahead of the April 2026 tax deadline. The move positions Robinhood to tap into the UK’s most popular long-term savings vehicle, where adoption among younger investors remains below average.

Mizuho views the ISA launch as a major catalyst for international expansion, citing a total addressable market exceeding $1 trillion compared with Robinhood’s current ~$333 billion in assets under custody. While HOOD shares fell alongside broader crypto market weakness, strategically the product strengthens Robinhood’s ambition to become a global retail investing platform beyond its US core.

Amazon Accelerates Corporate Restructuring to Flatten Management Layers

Amazon (AMZN) plans to eliminate another 2,200 corporate roles, adding to more than 57,000 job cuts since CEO Andy Jassy took over in 2021. Management frames the layoffs as an organizational redesign rather than a response to financial stress or AI disruption, with a clear focus on removing duplicated management layers and accelerating decision-making. The move reinforces Amazon’s ongoing shift toward operational efficiency and accountability as the company balances cost discipline with heavy long-term investment in logistics, cloud infrastructure, and AI capabilities.

Palantir Signals Structural AI Supercycle with Aggressive 2026 Growth Outlook

Palantir Technologies (PLTR) outlined a 61% revenue growth target for 2026 following a historic 2025 marked by 70% overall growth and a 93% surge in US revenue. Management emphasized explosive demand from US commercial and government customers, record contract values, and rapid deployment of AI platforms such as AIP and AI FDE across mission-critical use cases.

With adjusted operating margins exceeding 50% and free cash flow scaling sharply, Palantir is positioning itself not as a traditional enterprise software provider but as a core AI operating platform embedded deeply in defense, industrial, and commercial decision systems. The key challenge ahead remains replicating US momentum internationally.

Recent swings across precious metals, crypto, and select equities have highlighted how quickly risk sentiment can shift, particularly around earnings and major headlines. In environments like this, options are often discussed as a way investors frame risk around specific events or price levels.

For a clear, plain-language introduction, see Options Trading: Definition, How It Works, and Smart Strategies.

📅 Earnings Watch

With cross-asset volatility still in play, markets are leaning on earnings resilience for support. As this week’s reporting accelerates, leadership is likely to stay selective, with guidance and spending signals doing more to move stocks than broad index-level narratives.

What stocks are you watching today?