Rate-cut bets shift as labor resilience tempers easing hopes.

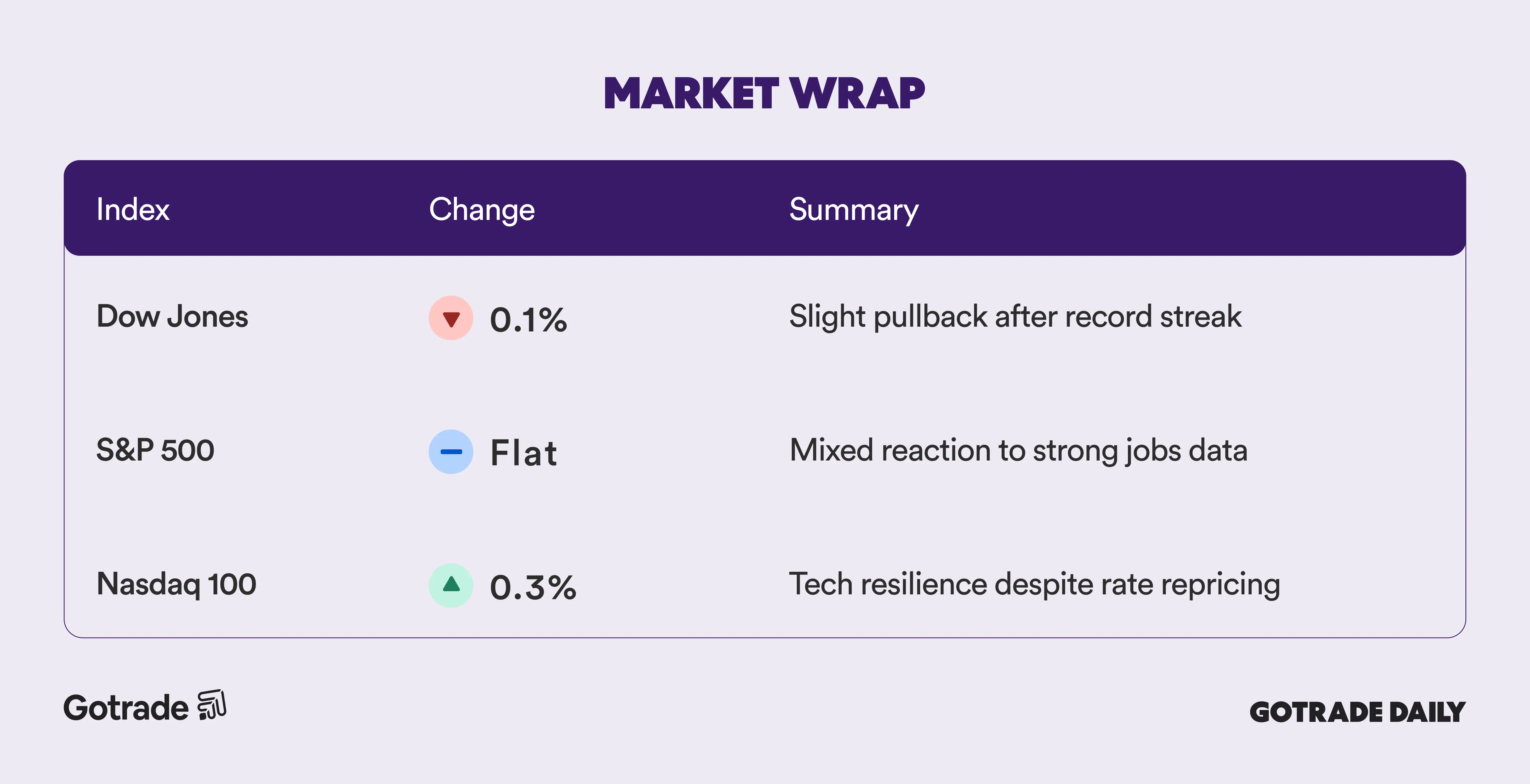

U.S. equities closed slightly lower Wednesday as investors assessed a stronger-than-expected January employment report alongside an active earnings slate. The Nasdaq and Dow Jones Industrial Average finished down 0.2% and 0.1%, respectively, while the S&P 500 closed marginally lower after the Dow had logged record highs in the prior three sessions.

According to the Bureau of Labor Statistics, U.S. employers added 130,000 jobs in January, well above expectations of 55,000. The unemployment rate edged down to 4.3% from 4.4%, reinforcing the view that labor market conditions remain firm despite signs of cooling earlier this year.

Bond markets reacted in textbook fashion. The 10-year Treasury yield rose to 4.18%, and CME’s FedWatch tool now reflects a 94% probability that the Federal Reserve will hold rates steady in March. A resilient jobs print reduces urgency for near-term easing and recalibrates expectations around the timing of rate cuts.

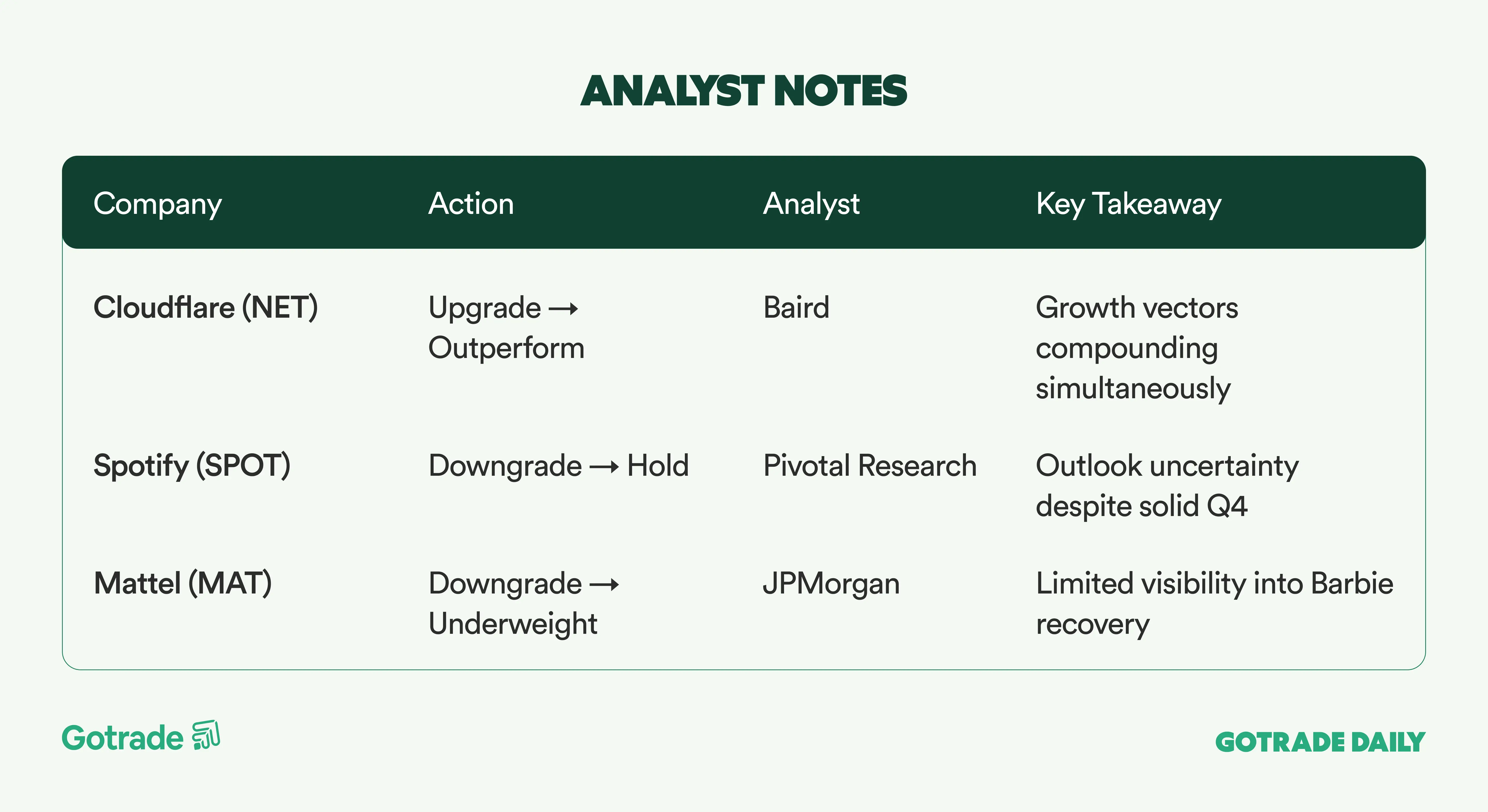

Within equities, the Magnificent Seven ended mixed. Nvidia (NVDA) and Tesla (TSLA) posted modest gains, while Alphabet (GOOGL) declined 2.4%, leading large-cap tech lower. Outside mega-cap names, dispersion remained pronounced: Mattel (MAT) plunged 25%, Lyft (LYFT) fell 17%, and Robinhood (HOOD) dropped 9%, while Cloudflare (NET) gained 5% and T-Mobile (TMUS) rose 5%.

Commodities saw renewed volatility. Gold futures climbed 1.6% to $5,110 per ounce and silver surged 4.5% above $84, reflecting ongoing positioning shifts across precious metals markets. Bitcoin traded near $67,600, below overnight highs, as risk appetite remained selective.

📊 Market Wrap Feb 12th 2026

🧠 Analyst Notes

💬 Market Highlights

Super Bowl LX Sees Slight Viewership Dip as Comcast Generates ~$800M in Ad Revenue

Super Bowl LX drew approximately 125 million viewers, down 2.2% from last year’s 127.7 million, yet it remained one of the most-watched games in history. Viewership peaked at nearly 138 million during the second quarter, while the Apple Music-sponsored halftime show averaged 128.2 million viewers.

On the commercial front, Comcast’s (CMCSA) NBC and Peacock generated roughly $800 million in advertising revenue, with 30-second spots averaging $8 million and several selling for more than $10 million. Despite the modest decline in viewership, pricing power remained strong, reinforcing the Super Bowl’s status as a premium asset across both linear and streaming media platforms.

Kraft Heinz Faces Margin Pressure, Pauses Breakup Plan to Refocus on Growth

Kraft Heinz (KHC) delivered mixed fourth-quarter results, with net sales declining 3.5% amid softer North American demand and pricing actions that pressured volumes in key categories such as cold cuts, coffee, and frozen foods. Gross margins compressed, and 2026 guidance came in below expectations, with organic sales projected to decline up to 3.5% and EPS below consensus.

In response, management announced a pause on its planned business separation and committed $600 million toward restoring profitable growth. The move signals a strategic pivot from structural reorganization toward operational turnaround, though skepticism persists, including from major shareholder Berkshire Hathaway.

Unity Plunges as Weak Q1 Outlook Overshadows Strong Q4 Beat

Unity (U) reported fourth-quarter results that exceeded expectations, supported by strong performance from its AI-powered ad platform Vector and accelerating adoption of Unity 6. However, first-quarter 2026 revenue guidance fell short of consensus, triggering a sharp selloff with shares down more than 25% in premarket trading.

While management highlighted long-term momentum and its ambition to become essential infrastructure for interactive entertainment, investors reacted negatively to near-term revenue softness and execution risk. The market response underscores heightened sensitivity to forward guidance within the gaming and technology sectors.

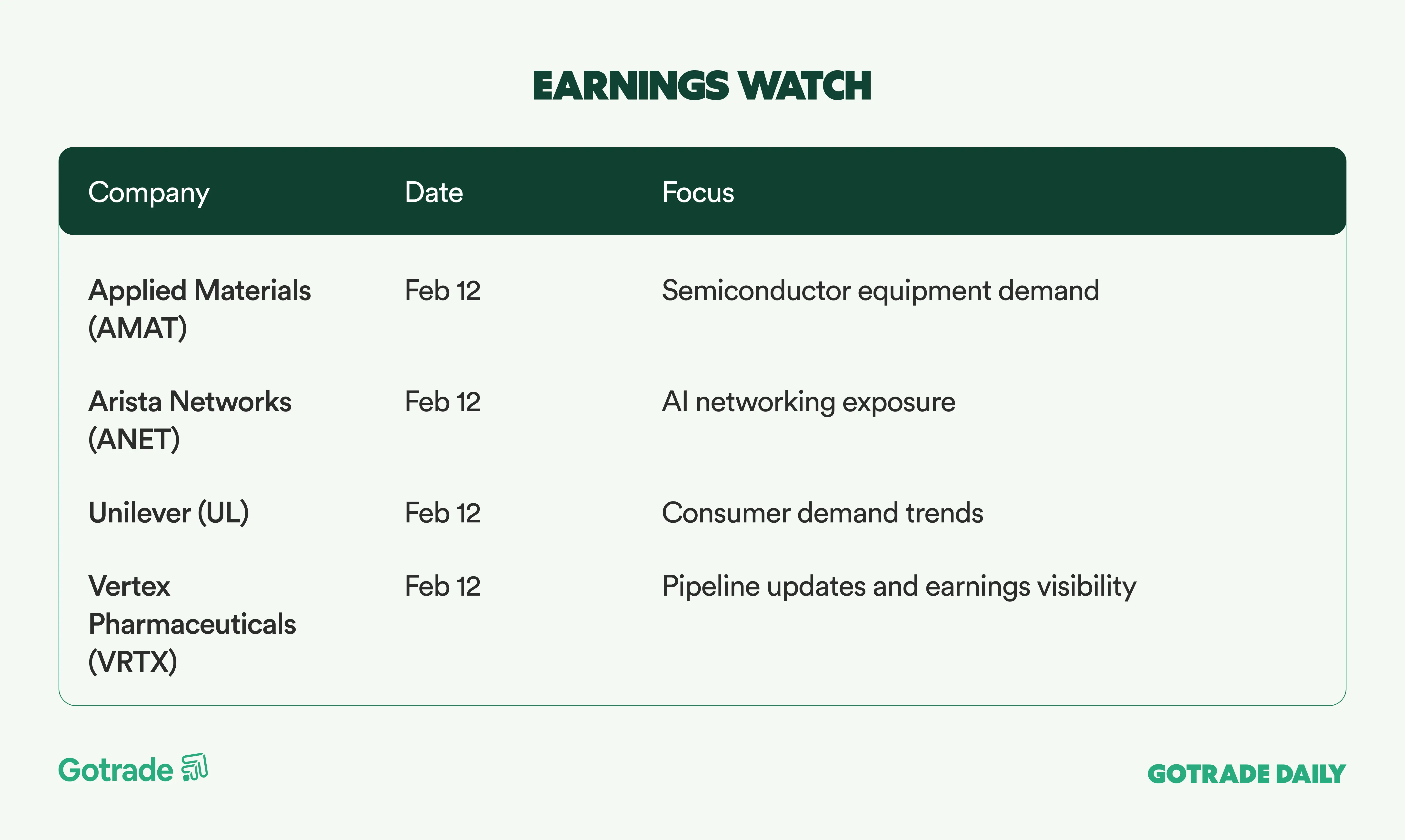

📅 Earnings Watch

With labor strength and earnings dispersion unfolding simultaneously, markets enter a phase where policy expectations and company-specific execution matter more than headline index moves. Selectivity remains key as investors balance macro resilience against valuation sensitivity.

What stocks are you watching today?