Major US indexes closed at fresh record highs, continuing recent momentum.

Wall Street closed higher on Wednesday, with major indexes setting new record closes. Gains were supported by large-cap stocks and continued strength from the previous session.

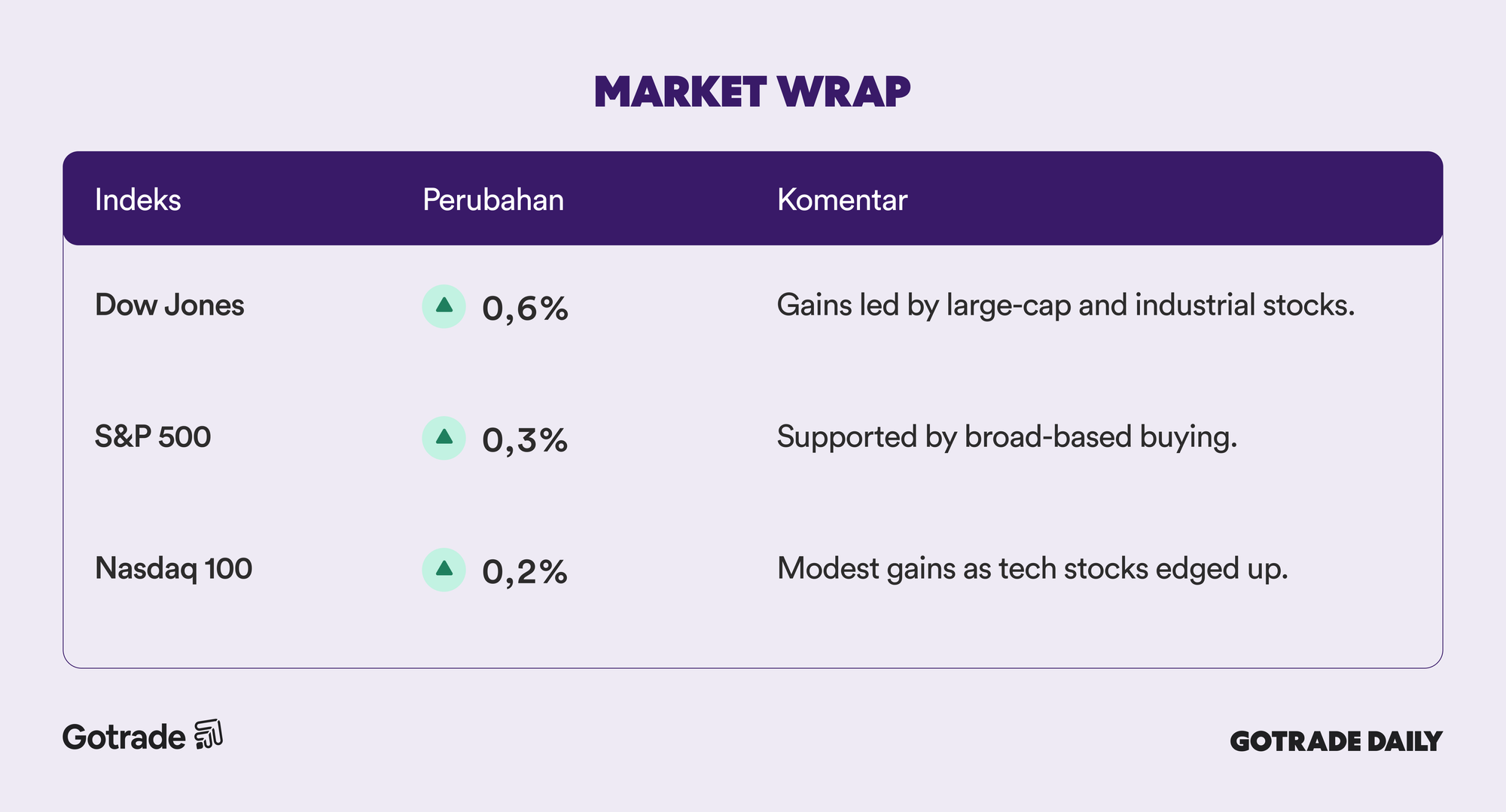

The S&P 500 rose 0.32% to close at 6,932.05. The Dow Jones Industrial Average gained 0.60% to 48,731.16, while the Nasdaq Composite added 0.22% and ended at 23,613.31.

Nike (NKE) rose 4.6% after Apple CEO Tim Cook disclosed a personal purchase of the stock. Micron Technology (MU) and Citigroup (C) also finished higher, up 3.8% and 1.8% respectively, and both reached new intraday highs.

Markets extended gains from the prior session, which was led by large technology names including Alphabet (GOOG/GOOGL), Nvidia (NVDA), Broadcom (AVGO), and Amazon (AMZN).

Investor sentiment was also influenced by the release of third-quarter US gross domestic product data, which showed growth of 4.3%, above the 3.2% consensus estimate. The report had been delayed due to the government shutdown. Following the release, expectations for near-term interest rate cuts eased, although futures markets continue to reflect two rate cuts by the end of 2026.

📊 Market Wrap Dec 26th 2025

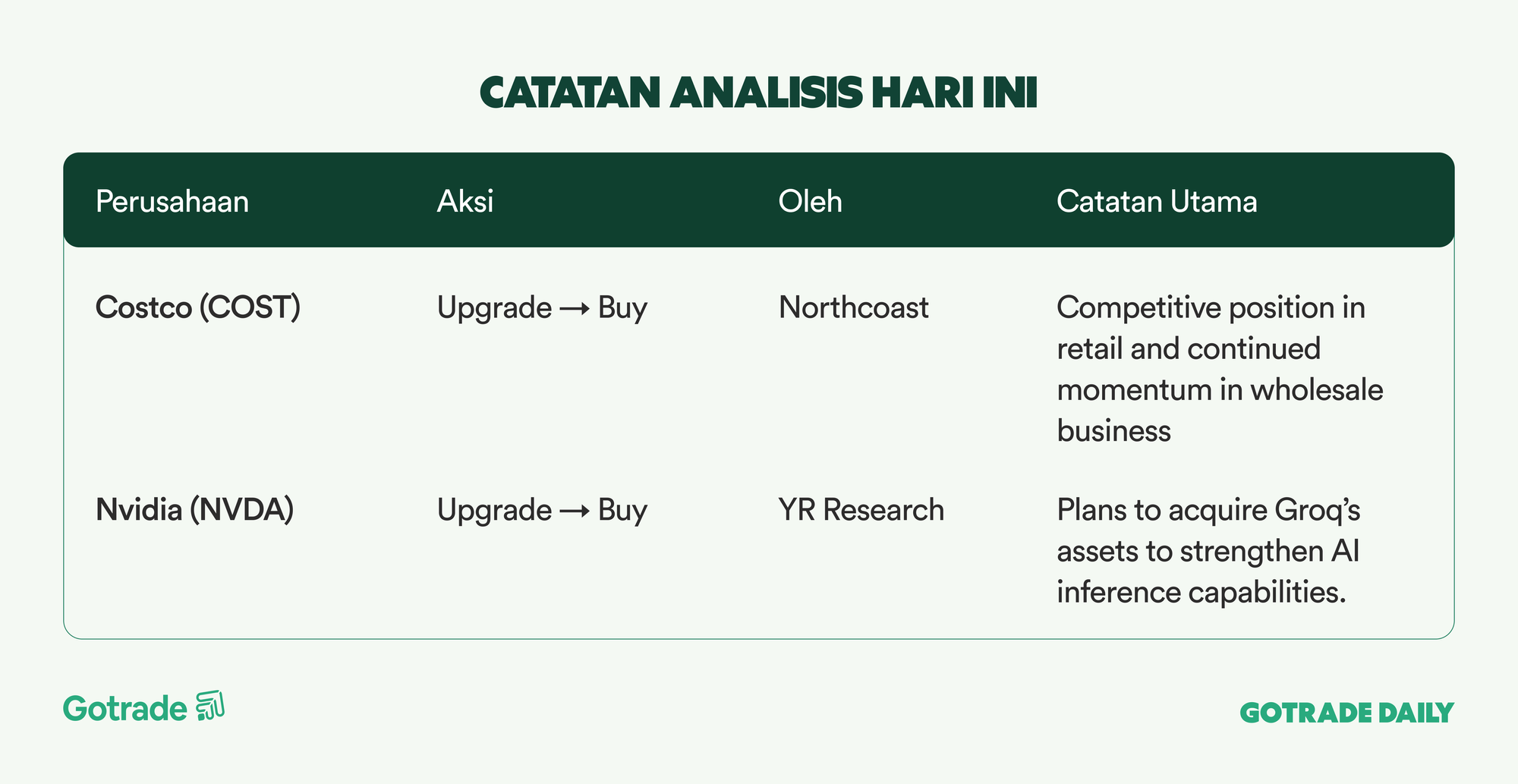

🧠 Analyst Notes

💬 Market Highlights

Snowflake Reportedly Targets US$1 Billion Acquisition of Observe

Snowflake (SNOW) is reported to be in advanced talks to acquire Observe, an AI-native observability startup, at a valuation of around US$1 billion. If completed, this would mark Snowflake’s largest acquisition to date and further strengthen its expansion into application monitoring and AI infrastructure. Observe is known for its full-stack observability technology built on data lake architecture and agentic AI, and has long relied on Snowflake’s database platform.

Prudential Financial Rebounds After Six Consecutive Sessions of Pressure

Prudential Financial (PRU) shares rebounded after posting six straight sessions of declines, supported by stabilizing price sentiment and a planned share buyback of up to US$1 billion starting in 2026. While the stock’s performance still lags the broader benchmark this year, recent one-month trading shows signs of recovery. The market continues to view Prudential’s business profile as solid for income-oriented investors, although growth prospects are seen as limited and analyst consensus remains cautious.

AST SpaceMobile Launches Largest Satellite, Shares Pressured by Valuation Concerns

AST SpaceMobile (ASTS) successfully launched its BlueBird 6 satellite, claimed to be the largest commercial communications array in low Earth orbit, capable of delivering 4G and 5G services directly to standard smartphones. Despite the technological milestone and a strengthened roadmap to deploy dozens of satellites through 2026, ASTS shares moved lower as investors raised concerns about valuation following a sharp rally earlier this year.

📅 Earnings Watch

No major earnings releases this week.

US equity markets recorded fresh record closes, supported by gains in large-cap stocks and stronger-than-expected economic data.

Market movements reflected investor responses to corporate developments and macroeconomic releases, with attention remaining on the path of monetary policy ahead.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.