Markets wait for clues on next year’s rate path.

US markets traded cautiously on Tuesday as attention shifted fully to the Federal Reserve’s final policy meeting of the year. Officials are widely expected to cut rates by 25 basis points, but divisions inside the committee have made the outcome and tone of the decision more important than the cut itself.

For traders, the key question is not whether the Fed moves today, but how the statement, dot plot, and Powell’s press conference shape expectations for 2026. A split committee raises uncertainty about the pace of easing, especially as some policymakers warn that lower rates could reignite inflation while others argue that the labor market is softening.

What to watch:

- Whether Powell signals a hawkish cut by emphasizing inflation risks

- How many rate cuts the median dot implies for 2026

- Whether dissents appear on both sides of the vote

- Any change in the statement language around “extent and timing” of future adjustments

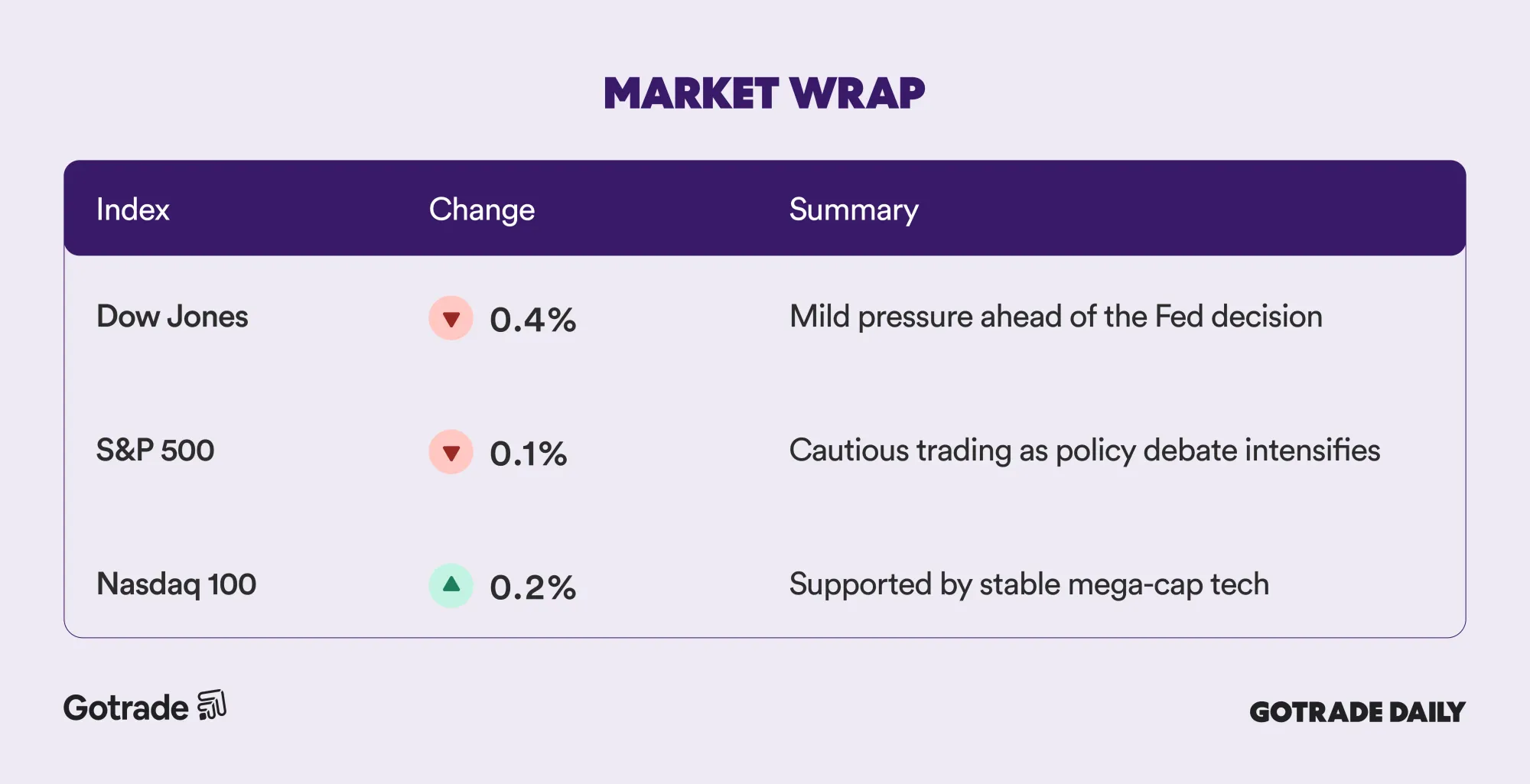

Markets remain sensitive to every shift. The Dow fell 0.4 percent, the S&P 500 eased 0.1 percent, and the Nasdaq 100 slipped 0.2 percent.

📊 Market Wrap Dec 10 2025

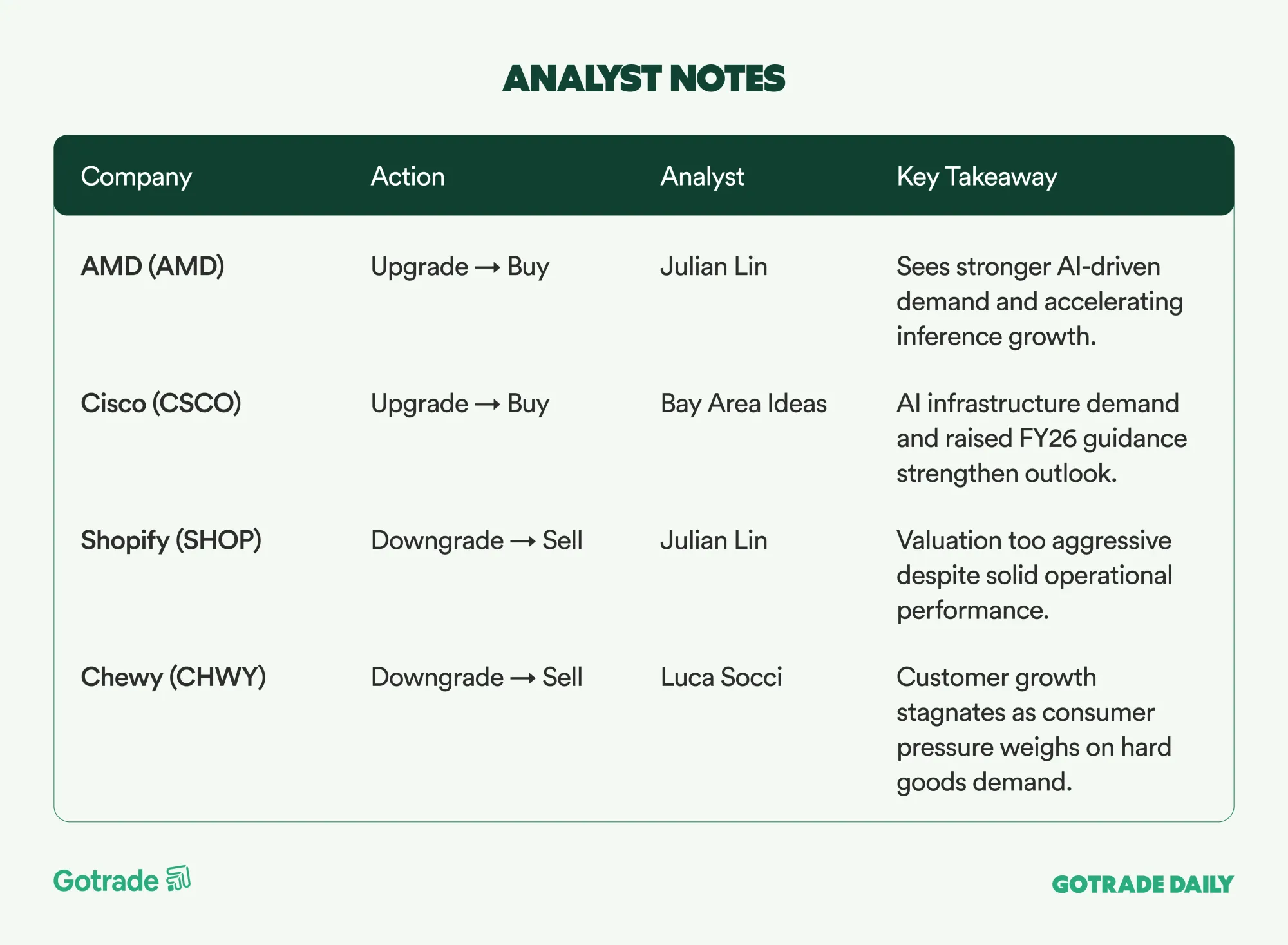

🧠 Analyst Notes

💬 Market Highlights

JPMorgan Chase Announces Quarterly Stock Dividend

JPMorgan Chase (JPM) declared its quarterly common stock dividend, with full details available through the company’s Investor Relations page. With US$4.6 trillion in assets and US$360 billion in equity as of September 2025, JPM remains one of the most dominant players in global financial services, serving retail, corporate, and institutional clients worldwide.

U.S. Navy Taps Palantir to Accelerate Nuclear Submarine Production

The U.S. Navy selected Palantir (PLTR) to help speed production of Virginia- and Columbia-class nuclear submarines, which have faced delays and rising costs. Using its Foundry and AIP platforms under the ShipOS program, Palantir will enhance supply-chain visibility, factory-floor coordination, and intelligent logistics networks. The initiative aims to address data fragmentation and workforce shortages that have slowed output.

Eli Lilly to Build US$6 Billion API Manufacturing Facility in Alabama

Eli Lilly (LLY) announced a US$6 billion investment to build a new active pharmaceutical ingredient (API) facility in Huntsville, Alabama. The site will produce key pipeline drugs, including orforglipron, an oral GLP-1 obesity treatment expected to be submitted to the FDA later this month. The plant is slated to begin operations in 2032, employing 450 full-time workers and 3,000 construction workers, and is part of Lilly’s broader U.S. manufacturing expansion.

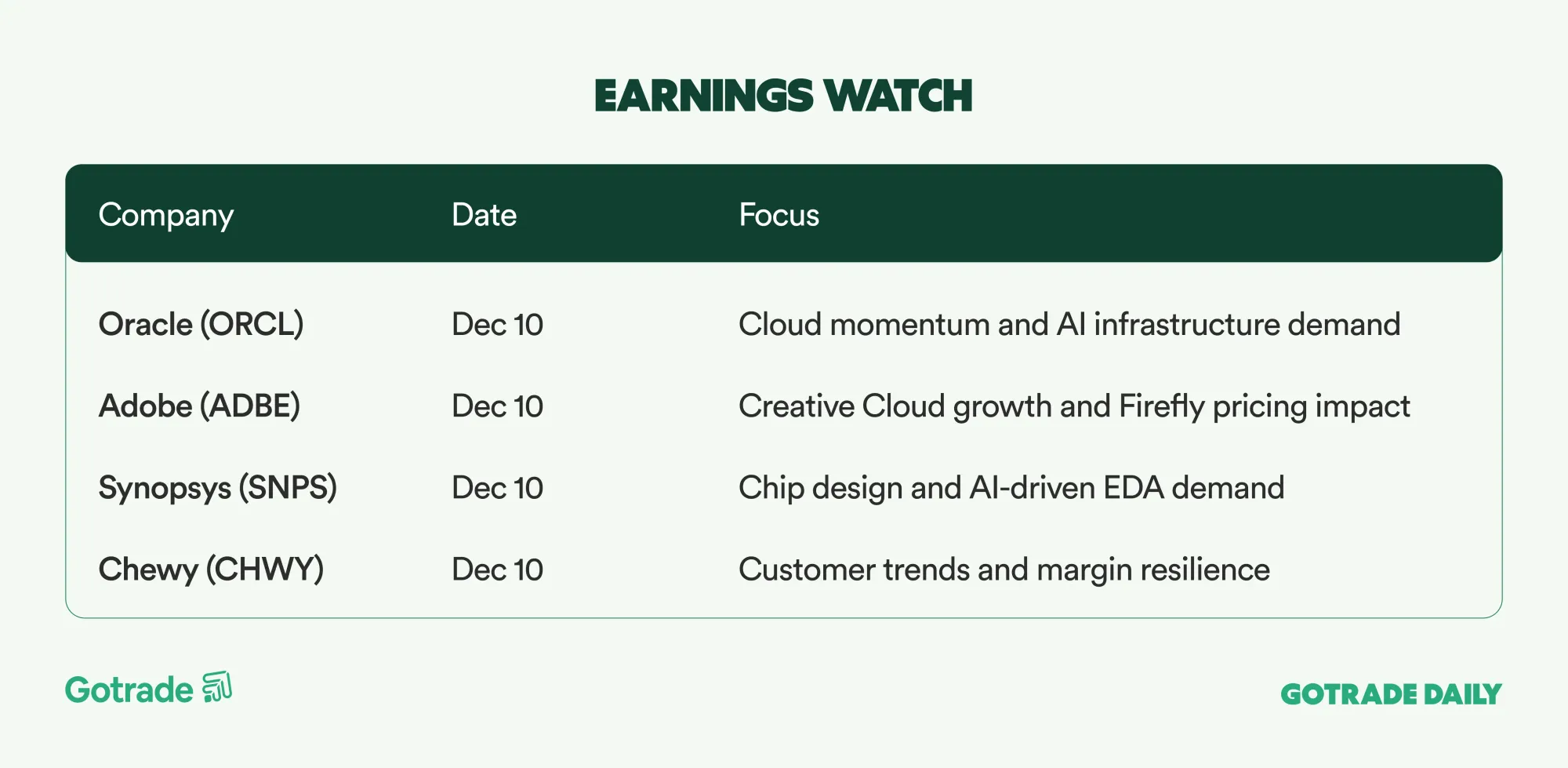

📅 Earnings Watch

Markets are holding steady ahead of the Fed, with traders watching how today’s decision shapes expectations for 2026. Sentiment may shift quickly as Powell speaks and the new dot plot is released.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.