Gotrade News - Mastercard is scheduled to release its fourth-quarter financial results this Thursday (Jan 29) before the market opens. This moment serves as a crucial test for investors awaiting confirmation of growth amidst market fluctuations.

The payments giant's stock is currently in a price correction trend ahead of this data release. You need to observe whether this dip is an entry opportunity or a warning signal.

Key Takeaways:

-

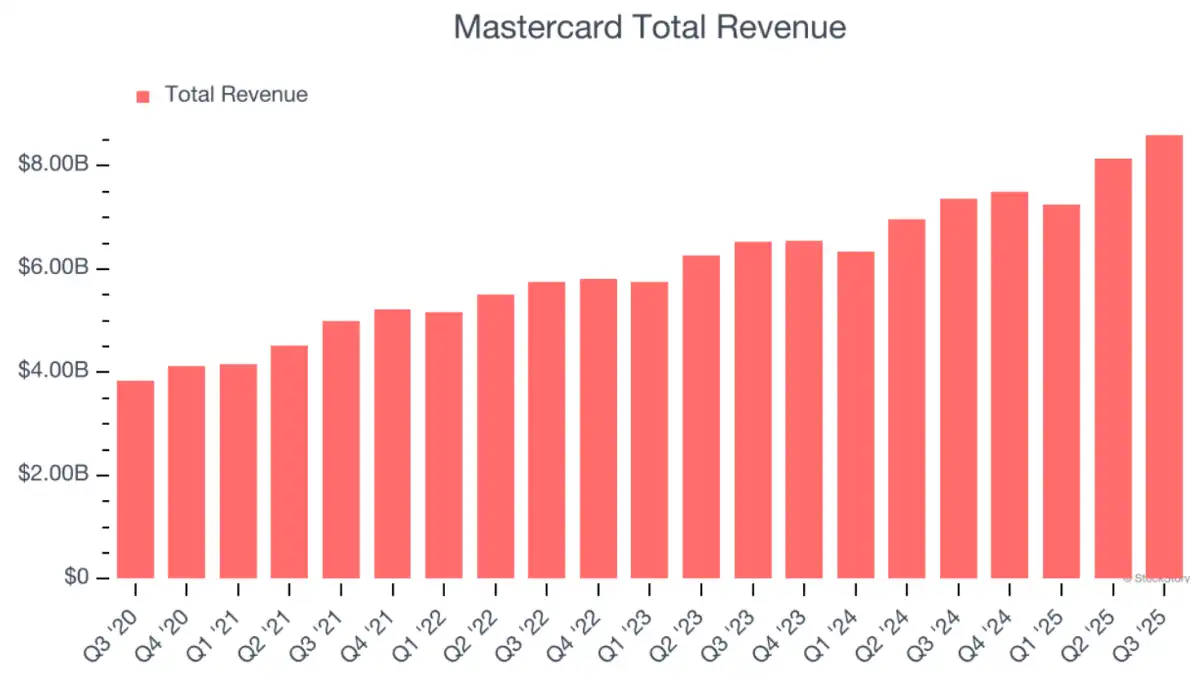

Mastercard earnings revenue is predicted to grow around 16-17 percent year-over-year.

-

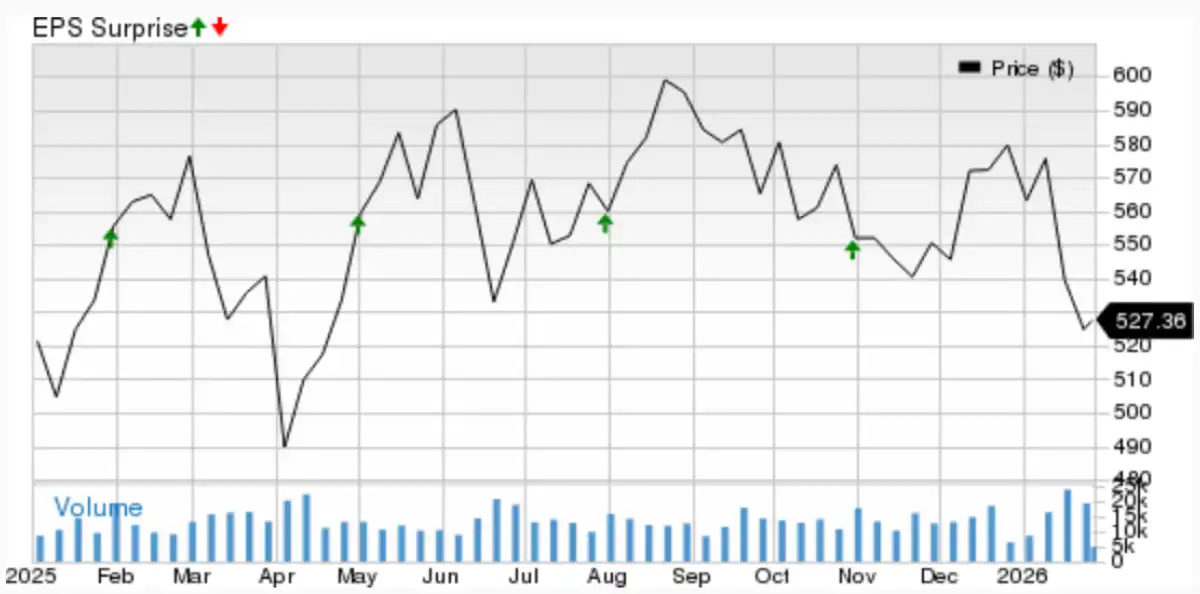

The share price has corrected nearly 10 percent in the last month ahead of the report.

-

Premium valuation leads analysts to suggest a "wait and see" stance before buying.

Read also: Apple Earnings Q4 Preview: Premium Valuation vs. AI Reality

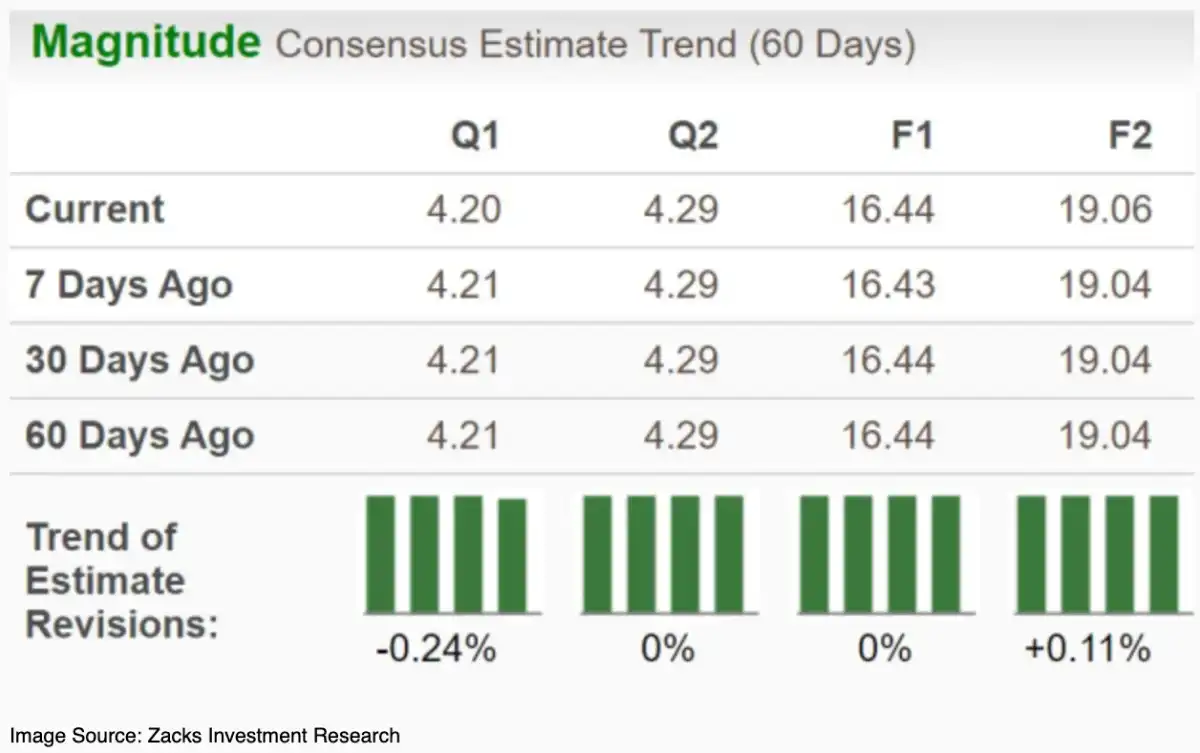

Market analysts hold high expectations for the company's financial performance in this 2025 closing quarter. According to Zacks data, revenue is predicted to reach $8.74 billion or grow 16.7 percent compared to last year.

This aligns with Stock Story's projection estimating revenue growth of 17.1 percent to $8.77 billion. Earnings per share (EPS) are also expected to land in the $4.20 to $4.24 range.

Key Performance Drivers

A surge in cross-border travel volume and domestic spending are the main engines for Mastercard's transaction growth. Zacks estimates cross-border volumes will jump up to 18.1 percent compared to the same period last year.

Additionally, value-added services are predicted to record net revenue growth of 23.1 percent. Demand for consulting services and loyalty solutions supports the stability of the company's recurring revenue.

Mastercard boasts a strong history of exceeding analyst expectations for four consecutive quarters. Stock Story notes that the average revenue surprise reached 1.4 percent above estimates over the past two years.

However, market reactions to peers in the financial sector signal caution for investors right now. For instance, Capital One saw its share price drop 7.5 percent despite beating analyst revenue estimates.

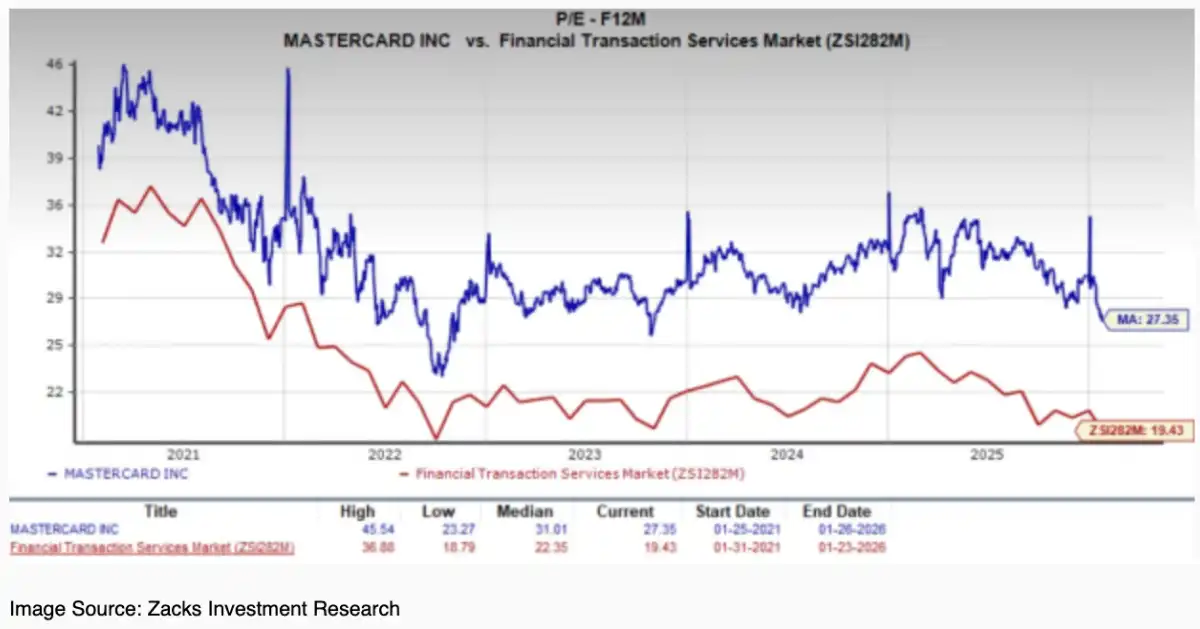

Despite solid fundamentals, the current stock valuation is considered quite pricey compared to the industry average. Mastercard trades at a price-to-earnings (P/E) ratio of 27.35x, higher than peers like Visa and American Express.

This condition makes potential short-term stock price gains quite limited according to Zacks analysis. The price correction occurring lately hasn't fully normalized market valuation expectations yet.

Recent Stock Performance

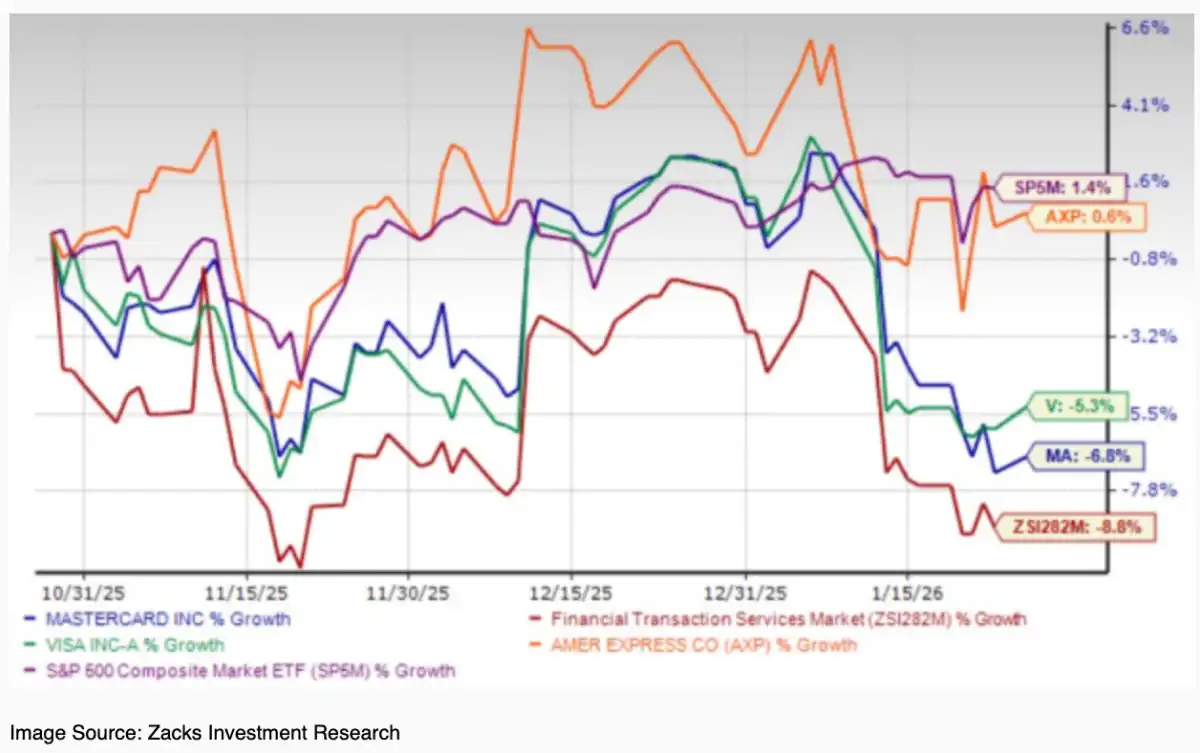

In the last month, Mastercard stock recorded a drop of around 9.9 percent toward the $520.87 level. This decline contrasts with consumer finance sector movements which have tended to stay flat ahead of earnings season.

The S&P 500 ETF itself still recorded positive growth amidst the volatility of this payments sector. Regulatory pressure in the UK and US also adds short-term risk to share price movements.

The combination of strong fundamentals but expensive valuation places Mastercard in a position demanding investor patience. Zacks advises holding positions and waiting for a more attractive entry point post-report.

Investors are advised not to rush into chasing prices before actual performance data certainty arrives tomorrow. Current market volatility requires you to be more selective in timing premium stock purchases.

Interested in Owning a Global Payments Giant?

Mastercard's performance proves the global payments sector still has solid long-term growth potential. Are you ready to take part in the US financial industry's growth?

Don't let high share prices block your investment steps now. With Gotrade, you can start buying fractional shares of Mastercard (MA) starting from just $1.

That’s the market update worth watching today. Follow Gotrade News for timely coverage on US stocks, ETFs, and macro moves that shape market direction. For a structured starter guide, visit the Gotrade Blog to learn the basics and build your plan.

If you want to act on this news, track price moves and review your portfolio in the Gotrade app. You can start investing in US stocks and ETFs with $1, then align your next steps with your goals and risk profile. Download and open the Gotrade app now!

Reference:

-

Stock Story, Mastercard (MA) To Report Earnings Tomorrow: Here Is What To Expect. Accessed on January 28, 2026

-

Zacks, Is Mastercard Stock a Smart Bet Ahead of Q4 Earnings? Key Estimates. Accessed on January 28, 2026

-

Featured Image: Shutterstock