Jakarta, Gotrade News - Tesla, Inc. shares took a dip after Morgan Stanley’s new analyst shifted the rating from Overweight to Equal-weight. This move comes as the company's current valuation seems to have fully priced in the market’s high expectations for its AI ambitions.

Keytakeaways:

- Morgan Stanley cuts Tesla rating to Equal-weight as AI hype is seen as fully priced in.

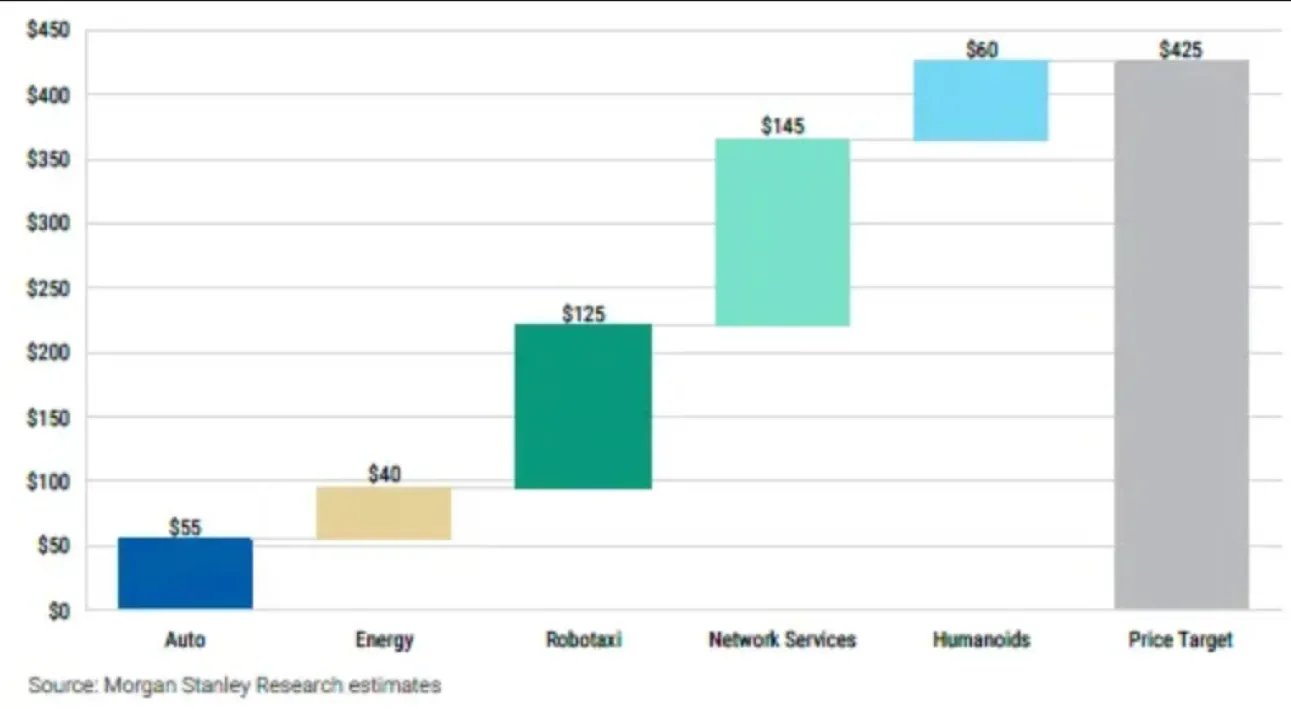

- Price target raised to $425 thanks to Optimus robot potential, despite a dip in auto volume forecasts.

- FSD tech remains the "crown jewel," though regulatory and weather risks are still in play.

Andrew Percoco sees the current price as fair, even though he actually bumped the price target up to $425 a share. According to a report from Yahoo Finance, this shift follows the transition of previous analyst Adam Jonas to a different role within the firm.

AI Valuation vs. Auto Business Struggles

The outlook for the core auto business actually got a trim, driven by slowing EV adoption in the US and fierce global competition. Percoco projects a 10.5% drop in delivery volumes for 2026.

So, where’s the price target hike coming from? It’s largely driven by the potential value add from the Optimus humanoid robot business. Based on Morgan Stanley’s sum-of-the-parts analysis chart, the Humanoids segment now contributes a solid $60 to the per-share value.

Future Potential and Regulatory Roadblocks

The analyst remains bullish on Full Self Driving (FSD) tech, viewing it as the company’s crown jewel. Tesla plans to expand its Robotaxi service trials to Nevada and Arizona in the near future.

However, regulatory hurdles are still looming, particularly regarding the vision-only system which can be vulnerable to bad weather conditions. For long-term investors, though, the current price levels still offer a pretty attractive risk-reward ratio.

Referensi:

- Yahoo Finance, Tesla stock drops as new Morgan Stanley analyst downgrades shares, citing valuation. Accessed on December 9, 2025

- Featured Image: Shutterstock

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.