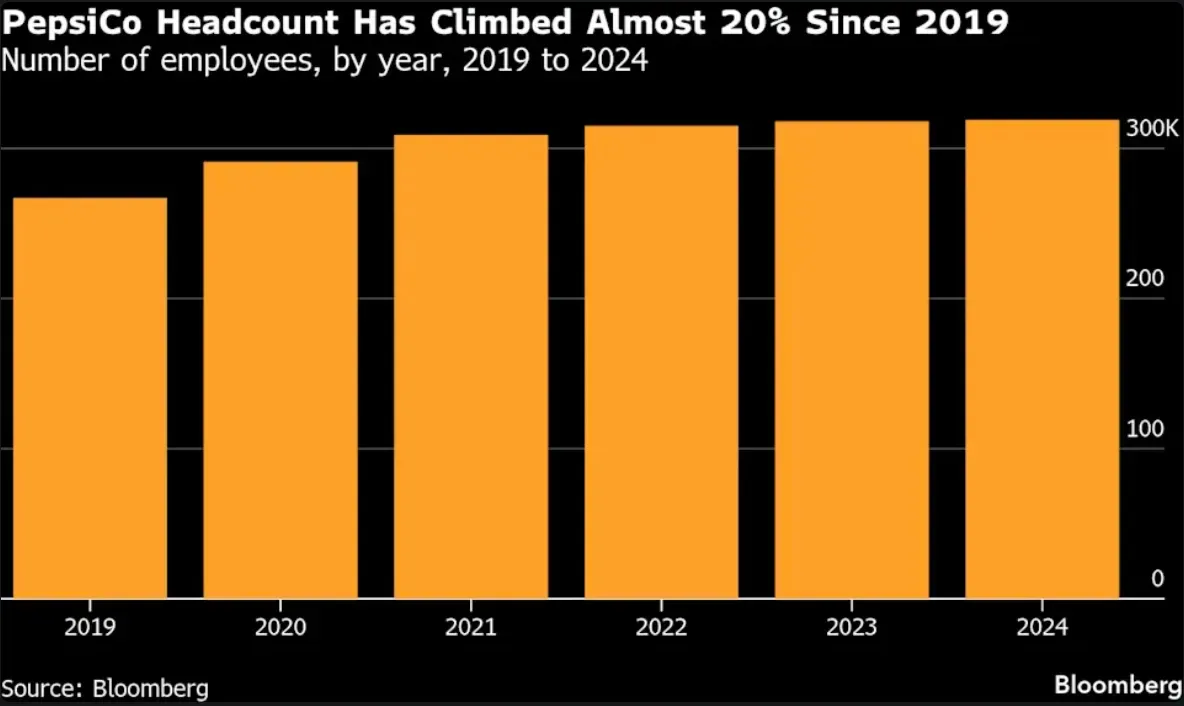

Jakarta, Gotrade News - PepsiCo, Inc. is planning to cut its headcount and drop 20% of its product variety in the US. This move comes after striking a deal with activist investor Elliott Investment Management to jumpstart the company's growth.

The pressure from Elliott stems from PepsiCo’s brand portfolio being seen as too complex and confusing for the market. As reported by Bloomberg, Elliott demanded better efficiency as PepsiCo’s stock has dipped 4.2% throughout this year.

The company has already instructed employees at several HQs to work remotely this week. This WFH policy is often a major red flag before an official layoff announcement drops.

Doubling Down on Core Products

Management is set to focus on their best-selling salty snacks while trimming down less productive beverage lines. According to Marc Steinberg from Elliott, this plan aims to drive greater revenue and profit growth.

Elliott also suggested divesting specific cereal brands like Quaker Oats and Rice-A-Roni. This strategy is expected to fix the stock performance that has been lagging far behind the SPDR S&P 500 ETF Trust.

The CFO position has been taken over by Steve Schmitt, a former executive at Walmart Inc., to tighten financial discipline. PepsiCo is projecting organic revenue growth of 2% to 4% for the upcoming fiscal year 2026.

Referensi:

- Bloomberg, PepsiCo Plans Layoffs as It Looks to Wrap Up Elliott Talks. Accessed on December 9, 2025

- Featured Image: Shutterstock

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.