Appian Corporation (NASDAQ: APPN) is entering a strong rebound phase, powered by renewed confidence in AI-driven process automation and improving financial performance.

Following its Q3 earnings beat, the stock surged nearly 40%, yet remains undervalued versus peers.

- Q3 Revenue: $187M (+21% YoY), beating estimates of $174M (+13% YoY).

- Subscription Growth: +17% constant currency, up from +14% in Q2.

- Adj. EBITDA: $32.2M (17.2% margin), nearly tripling YoY with operating leverage from higher sales productivity.

- FY25 Guidance: Revenue $711–$715M (+15–16%), Adj. EBITDA $67–70M (~9.6% margin).

- FY26 Outlook: Street expects $790.5M revenue (+11%), implying continued margin expansion.

- Valuation: 4.5x EV/FY25 revenue and 4.0x EV/FY26, still below mid-teens software peers (Workday, Adobe).

Appian’s AI-native automation platform and margin expansion trajectory make it one of the most attractive “comeback” stories in enterprise software.

Rating: BUY, early-stage rebound, strong setup for 2026.

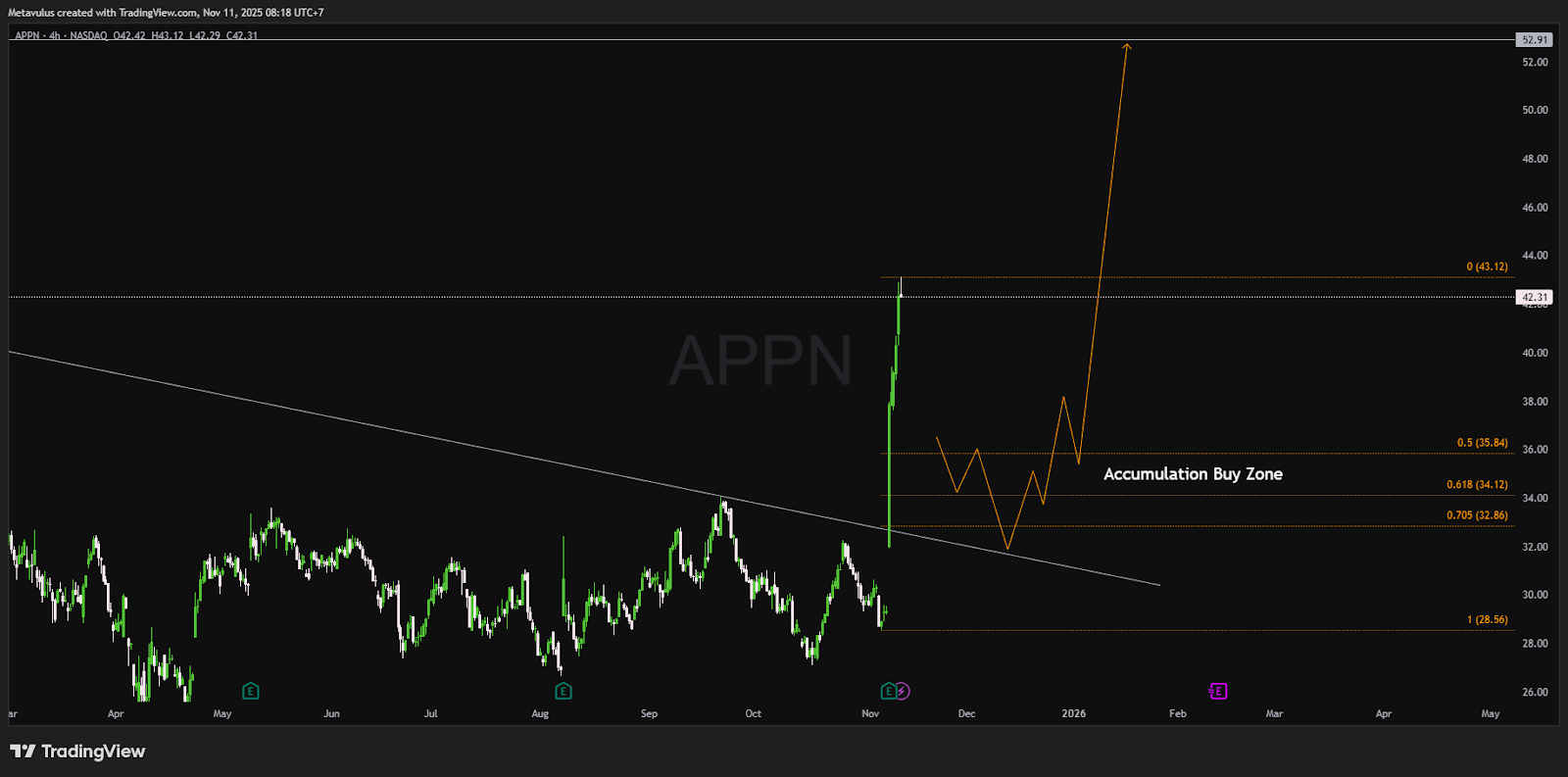

Technical Analysis

- Current Price: $42.31

- Healthy Accumulation Zone: $35.84 – $32.86 (Fibonacci 0.5–0.705 retracement)

- Key Support (Invalidation): $28.56 (weekly close below)

- Resistance/Targets: $43.12 → $52.91

Appian’s explosive post-earnings breakout has created a new trend structure. After a strong leg up, a short-term correction into the $36–33 buy zone is likely before continuation toward $53+, assuming broader tech momentum holds.

Trading Setup

Accumulation Plan (DCA):

- 40% at $35.8–34.5

- 40% at $34.1–32.9

- 20% reserve bids at $30–28.6 (extreme flush zone)

Stop Loss: Weekly close below $28.56

Take Profit (TP):

- TP1: $43.12 (reclaim of post-earnings high)

- TP2: $52.91 (measured target)

Risk/Reward Example: Entry ~$34.5, risk $6 (to $28.5), reward ~$18 (to $52.9) → 3R setup.

Optional Income Play: Sell cash-secured puts at $32–35 (30–45DTE) to accumulate at discount; once assigned, sell covered calls at $50–55 for additional yield.

Growth Thesis: Why the Rally Is Fundamentally Backed

1. AI Automation Driving Enterprise Efficiency

Appian has quietly built one of the most advanced process automation suites. Now integrating Appian AI and Intelligent Document Processing (IDP).

- Customers using Appian AI report:

- 36% faster invoice processing

- 83% faster patient intake

- 3x faster audit workflows

- 95% automation in order management

- IDP accuracy: 95–99% vs. 60% traditional OCR, validating product superiority.

- The new Agent Studio feature allows business users to create AI agents via natural language prompts, already oversubscribed in beta.

2. Accelerating Growth in a Tough Environment

- While peers decelerated due to IT budget cuts, Appian’s revenue accelerated +5pts QoQ (to +21% YoY).

- Sales productivity ratio reached 3.5, the ninth consecutive quarterly increase.

- Indicates structural demand tailwinds from automation + AI consolidation.

3. Expanding Profit Margins

- Q3 Adj. EBITDA tripled YoY, rising to 17.2% margin as OpEx grew just 3% YoY.

- FY25 guide implies a 9.6% full-year margin, positioning Appian for sustainable operating leverage into FY26+.

4. Attractive Valuation vs Peers

- EV/FY25 Revenue: 4.5x

- EV/FY26 Revenue: 4.0x

- Workday (WDAY) and Adobe (ADBE): both slower growers, trade at 6–8x sales.

- As EBITDA margins scale, Appian could re-rate toward 5–6x EV/Revenue in 2026.

Valuation & Risks

Valuation Snapshot:

| Metric | FY25 | FY26 |

|---|---|---|

| EV/Revenue | 4.5x | 4.0x |

| EV/EBITDA | ~40x | ~28–30x (est.) |

| Revenue Growth | +15–16% | +11% |

Key Risks:

- EBITDA still modest: profitability needs to scale further.

- Competition intensifying in workflow automation (ServiceNow, Microsoft Power Automate, UiPath).

- Macroeconomic slowdown could delay enterprise automation deals.

- Potential multiple compression if growth cools below mid-teens.

Mitigation: Strong recurring revenue base, expanding customer use cases, and visible pipeline for AI-driven products provide durability through cycles.

Conclusion

Appian’s Q3 marked a clear inflection point; accelerating growth, rising profitability, and strategic AI differentiation.

Despite a 40% post-earnings rally, the stock’s 4.5x EV/FY25 multiple remains deeply discounted relative to quality SaaS peers.

This setup combines fundamental reacceleration + technical breakout + valuation safety, forming a textbook “early-stage rebound” opportunity.

✅ BUY and accumulate between $36–33, with targets at $43 → $53, invalidation below $28.5 weekly close.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.