Duolingo, Inc. (NASDAQ: DUOL) remains the world’s top language-learning platform, delivering strong user growth, profitability, and engagement despite a 35% stock decline and post-earnings volatility.

The company continues to post robust performance: daily active users (DAUs) are up 36% YoY (now >50M) and paid subscribers +34% YoY, showing continued traction even as management shifts focus from near-term monetization to long-term user expansion.

Concerns over competition (especially from OpenAI) are overstated. Duolingo’s structured curriculum, gamified experience, and educational ecosystem make it hard to replicate.

At a forward P/E of ~23x with revenue growth of ~23% expected for next year, DUOL now trades at an attractive valuation for a profitable growth company.

Rating: BUY.

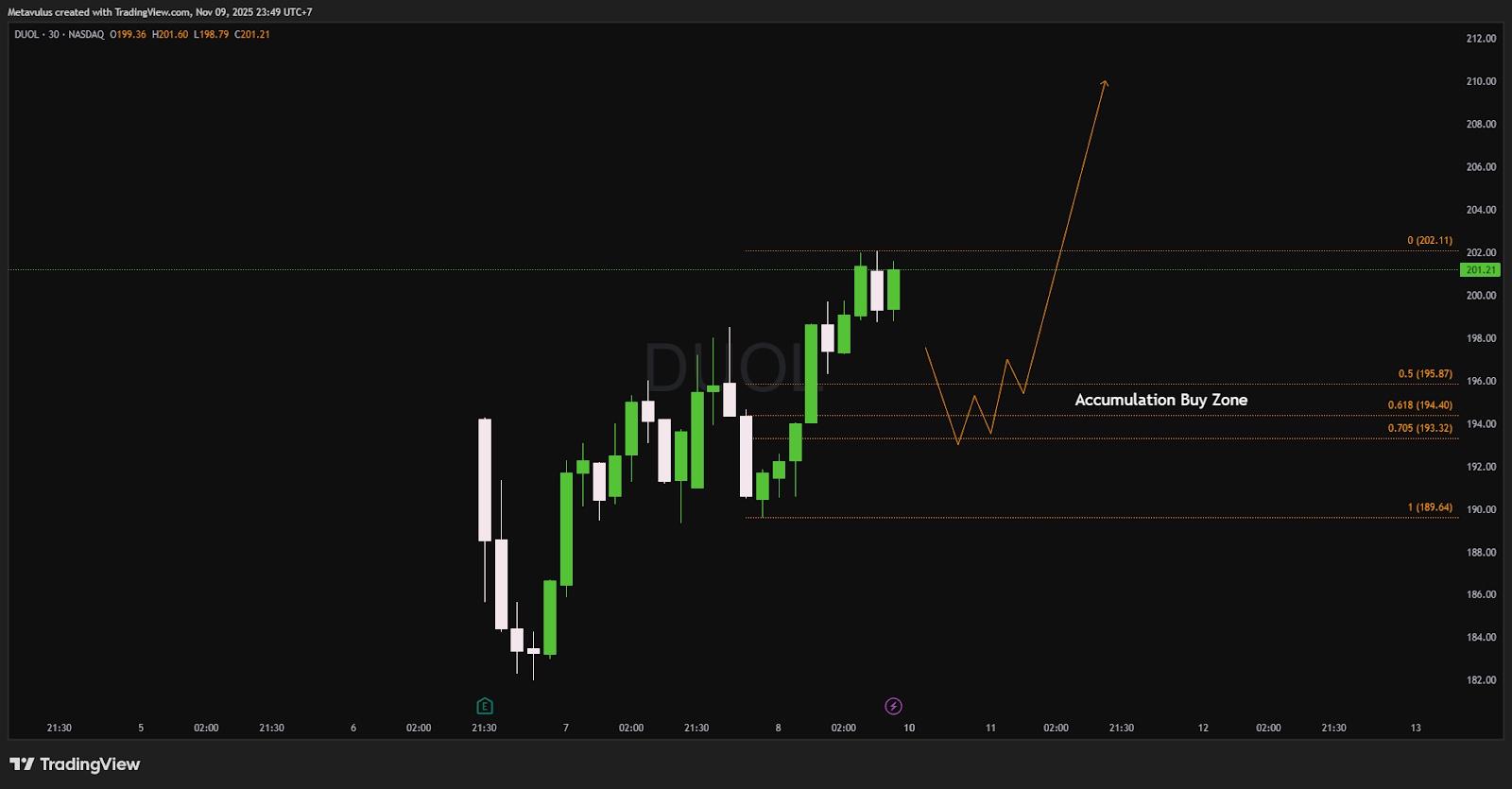

Technical Analysis

- Current Price: $201.21

- Resistance: $202.11 (minor intraday barrier)

- Accumulation Zone (Fibonacci): $195.9 – $193.3 (0.5–0.705 retracement)

- Key Support: $189.6 (1.0 retracement, invalidation level)

- Upside Targets: $202.1 → $210–212

Technically, DUOL is consolidating after a sharp rebound.

The ideal setup: a retracement toward $196–193 (accumulation zone) → formation of a higher low (W pattern) → breakout above $202 toward $210+.

Trading Setup

- Accumulation Plan (DCA):

- 50% at $195.9–194.4

- 30% at $194.4–193.3

- 20% at $191–190 (extreme dip bids)

- Stop Loss: Weekly close < $189.6

- Take Profit:

- TP1: $202.1

- TP2: $210–212

Optional Strategy:

Sell cash-secured puts ($195–190, 30–45DTE) to enter at a discount; once assigned, sell covered calls ($210–215) for yield enhancement.

Growth Thesis: Why the Panic Creates Opportunity

- User Flywheel Still Accelerating.

- DAUs +36% and paid subscribers +34% YoY — strong organic momentum.

- China now contributes 5–6% of total revenue and remains DUOL’s fastest-growing market, offering a massive runway.

- Disciplined Profitability.

- Despite user-first strategy, management still targets ~29% adjusted EBITDA margin (FY25).

- Users with high computational costs are paywalled, preserving unit economics.

- Unmatched Learning Moat.

- Structured progression, gamified engagement, and real pedagogical outcomes make DUOL far stickier than chatbot-style learning.

- OpenAI’s large models lack Duolingo’s educational structure — and have no presence in China, where DUOL is expanding.

- Valuation Reset = Opportunity.

- From ~88x P/E (May 2025) to ~23x forward P/E today, with 23–25% growth and improving margins.

- This correction sets up an attractive asymmetric entry point.

- Analyst Upgrades & Fundamental Support.

- Wall Street is revising revenue and EBITDA estimates upward after the earnings pullback.

- The market’s overreaction to “growth normalization” presents a rare buy zone for long-term investors.

Valuation & Risks

- Attractive Relative Metrics:

- Forward P/E: ~23x (below prior highs and close to S&P 500’s 23x)

- EBITDA Margin: ~29% (expected to rise toward 31%)

- Revenue Growth: ~23% YoY forecast for FY26

Key Risks:

- Booking slowdown in Q4–FY26 could delay re-rating.

- AI-based competitors may erode pricing power over time.

- Geopolitical/regulatory constraints (especially in China).

- High short interest (~10%) = potential volatility swings.

Conclusion

Duolingo remains a profitable, cash-generating, high-growth edtech with a dominant brand and massive user base.

The recent drop reflects sentiment, not fundamentals. DUOL’s long-term growth trajectory and monetization optionality remain intact.

✅ BUY on weakness.

Accumulate around $196–193, target $210+, cut below $189.6 weekly.

Risk/reward setup is highly favorable for 12–18 month investors.

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.