Jakarta, Gotrade News - Global financial markets started the week under pressure after President Donald Trump announced plans for new import tariffs targeting eight European nations. This protectionist move triggered a risk-off wave, dragging down stock futures in both the US and Europe.

Key Takeaways

-

Trump plans to impose a 10% tariff starting Feb 1, 2026, on countries supporting Greenland's sovereignty.

-

S&P 500 futures dropped 0.8% while Euro Stoxx 50 futures slumped 1.2% in early Monday trading.

-

The EU is considering activating its anti-coercion instrument as a retaliatory measure against US economic pressure.

Trump’s latest move serves as leverage to force these nations to support the US bid to purchase Greenland. According to Bloomberg, these levies could jump to 25% by June unless a "Complete and Total purchase" deal is reached.

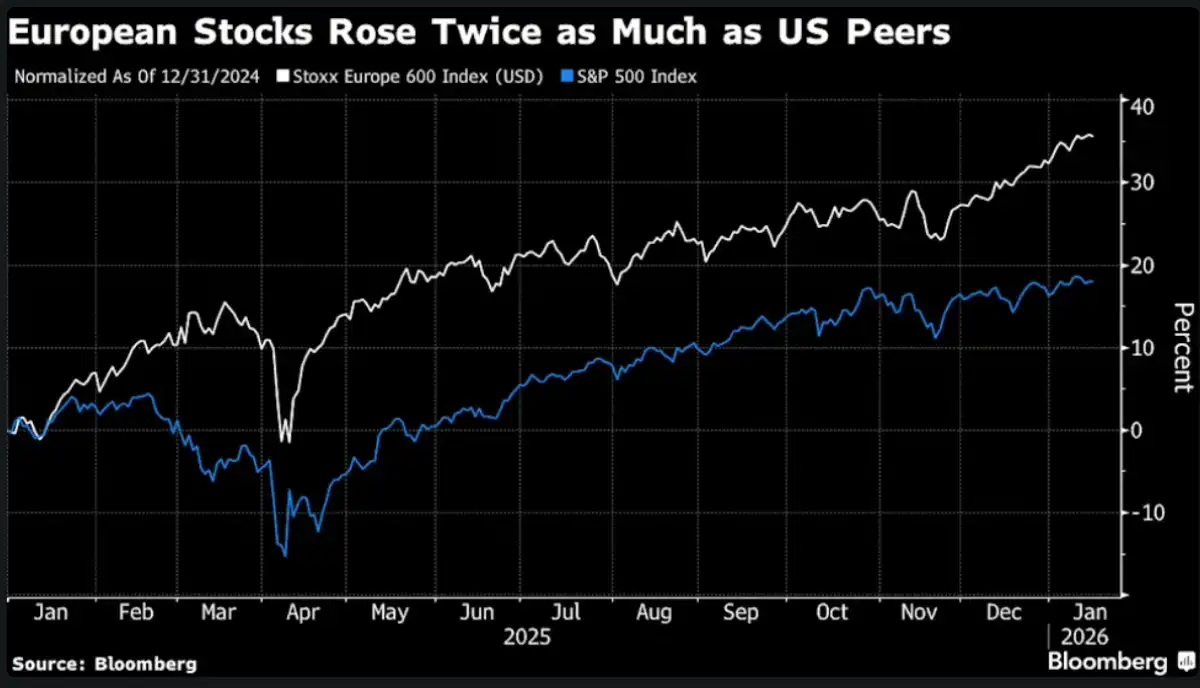

This negative sentiment hits the market just as European equities were enjoying a massive run. Data shows that since the start of 2025, the Stoxx Europe 600 index has soared 36 percent in dollar terms.

This gain is actually double the performance of the S&P 500 Index over the same period. However, this tariff threat risks killing the vibe of a long rally fueled by German fiscal spending and improving profit expectations.

European stock valuations are now sitting at nearly 16 times forward earnings, hovering above their 15-year average. Bloomberg reports that this rally has narrowed the valuation discount of European markets against US peers to just about 30 percent.

Beata Manthey, a strategist at Citigroup Inc., estimates that a 10% tariff would result in a 2 to 3 percentage-point drag on European earnings-per-share growth. The auto and luxury goods sectors are expected to be the hardest hit by this policy.

Investors reacted to the news by rotating capital into safe havens like the Swiss Franc, Japanese Yen, and gold. Florian Ielpo from Lombard Odier noted that any sudden tariff escalation usually triggers a classic short-term risk-off episode.

However, US cash markets are closed this Monday for a holiday, which means trading volumes will likely stay thin. This suggests that the full market volatility might not be fully visible until regular bursa hours resume.

Some analysts believe the market reaction might cool down once there is more clarity on the actual executive order. According to Brian Jacobsen from Annex Wealth Management, the delayed implementation until February gives investors room to wait and see without overreacting.

Reference:

-

Bloomberg, Stock Futures Fall as Trump’s Europe Tariffs Weigh on Sentiment. Diakses pada 19 Januari 2026

-

Featured Image: Shutterstock