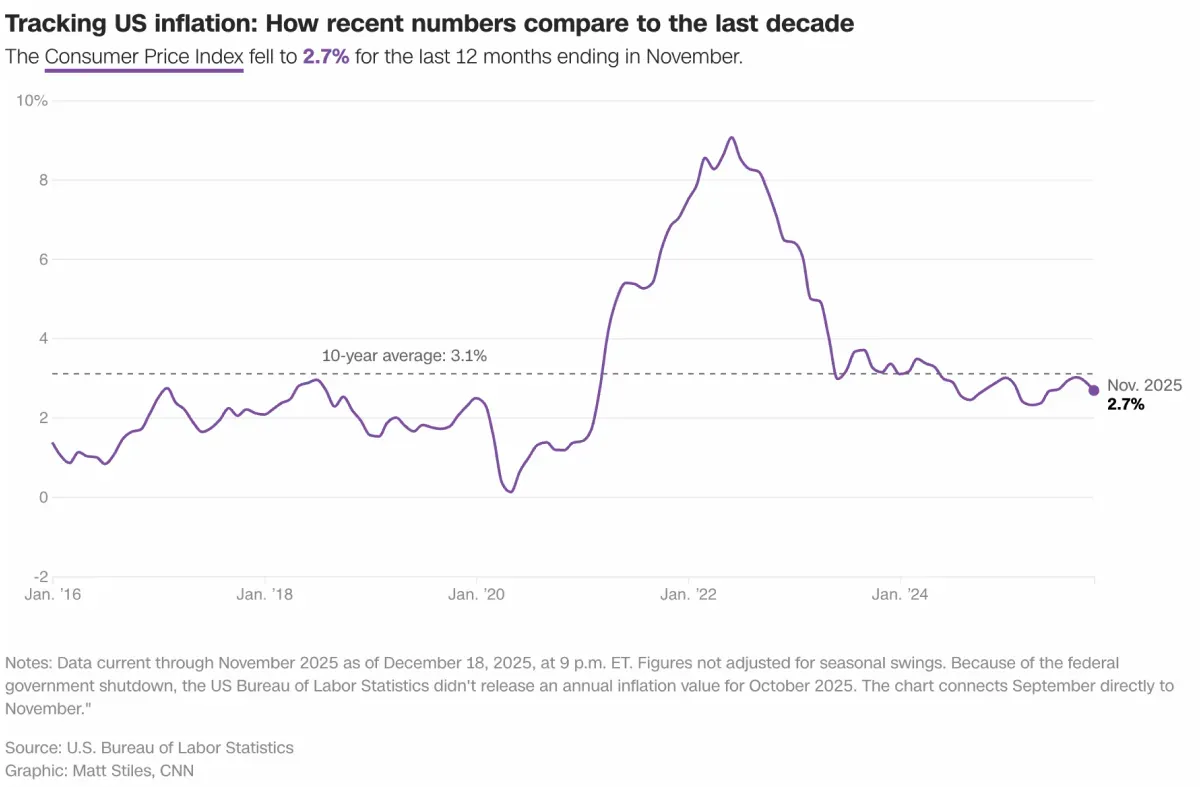

Jakarta, Gotrade News - US inflation data for November surprisingly dropped to a cool 2.7% year-over-year. This dip is a breath of fresh air for everyone currently squeezed by the high cost of living. However, economists are warning that this figure might be a bit distorted due to the recent government shutdown.

This Consumer Price Index (CPI) report was released right after a 43-day gap in federal funding. The Bureau of Labor Statistics couldn't crunch the October numbers due to operational limits back then.

According to Heather Long from Navy Federal Credit Union, the government shutdown clearly took a heavy toll on the data collection process.

Key Takeaways

- Nov US inflation dropped to 2.7%, way below the economist forecast of 3.1%.

- Data validity is questionable because October data went missing during the US gov shutdown.

- The stock market reacted positively, hoping the Fed will chill with its monetary policy.

Doubts Behind the "Sweet" Numbers

Core inflation, which strips out the volatile food and energy sectors, also slowed down to 2.6%. This actual figure came in lower than the market prediction, which was sitting at 3%.

Data from CNBC shows the monthly increase only hit 0.2%, below the consensus estimate of 0.3%.

The missing historical data makes a lot of finance experts doubt the accuracy of this drastic price drop. Joe Brusuelas from RSM US called this report flawed because the rent data looks a bit off and unnatural.

Economists from Wells Fargo & Company even explicitly suggested taking this data with a huge grain of salt.

Market Response and Policy Outlook

Despite the shady data, the stock market is vibing with it, showing gains in SPDR S&P 500 ETF Trust futures. Investors are reading this tame inflation as a signal that the Fed might actually cut interest rates.

The CME Group FedWatch tracker now shows the odds of a rate cut in March have bumped up to 58.3%.

The White House is celebrating this report as an economic win, but analysts foresee a potential price rebound coming up.

The Wells Fargo team warned that inflation data will likely remain choppy for at least the next two months.

Reference:

- CNBC, November consumer prices rose at a 2.7% annual rate, lower than expected, delayed data shows. Accessed on December 19, 2025

- CNN, Inflation cooled in November to 2.7%, but economists say to take it with ‘the entire salt shaker’. Accessed on December 19, 2025

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.