Jakarta, Gotrade News - The US government is reportedly giving a strict ultimatum to major oil companies: they must commit to fresh investments in Venezuela’s energy sector if they want to recover compensation for assets seized years ago.

This move is part of the White House’s contingency planning for a post-Nicolás Maduro economy. For energy investors, this completely shifts the risk profile—companies essentially have to finance the rebuild upfront before they can even talk about cashing in on old debts.

Key Takeaways

- US oil firms must foot the bill for rehabilitating Venezuela’s oil infrastructure as a prerequisite to getting their compensation claims addressed.

- Between "badly broken" infrastructure and the nature of Venezuela’s "heavy" crude, ramping up production could take up to a decade.

- The impact on global oil prices will likely be minimal in the short term, as global supply remains sufficient.

Read also: Pepsi & Coca-Cola's 'Reset' Signal in Venezuela

According to a Reuters report cited by Seeking Alpha, the message from US officials is crystal clear: rebuilding production capacity comes first; compensation talks come second.

This policy directly hits ConocoPhillips, which is chasing a roughly $12 billion claim, and Exxon Mobil Corporation with a $1.65 billion claim stemming from the nationalization era under Hugo Chávez.

While President Donald Trump has stated that American companies are "prepared" to return, the on-the-ground reality is far more complex than just getting political clearance.

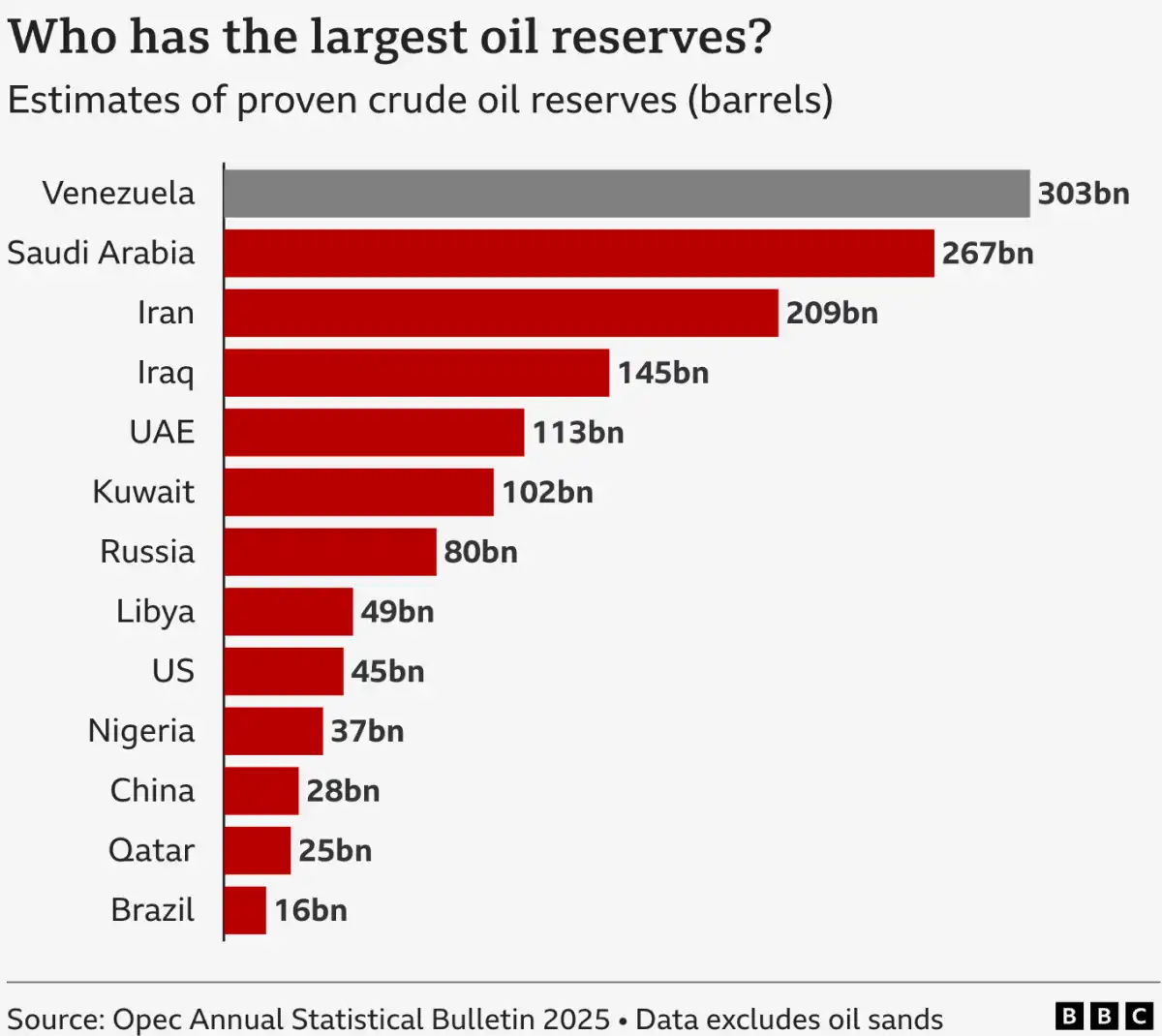

Citing BBC analysis, while Venezuela sits on the world’s largest proven oil reserves at 303 billion barrels, actual production has collapsed due to years of mismanagement and sanctions.

The Infrastructure Reality Check

The main hurdle isn't a lack of resources, but the state of the infrastructure, which Trump himself described as "badly broken." Chevron Corporation remains the only American player still operating in the country via joint ventures, making them the only company with a real operational foothold amidst this uncertainty.

Experts warn that restoring output to meaningful levels is a game of years, not months. Callum Macpherson from Investec noted in the BBC report that current production is barely a third of what it was ten years ago, and the facilities need a total overhaul.

Furthermore, Neil Shearing from Capital Economics assesses that this plan won't drastically move the needle on global oil prices in 2026. With OPEC+ supply still robust, the world isn't exactly starving for oil right now.

Read also: Stocks Hit Record Highs as Investors Weigh Venezuela Conflict

Plus, Venezuela’s crude is "heavy and sour"—harder to refine—meaning any new supply will take a very long time to actually impact the market.

Reference:

- Seeking Alpha, U.S. is said to signal oil companies must reinvest to recover Venezuela claims. Accessed on January 5, 2026

- BBC, Trump wants Venezuela's oil. Will his plan work?. Accessed on January 5, 2026

- Featured Image: Shutterstock

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.