Jakarta, Gotrade News - The US coffee scene is seeing a major shift as more investors hunt for a solid rekomendasi saham AS 2026 beyond the usual crowded trades. A recent report from The Motley Fool highlights Dutch Bros as a top pick for those looking to put idle cash to work this year.

Key Takeaways

-

Dutch Bros plans a massive expansion to 7,000 stores, challenging the industry's biggest players.

-

Same-store sales growth hit 5.7%, significantly outperforming major rivals in the last quarter.

-

With a $76.95 price target, analysts see a huge opportunity in BROS’ authentic business model.

This company holds a serious competitive edge with its drive-thru kiosk model that is both efficient and low-key. As of September 2025, Dutch Bros is already operating 1,081 locations and shows no signs of slowing down its expansion.

In contrast, Starbucks Corporation shut down 107 stores during the same period despite its massive global footprint. Meanwhile, Dutch Bros successfully opened 38 new shops, proving its growth momentum is still very much on fire.

Data from The Motley Fool shows that Dutch Bros’ same-store sales grew by a solid 5.7% year over year. This performance stands in stark contrast to its main rival, which saw flat growth in the third calendar quarter of last year.

The secret sauce seems to be their "authentic" vibe, which resonates deeply with younger, coffee-loving crowds. CEO Christine Barone has even upped the company's long-term goal from 4,000 to a whopping 7,000 stores nationwide.

Dutch Bros is on track to hit the 2,000-store milestone by 2029. This bold commitment from leadership sends a strong signal to the market about the company's long-term scaling potential.

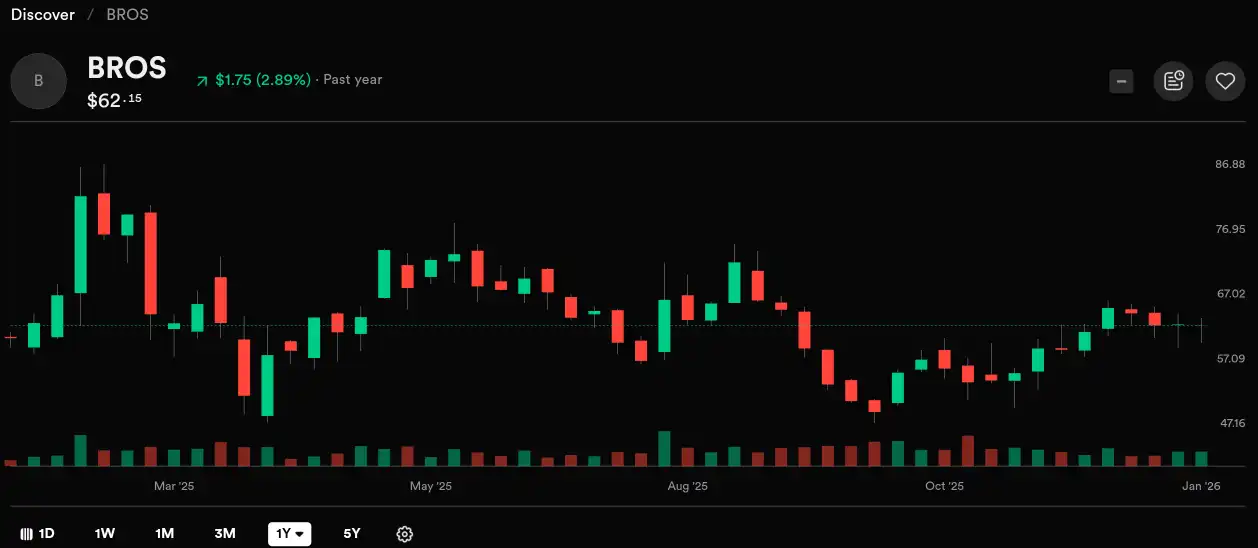

Wall Street analysts currently set a consensus price target of $76.95 for BROS stock. According to The Motley Fool, this represents a potential 26% upside from its current market price.

Most analysts covering the stock have slapped a "Strong Buy" rating on it, citing significant growth ahead. Even though it’s a top rekomendasi saham AS 2026, investors should still expect some typical high-growth volatility.

Dutch Bros works best as a "booster" for your portfolio rather than a core pillar, given its evolving scale. Since the stock hasn't made much net progress since last year, many see this as a perfect "buy the dip" window.

As Gen Z and Millennials gain more spending power, their preference for authentic, "no-fuzz" brands will likely keep rising. Dutch Bros is perfectly positioned to ride this wave through its unique and casual "broista" culture.

Reference:

-

The Motley Fool, The Ultimate Growth Stock to Buy With $1,000 Right Now. Accessed on January 19, 2026

-

Featured Image: Shutterstock