Policy signals and Magnificent 7 results shape market direction

Markets head into the week with attention split between macro policy direction and the acceleration of earnings season. Investors are focused on the Federal Reserve’s first interest rate decision of 2026, with consensus expectations pointing to a pause, while closely parsing signals from Fed Chair Jerome Powell amid political pressure from the White House to push rates lower. With inflation still elevated and labor data mixed, communication and guidance may matter more than the rate decision itself.

At the same time, earnings season shifts into high gear as the Magnificent 7 begin reporting. Results from Microsoft (MSFT), Meta Platforms (META), Tesla (TSLA), and Apple (AAPL) will give investors a direct read on the AI trade, enterprise spending, and consumer demand across the world’s largest companies. These reports are expected to shape short-term leadership in technology and growth sectors.

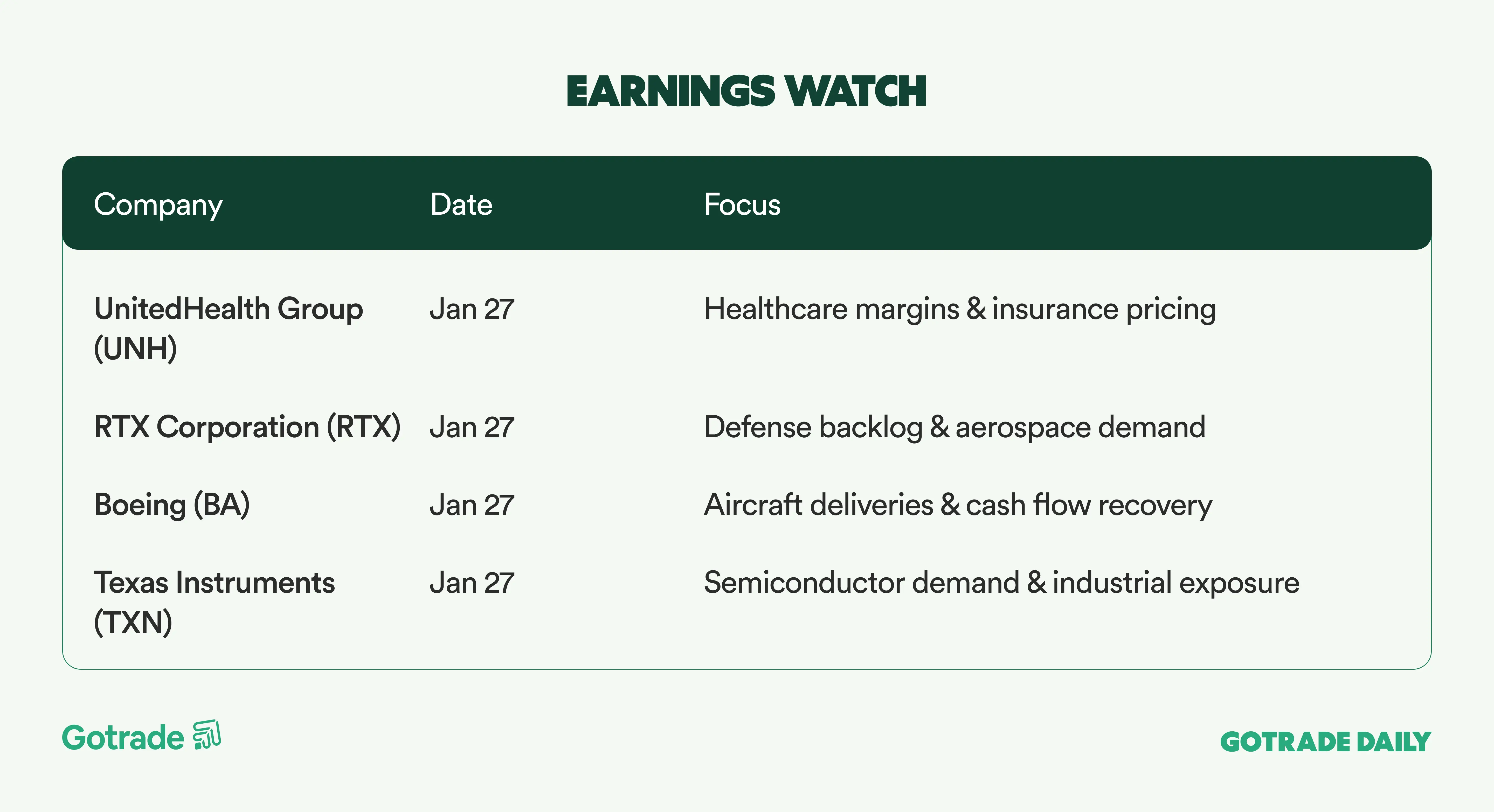

Beyond Big Tech, attention is also on cyclical and defensive signals from Caterpillar (CAT), Boeing (BA), General Motors (GM), Visa (V), Mastercard (MA), Exxon (XOM), and Chevron (CVX). Together, these earnings provide insight into manufacturing momentum, industrial demand, consumer activity, and global energy flows, offering a broader read on economic strength beyond AI-driven narratives.

This week’s setup places markets at the intersection of policy, earnings, and positioning. With indices near elevated levels, leadership will be shaped less by macro headlines and more by execution, guidance, and sector-level earnings differentiation, as capital rotates toward companies delivering tangible results rather than long-term promises.

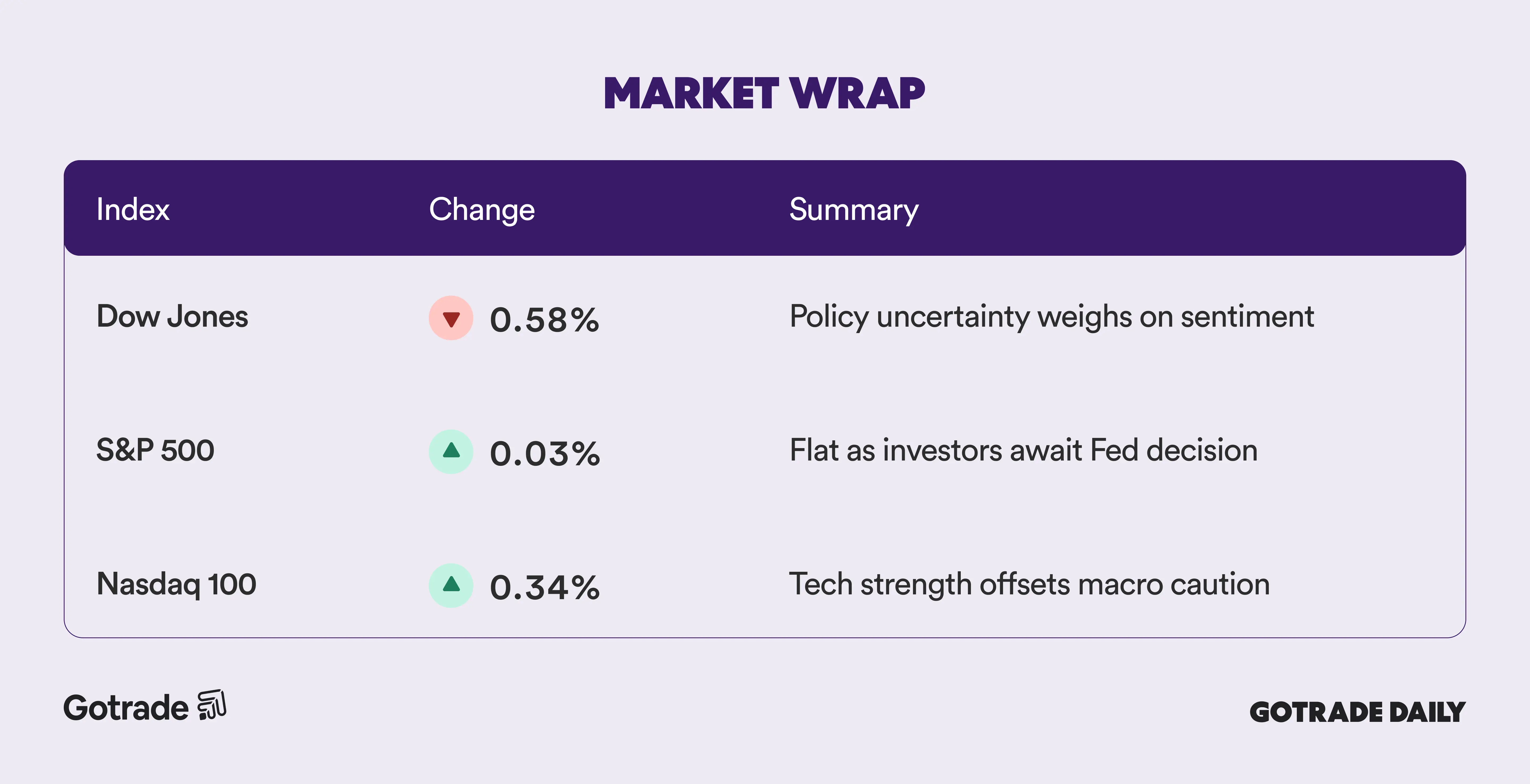

📊 Market Wrap Jan 26th 2026

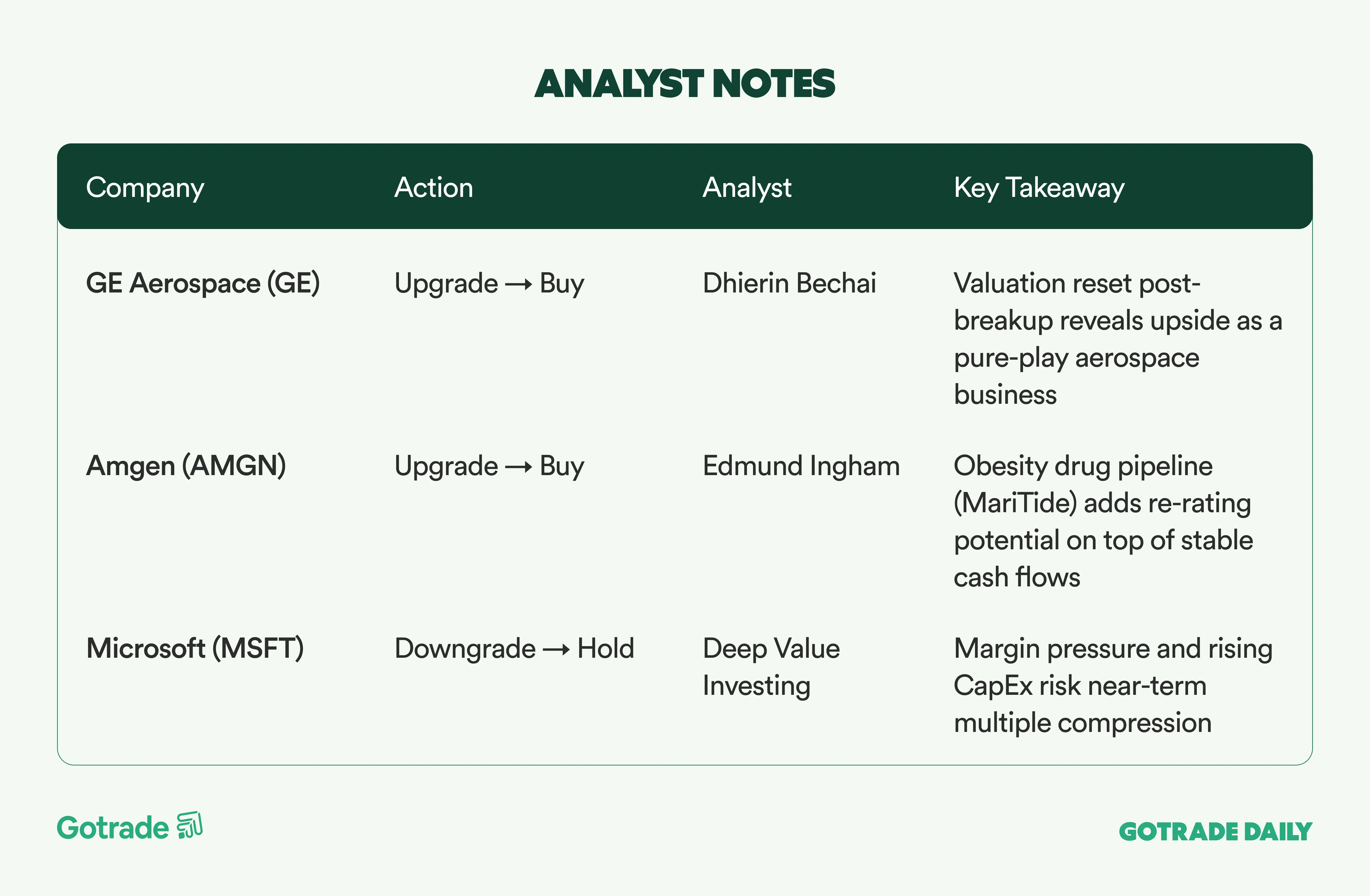

🧠 Analyst Notes

💬 Market Highlights

AI Boom Shifts Pricing Power to Memory Makers

Jefferies says investor focus in the AI trade is shifting away from hyperscalers toward suppliers of critical components, particularly memory makers. The firm argues pricing power is now concentrated with companies like Micron Technology (MU) and SK Hynix, as advanced memory prices jumped an estimated 50% last quarter.

While AI-related capex continues to grow at a double-digit pace, hyperscaler stocks have lagged since late 2025, reflecting rising investor scrutiny over returns on massive infrastructure spending. Jefferies cautions that although the AI cycle remains intact, leadership within the trade is changing, with memory suppliers emerging as near-term winners.

Merck Halts Acquisition Talks With Revolution Medicines After Valuation Dispute

Merck (MRK) has ended discussions to acquire Revolution Medicines, a cancer drug developer that could have been valued at around $30 billion, according to The Wall Street Journal. Talks reportedly stalled due to disagreements over valuation, though negotiations could resume in the future or attract other bidders.

Revolution, which focuses on targeting the hard-to-drug RAS pathway in cancer, has seen its valuation rise sharply amid takeover speculation. Merck’s management has signaled a disciplined M&A approach, generally favoring deals below $15 billion, despite remaining open to larger transactions under the right conditions.

Chevron and Oilfield Service Giants Discuss Rapid Venezuelan Output Boost

The Trump administration is reportedly in talks with Chevron (CVX) and major oilfield service providers including SLB (SLB), Halliburton (HAL), and Baker Hughes (BKR) to quickly increase Venezuela’s oil production with limited upfront investment.

The plan focuses on repairing aging infrastructure and reviving existing fields to add several hundred thousand barrels per day, rather than undertaking a full-scale rebuild estimated to cost over $100 billion. Chevron said it remains ready to support Venezuela’s recovery while strengthening U.S. energy security, as the administration pushes for near-term supply gains following the capture of President Nicolás Maduro.

📅 Earnings Watch

Sector leadership is rotating as markets recalibrate around policy signals and earnings momentum. Positioning this week will be shaped by the Fed’s tone and results from major earnings leaders.

What stocks are you watching today?