Geopolitics, jobs data, and Fed signals set the tone this week.

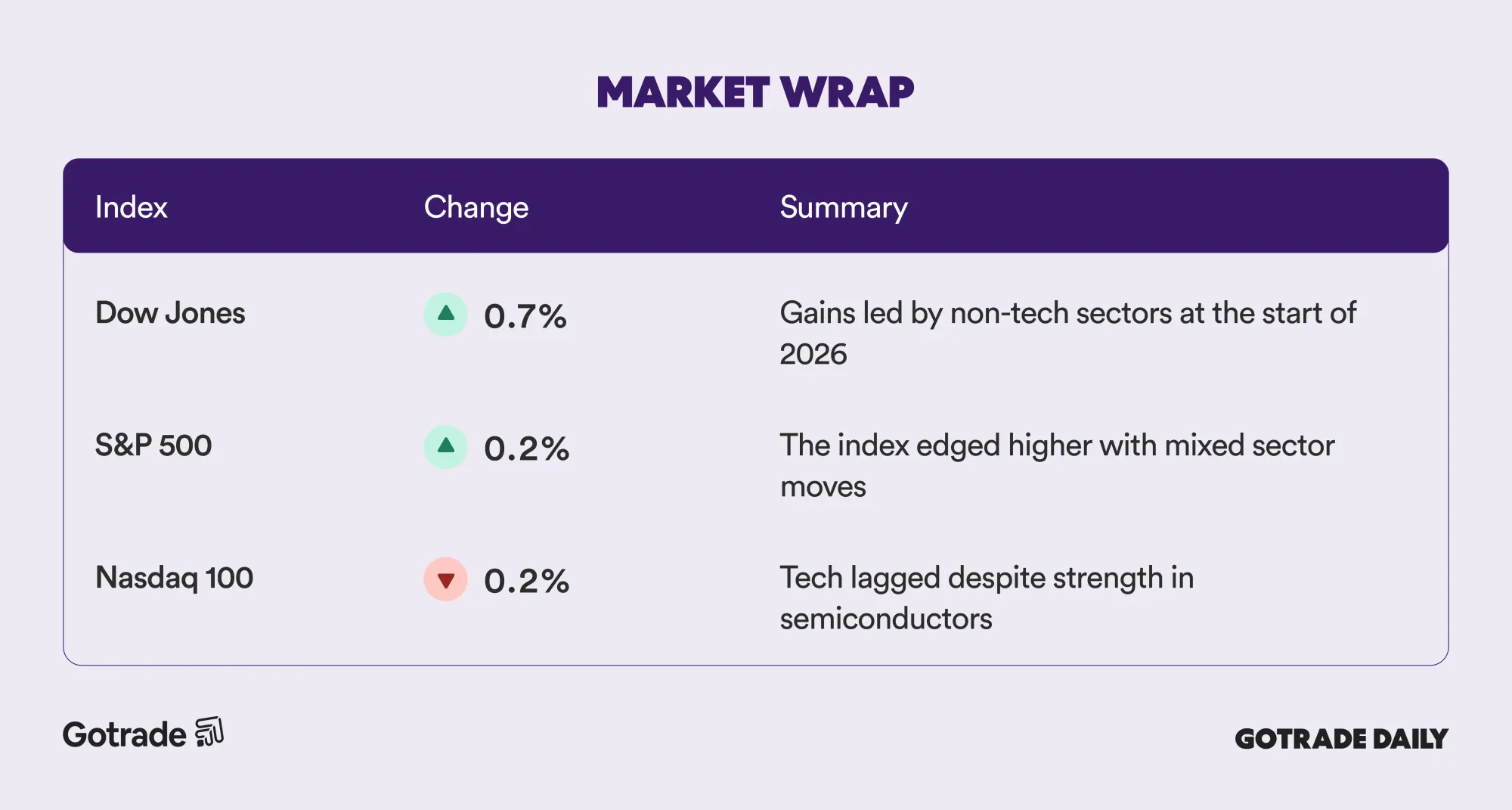

US markets closed the first trading session of 2026 mostly higher, extending a strong multi-year run while showing signs of selective positioning. The Dow Jones Industrial Average gained around 0.6 percent, while the S&P 500 edged up 0.2 percent. The Nasdaq 100 lagged slightly as investors rotated within tech after last year’s outsized gains.

Attention shifted sharply over the weekend after the US launched a military operation in Venezuela and removed President Nicolás Maduro from power. The development reintroduced geopolitical risk into markets just as the year begins, raising questions around political control, oil production, and the extent of future US involvement in the country.

For investors, Venezuela matters less as a demand shock and more as a potential supply and policy story. Venezuela holds the world’s largest proven oil reserves but currently produces a fraction of its historical output. Any signal that US energy companies may be allowed to rebuild infrastructure or expand production could influence energy stocks and oil volatility in the near term.

Beyond geopolitics, markets are also preparing for a busy macro week. The December jobs report arrives as Federal Reserve officials remain divided on the path of interest rates, with labor market data seen as a key trigger for any additional easing. Several economic indicators delayed by last year’s government shutdown are also scheduled for release, adding to the potential for short-term volatility.

📊 Market Wrap Jan 5th 2026

🧠 Analyst Notes

💬 Market Highlights

PepsiCo and Coca-Cola Reassess Longstanding Presence in Venezuela

PepsiCo (PEP) and Coca-Cola (KO) are navigating a new phase in Venezuela after decades of operating in what was once one of Latin America’s most profitable soft-drink markets. PepsiCo operates through a joint venture with Empresas Polar, retaining brand ownership while relying on local distribution, whereas Coca-Cola maintains a deconsolidated presence via Coca-Cola FEMSA in a high-risk environment.

Potential political shifts and increased U.S. involvement could gradually improve supply chains, currency stability, and infrastructure, prompting both companies to revisit long-term strategies in the country.

Chevron Holds Strategic Edge as Sole U.S. Oil Major in Venezuela

Chevron (CVX) remains the only major U.S. oil company actively operating in Venezuela, giving it a significant head start should the U.S. move to revive Venezuelan oil production. The company’s long-standing presence, asset familiarity, and unique payment-in-oil arrangement position it favorably relative to peers that exited years ago.

While geopolitical risks persist, including Venezuela’s territorial dispute with Guyana, Chevron’s strategic optionality strengthens its long-term investment case amid potential shifts in U.S. energy and foreign policy.

Healthcare Sector Mixed as Policy Scrutiny and Pricing Pressures Intensify

The S&P 500 Health Care (XLV) sector lagged broader markets amid heightened scrutiny on Medicare drug refill practices and intensifying price competition in obesity treatments.

UnitedHealth and Humana faced attention over early prescription refills, while Eli Lilly and Novo Nordisk cut GLP-1 drug prices in China to defend market share against rising local competition.

Meanwhile, Molina Healthcare outperformed after investor Michael Burry highlighted its cost discipline and resilience in Medicaid, drawing comparisons to Berkshire Hathaway’s early investment in GEICO.

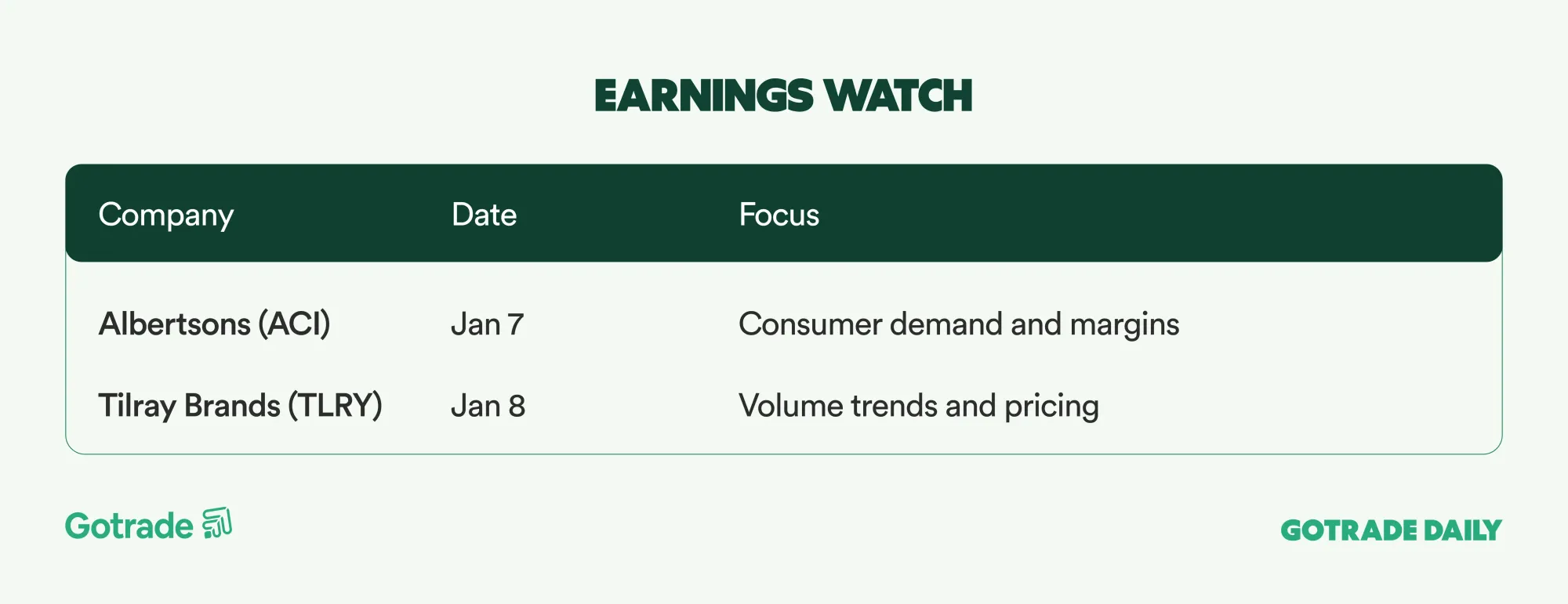

📅 Earnings Watch

Markets enter 2026 with strong momentum still intact, but with sensitivity to both macro data and geopolitical headlines increasing. Developments in Venezuela, labor market signals, and rate expectations are likely to shape early-year positioning across asset classes.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.