Oil surge and geopolitics test risk sentiment as traders reassess positioning.

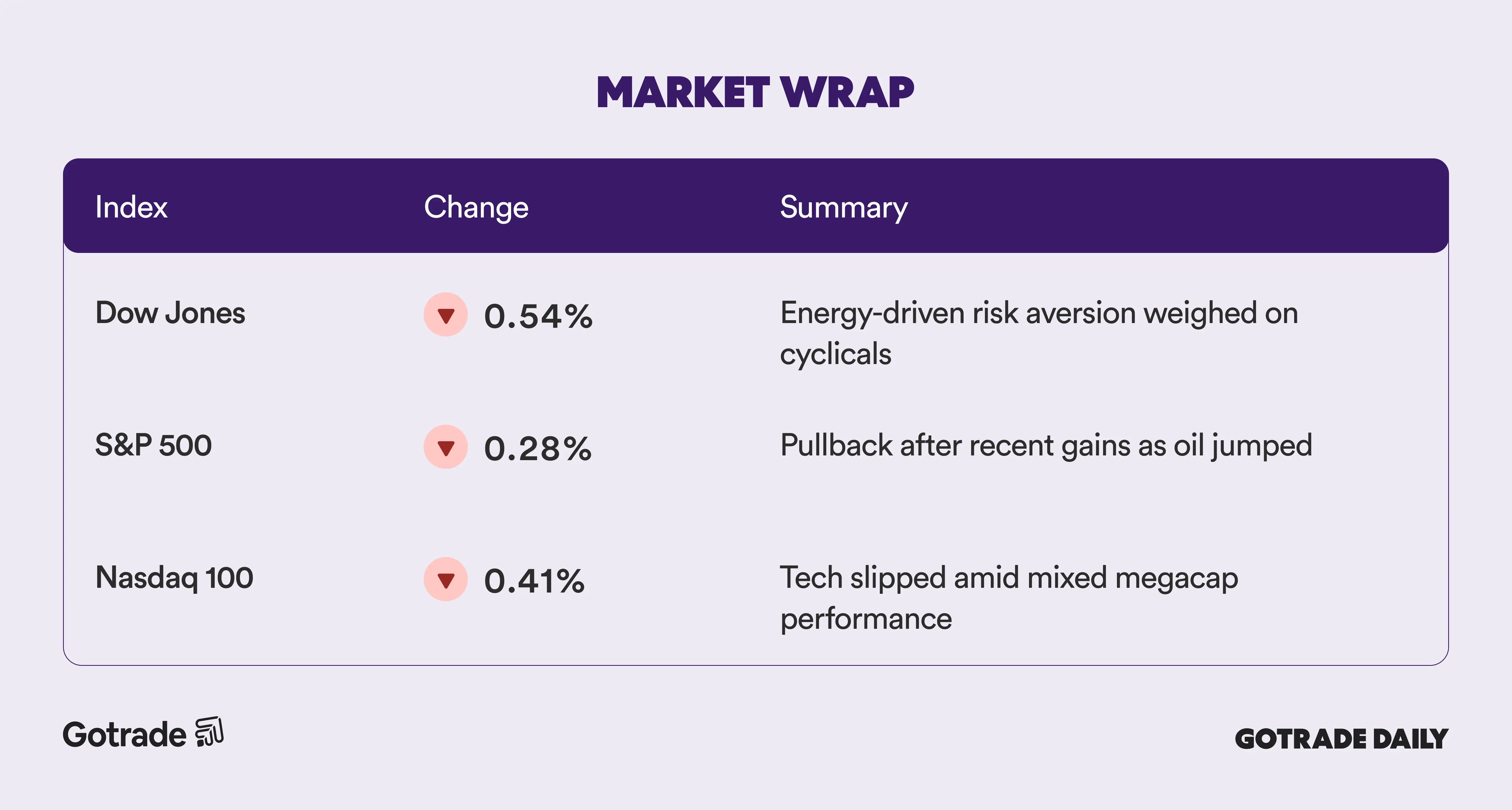

U.S. equities declined Thursday, snapping a three-session winning streak for major indexes as geopolitical tension between Washington and Tehran pushed crude prices to a six-month high. The Dow Jones Industrial Average fell 0.5%, while the S&P 500 and Nasdaq Composite each slipped about 0.3%, reflecting renewed caution after the previous session’s tech-led stabilization.

Oil’s climb to around $66.55 per barrel followed reports of increased U.S. military presence in the Middle East during ongoing nuclear negotiations with Iran. The move pressured fuel-sensitive sectors, sending airline stocks Delta (DAL), United (UAL), and American (AAL) down more than 5% as traders priced in higher cost risks.

Earnings reactions added to dispersion. Walmart (WMT) slipped despite strong sales growth, while Carvana (CVNA) dropped 8% after missing key profitability metrics. In contrast, DoorDash (DASH) rose 1.5% after issuing upbeat spending guidance that offset weaker headline results.

Megacap technology names were mixed as investors weighed reports that OpenAI is pursuing a $100 billion funding round to expand computing capacity. Apple (AAPL) fell more than 1%, and Nvidia (NVDA), Alphabet (GOOG), and Microsoft (MSFT) edged lower, while Amazon (AMZN), Meta (META), Broadcom (AVGO), and Tesla (TSLA) posted modest gains, signaling selective positioning rather than broad tech selling.

Safe-haven assets strengthened alongside geopolitical uncertainty. Gold rose 0.2% to about $5,015, silver gained 0.7%, and the U.S. dollar index ticked higher. Treasury yields eased slightly to 4.07%, while bitcoin hovered near $67,000, reflecting cautious cross-asset sentiment as traders evaluated macro and geopolitical signals simultaneously.

📊 Market Wrap Feb 20th 2026

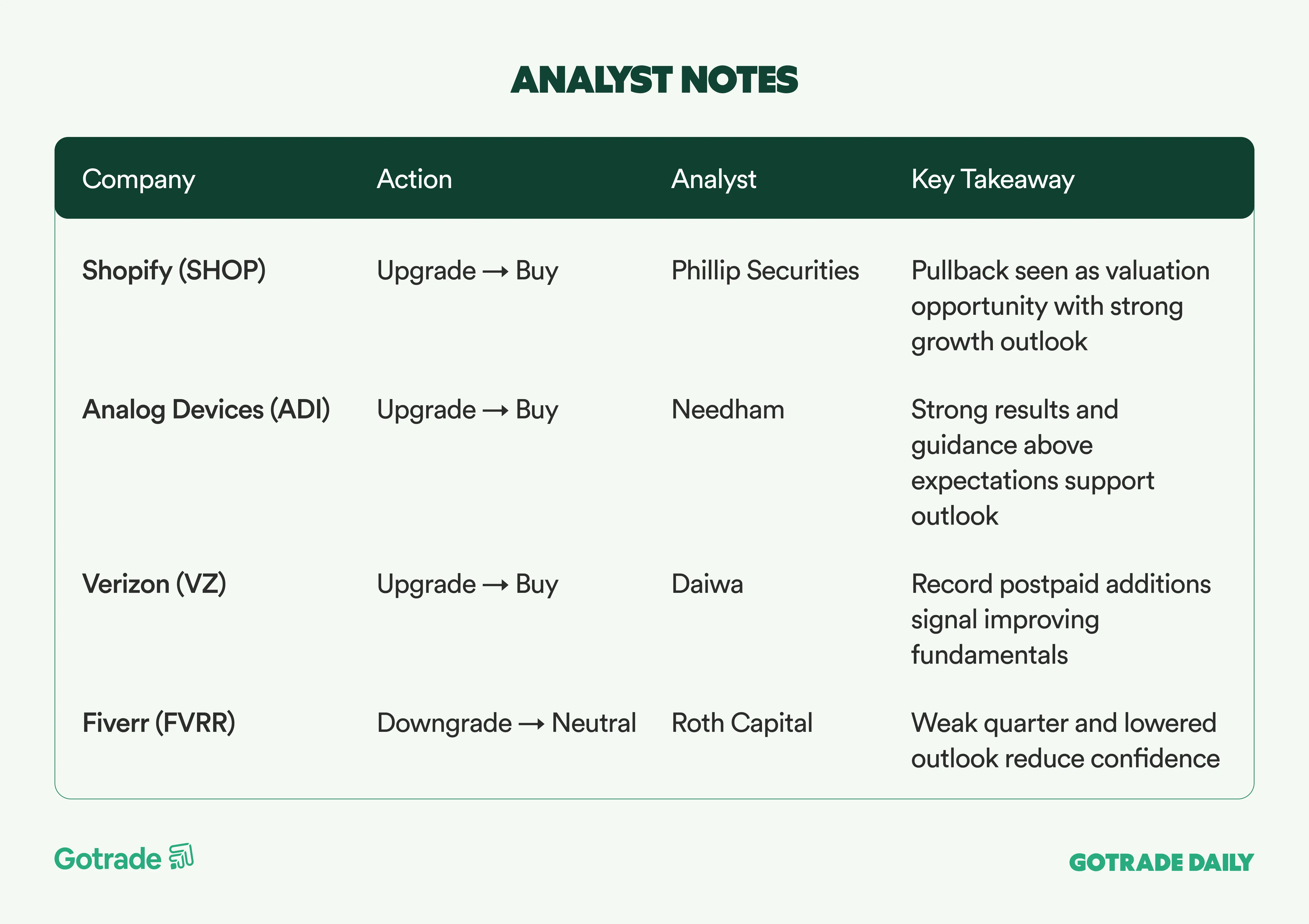

🧠 Analyst Notes

💬 Market Highlights

Germany Weighs Additional F-35 Orders as Next-Gen Fighter Program Stalls

Germany is reportedly considering purchasing more than 35 additional F-35 fighter jets from Lockheed Martin (LMT), on top of the 35 aircraft ordered in 2022, as its joint Future Combat Air System program with France faces delays; with each jet costing over $80 million, the potential deal would deepen Germany’s reliance on U.S. defense technology while buying time to reassess its long-term sixth-generation fighter strategy, although a government spokesperson denied any current plans, and if confirmed, the move could serve as a positive catalyst for LMT amid rising European defense spending.

Walmart Gains Share Among Higher-Income Shoppers

Walmart (WMT) moved higher after management highlighted resilient U.S. consumer spending, noting that growth in domestic stores was led by higher-income households while pressure persisted among those earning under $50,000 annually, supported by momentum in Marketplace, advertising, and Walmart+ membership, which posted double-digit growth during the holiday quarter, continued grocery share gains and strength in categories such as fashion, along with a newly authorized $30 billion share repurchase program, even as the company maintained a cautious outlook due to macroeconomic uncertainty.

Visa Expands Argentina Footprint with Prisma and Newpay Acquisition

Visa (V) is set to acquire Argentina-based Prisma Medios de Pago and Newpay from Advent International as part of its regional expansion strategy, with Prisma providing credit, debit, and prepaid card processing services and Newpay operating real-time payments, the Banelco ATM network, and the PagoMisCuentas bill payment platform; the transaction, expected to close in Visa’s fiscal second quarter of 2026, is aimed at accelerating digital payments adoption and deploying advanced technologies such as tokenization, biometric authentication, intelligent risk tools, and agentic commerce, reinforcing Visa’s role as a core digital payments infrastructure player in Latin America.

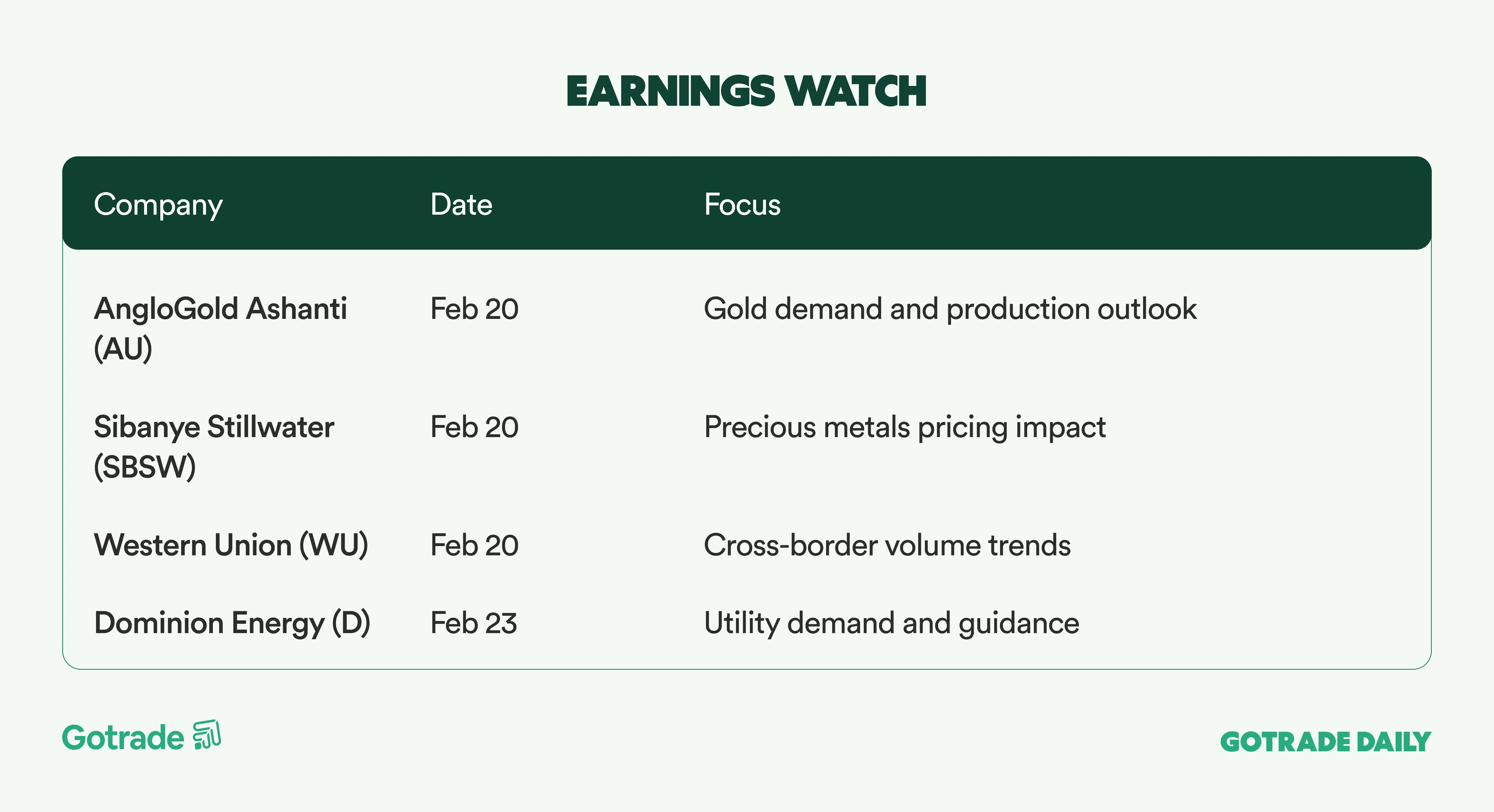

📅 Earnings Watch

What stocks are you watching today?