Markets enter the week with attention firmly on macro confirmation after last week’s rebound. A delayed January jobs report, fresh inflation data, and retail sales figures are set to clarify whether cooling labor conditions and easing price pressures are holding, or beginning to re-accelerate.

The January employment report from the Bureau of Labor Statistics is now scheduled for Wednesday after being postponed by last week’s brief government shutdown. December data showed slower job creation even as the unemployment rate edged lower, and investors will be watching closely to see whether hiring momentum continues to soften. Any renewed signs of labor market weakness could quickly influence expectations for Federal Reserve rate cuts later this year.

Inflation data follows on Friday with the release of January CPI. Headline inflation remained steady in December, while core CPI surprised to the downside, keeping hopes of eventual policy easing alive. Alongside this, Tuesday’s December retail sales report will offer insight into whether U.S. consumers maintained spending momentum through the holiday season, a key pillar supporting economic growth.

Earnings add another layer of signal this week, particularly in technology and infrastructure. Cisco (CSCO) reports on Wednesday, with investors watching closely for updates on AI-driven networking demand after management previously highlighted large opportunities tied to AI infrastructure. Other tech-related reporters include Applied Materials (AMAT), and Arista Networks (ANET), offering a broader read on semiconductor and equipment spending trends.

Consumer and platform companies are also in focus. Coca-Cola (KO) and McDonald’s (MCD) are expected to provide insight into pricing power and customer mix, while Ford (F), Honda (HMC), and Ferrari (RACE) will shed light on global auto demand. In parallel, results from Marriott (MAR) and Airbnb (ABNB) will be watched for travel trends, and trading platforms Robinhood (HOOD) and Coinbase (COIN) remain under scrutiny amid recent weakness across bitcoin and crypto-linked assets.

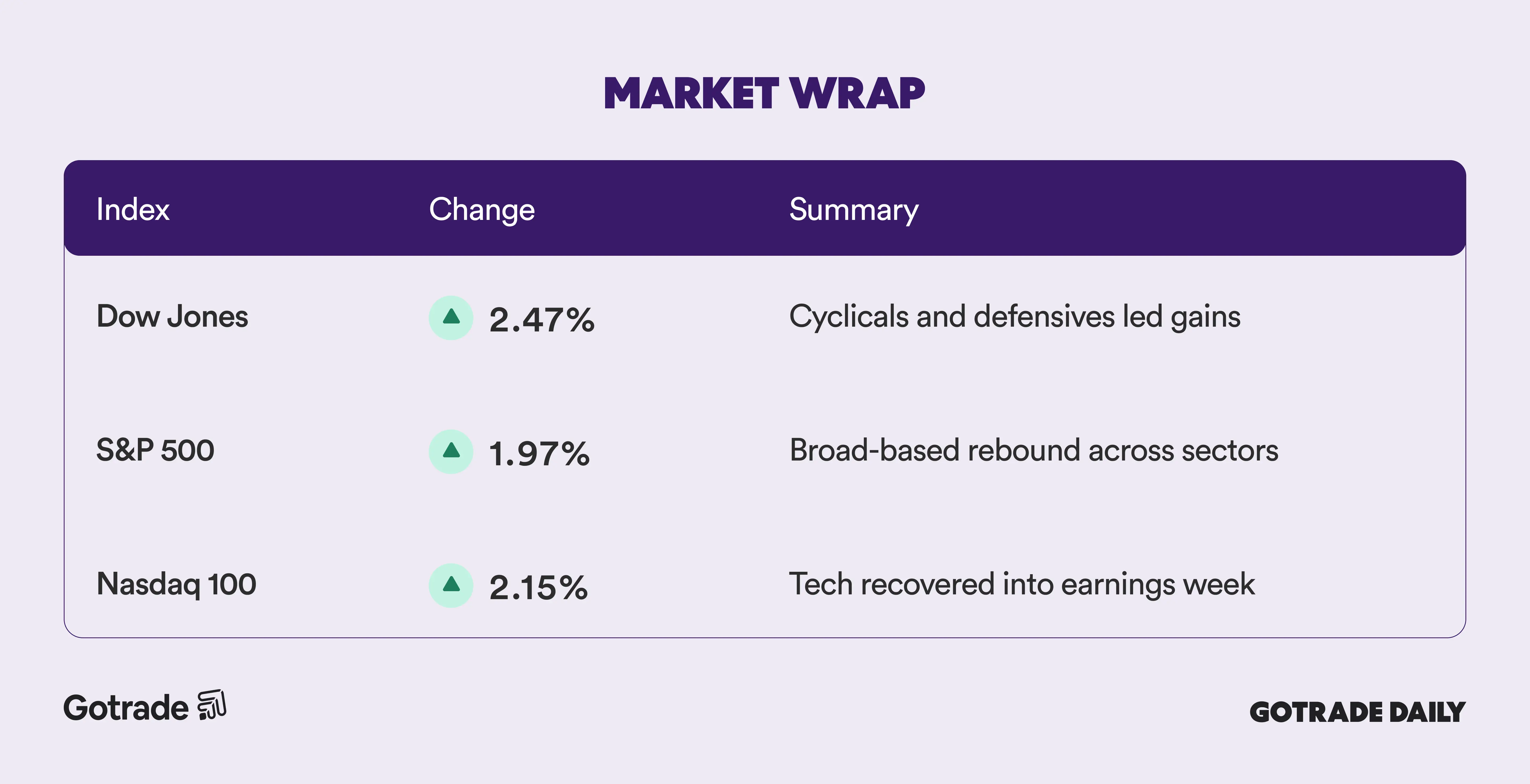

📊 Market Wrap Feb 9th 2026

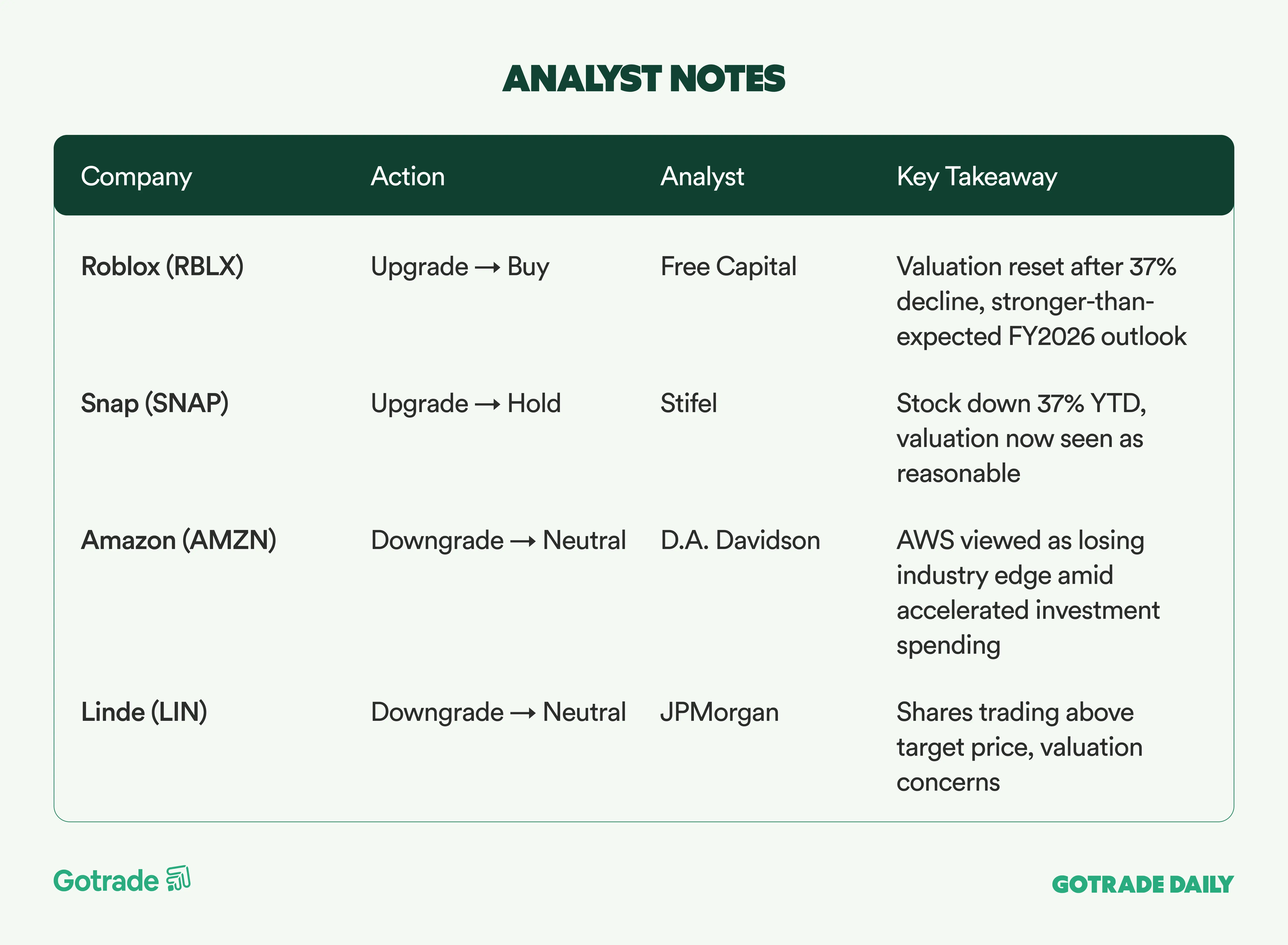

🧠 Analyst Notes

💬 Market Highlights

Bloom Energy Accelerates Scale on AI Data Center Demand and Record Backlog

Apple’s “Hermès Orange” iPhone Rekindles China Demand

Labor Deal Averts Nationwide U.S. Refinery Strike Risk

📅 Earnings Watch

Together, this week’s macro data and earnings will test whether markets can build on recent gains or revert to a more defensive stance as investors reassess growth, inflation, and policy expectations.

What stocks are you watching today?